PRIVACY, DATA PROTECTION, AI AND CYBERSECURITY – LAW MAP

Publication date: September 15, 2025

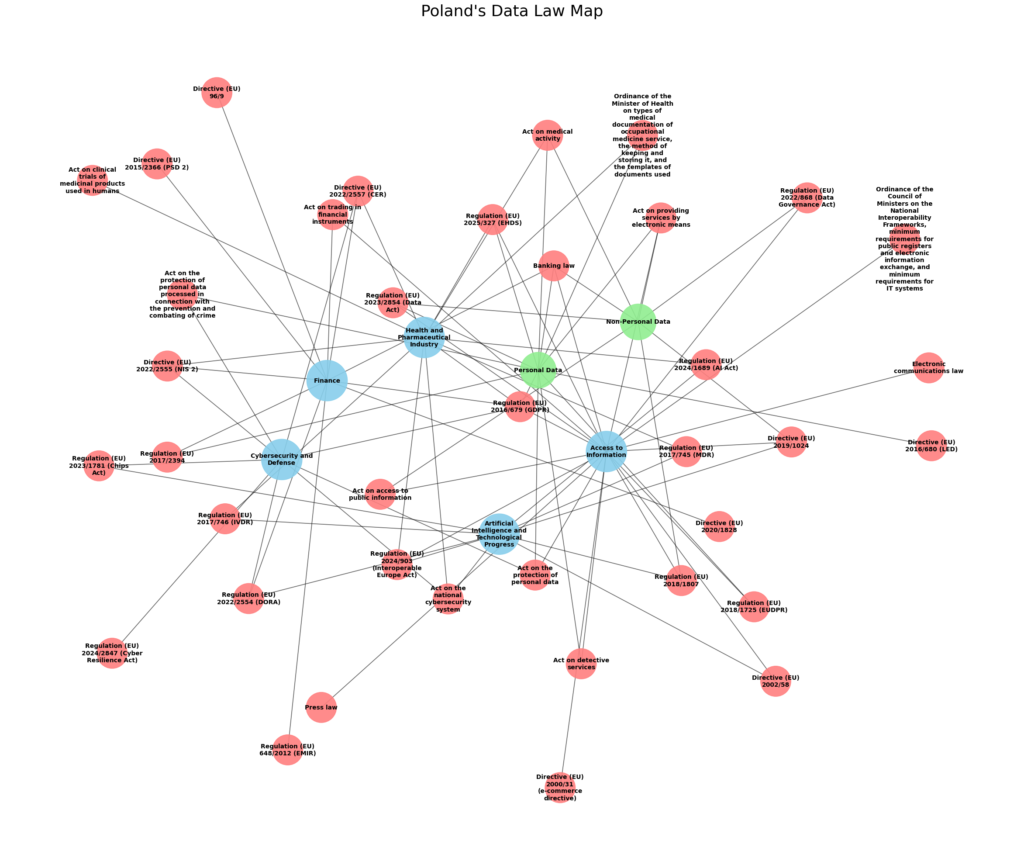

The phenomenon of dispersion of data law sources

Data law is no longer just about GDPR. The European Union’s legislative trend of incorporating data law regulations into comprehensive sectoral regulations: healthcare, financial markets, corporate stock market law, the defense industry, electronic communications, and the phenomenon of fair competition in trade, is resulting in a significant fragmentation of legal sources, the core subject of which is “DATA AND DATA PROTECTION

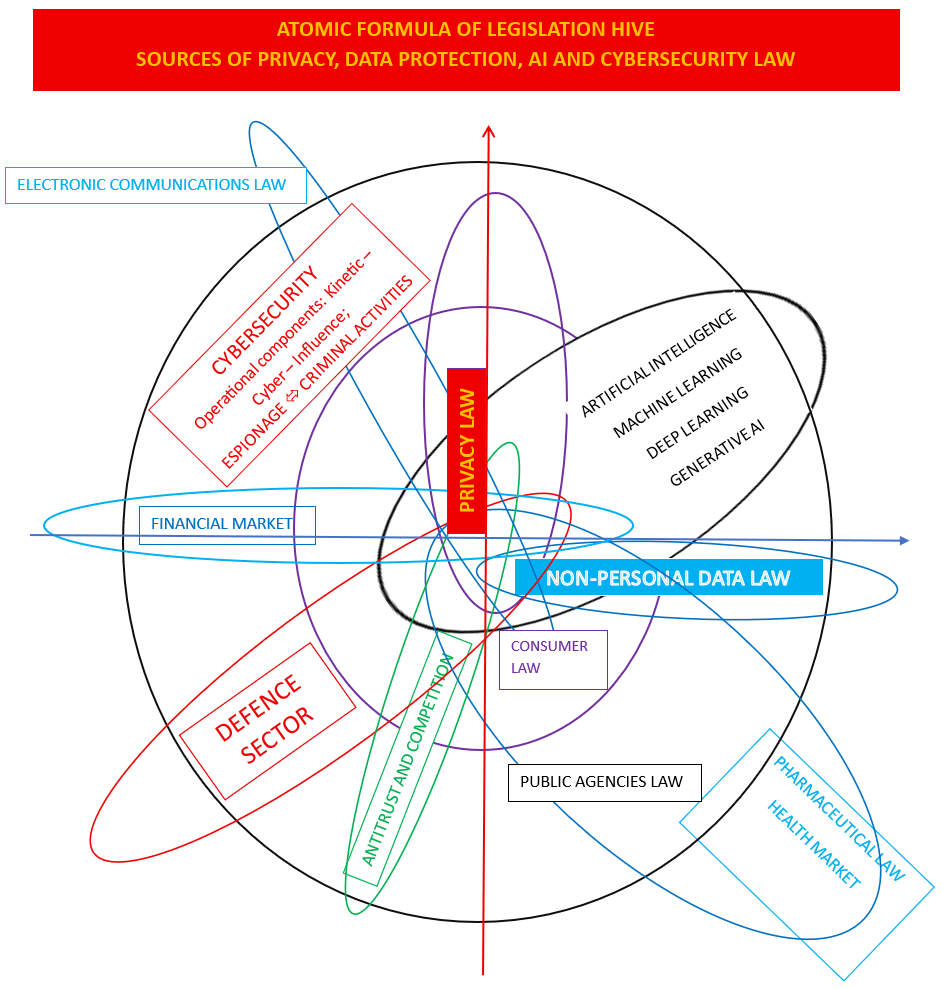

The interpenetration and interaction of the sources of law in the shape of an atom

The dispersion of legal acts at the legislative level, whether uniform for all European Union countries, or the Polish system and agencies within Polish jurisdiction, can be illustrated as a kind of legislative hive or the construction of an atom, which is focused on two axes: 1/ vertical as the law of privacy protection and generating funds on private data, and 2/ horizontal as the protection of non-private data and business processes, the financial market, the pharmaceutical and health market, and the defense sector.

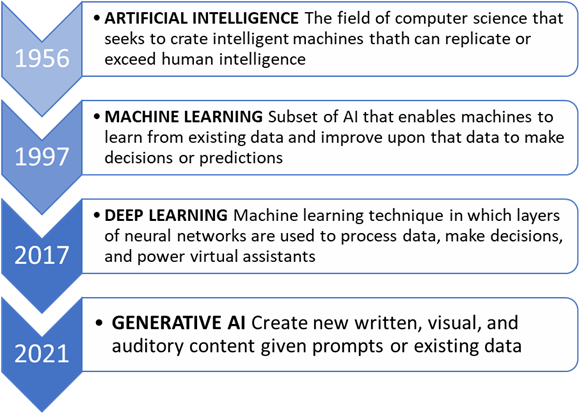

AI LAW

Within the atomic framework of “data, data access, and data processing”, the normative needs of cutting-edge technology, generative AI, should be highlighted. This is directly related to the legal environment of AI-based software, DEEP AND MACHINE LEARNING. The era of generative AI necessitates the creation of new regulations, as such a technological leap significantly complicates the legal relationships of economic participants. A key example is

The spherical nature of data law has at its core the law created for the competences of individual agencies and consumer protection.

The rise of cyber, defense, and data law regulations

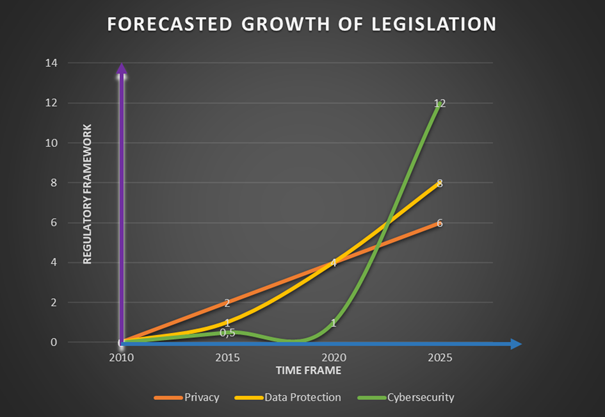

The year 2025 is a legislative year during the technological revolution of generative AI. It is worth noting, above all, the significant, slow, decisive, and consistent growth of personal data protection law, projecting a very clear trend of supplementing the level of legislation regarding the protection of non-personal data.

The forecast based on the current legislative initiative points to a very significant increase in cybersecurity law. This is a rapid and elliptical, massive expansion of cybersecurity law as part of an “offensive” of multiplying very extensive cybersecurity regulations.

Cybersecurity regulations are a particularly prominent legislative line within data law. Cybersecurity law shares many common points with defense industry regulations.

CYBERSECURITY

This is due to the fact that cybersecurity focuses on two separate problems that required a separate legal environment:

1/ the first is cybercrime and data leakage area;

The European Union, ENISA, and Polish legislation and agencies such as CSIRT Poland and the Polish Office of Electronic Communications are creating new regulations against hacker attacks and data leaks, which constitute online crimes against property. These are legal tools for the justice system, regulatory authorities, and victims of crimes such as random attacks, i.e., for ransom. This classic online crime has its own legal regulations surrounding data theft and data leaks for ransom, or crimes involving the use of specific email communications to trigger online banking transfers and the identity of bank account holders.

| Rising global cost of cybercrime 1287 password attacks per second (date as of 2023) | ||

| $3 TRILLION | $8 TRILLION | $10.5 TRILLION |

| 2015 | 2023 | 2025 |

– Microsoft data provided at the NDIA conference organized by ETI in Washington DC August 2023.

The goals of this legal community group are:

– computer systems that infect and secretly download data and do not interfere with the system’s functionality (an infected router with additional spyware in addition to the usual internet data transmission function – and this is a private theft patent for the purpose of stealing passwords to private content);

– software that interferes with the system by breaking security to destroy relevant data.

2/ the second is the cyber battlefield and spying tools on the Internet

Defence industry sector law, in addition to regulatory law such as the Chips Act for the creation of semiconductors, is rapidly evolving within the framework of cybersecurity law in the defence industry.

This is the result of changes in the needs of the defense sector, especially in the context of the Ukrainian conflict, which is neighboring Poland – the member of the EU and NATO. The conflict remains relevant because the first days of this armed conflict have already shown that, in addition to kinetic military measures concerning conventional objectives such as closing the ring around Kyiv, or through the initial drone revolution and jamming, concentrating the front line towards Odessa (southeastern Ukraine), cyberspace and data processing constitute a separate theater of war.

Therefore, for the Polish legal jurisdiction, in addition to the legal environment of the kinetic component (new law on drones or the issue of new technologies in cooperation with the jurisdiction of the USA, other countries of the North Atlantic Alliance, South Korea or Ukraine), it is the components of cybersecurity and network protection against disinformation (the influencer component) that are the key issues in cybersecurity law.

Therefore, the subject of cybersecurity law comprises three components of military cyber activity: kinetic, cyber and influence, regarding the weakening of the battlefield momentum, internal and external support and all of them concern data processing processes including:

– systems of destructive attacks on operational logistics systems and the transport sector;

– government network systems;

– critical infrastructure such as the functioning of public institutions, for example power plants;

– disruption of information and disinformation processes of media companies;

– destructive attacks and data infiltration.

An additional third legal challenge is the phenomenon of OSINT (Open-Source Intelligence Services) as information tracking.

OSINT as the analysis and tracing of analytical information is the analysis of data for the purposes of commentary in social media such as YT channels with commentary content from former military personnel when tracking armed conflicts, analysis of private stages of conflict development or the operation of new cybernetic and technological military technologies.

The legal environment for such OSINT encompasses the assessment of compliance with cyber law, media and press law, military and state secrets, electronic communications law, and data protection. It also addresses the protection of the interests of such online creators and influencers and freedom of content on social media. The complexity of the legality of the problem provides a new content phenomenon in Polish social media, such as comments on the Ukrainian conflict, assessments of how UV drone technology works and military methods of drone attacks (one of the first examples is the method of attacking a military ship using UV).

OSINT, as the acquisition of information about a debtor’s assets, is a legal field related to civil procedure to gain a procedural advantage in civil courts. It is also regulated by many telecoms’ regulatory provisions, data protection laws, and privacy laws. Modern methods of obtaining information also primarily concern the legality of the legal environment surrounding the use of OPSEC systems – that is, the anonymity of the entity collecting such information- such as the use of the TOR network on the Linux operating system, which makes it hard or even impossible to determine the location of an internet user. Another example of the subject of assessing the legality of analytical OSINT is the use of modern all-in-one investigation platforms, like Maltego, to collect data to, for example, identify participants in the crypto market.

Currently, NIS directives implement a number of regulations into the Polish legal system that underpin the legality of OTC securities trading platforms on the FOREX market. This is an example where the legality of implementing a financial market securities trading platform on the websites of professional brokers poses significant difficulties.

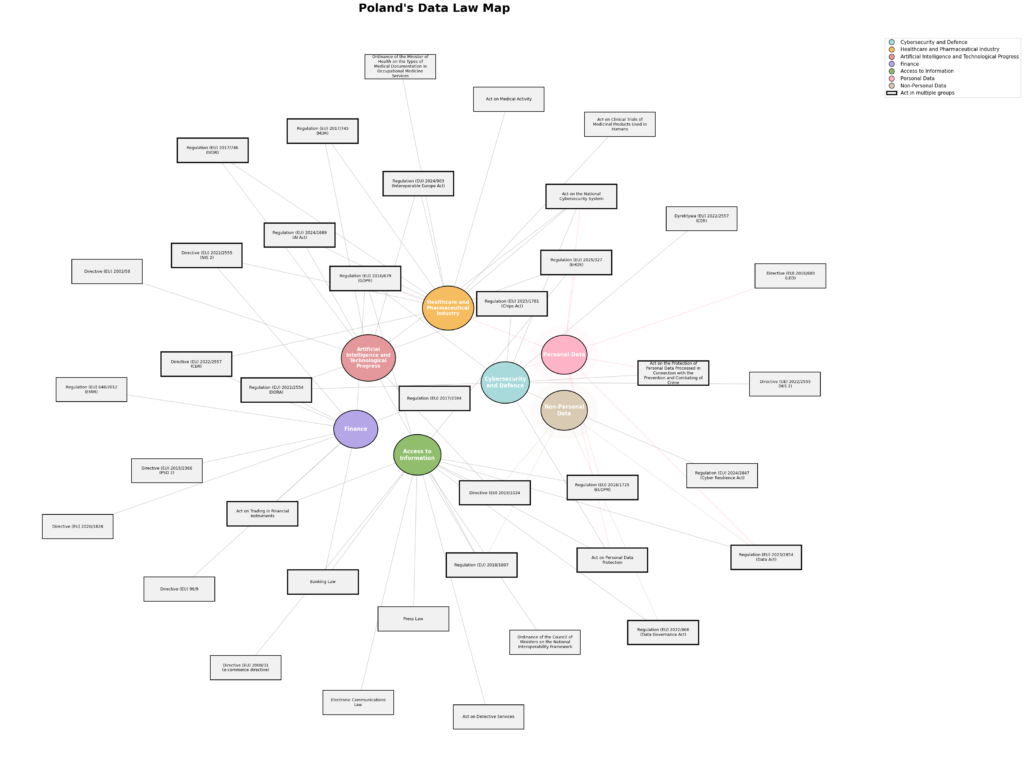

MAIN SECTORS AND VECTORS OF THE DATA LAW MAPS

The main areas of sectoral regulatory law that governs cybersecurity and data protection are:

- HEALTH, PHARMACEUTICALS AND PHARMACEUTICAL INDUSTRY DATA (EHDS initiative);

- GENERATIVE AI and NEW TECHNOLOGICAL PROGRESS; (AI ACT and AI procedures on sensitive data are the main basis for assessing that AI is a high-risk system);

- FINANCIAL SECTOR and cyber resilience of the financial sector and the problem related to blocking leverage services with financial instruments that operate at the system boundary of the scope of action of the EU agency ESMA dealing with the stock exchange and the problem of the functioning of the financial instruments market;

- Of particular interest to the law in this sector is software that gives an advantage to stock brokers and special regulations blocking the international freedom of these online services. This concerns legal protections for consumers against speculation in financial derivatives. It is worth mentioning the ESMA regulations and the NIS 1 and NIS 2 directives. The DORA regulation, which concerns cybersecurity of data in banks and stock exchanges, and the CER directive are key.

- Poland has a special act on internet incidents and an act on the cybersecurity system.

- PERSONAL DATA PROTECTION LAW, INCLUDING SENSITIVE DATA, where, in addition to the GDPR, the Polish jurisdiction has an entire range of guidelines from the European Data Protection Board (one of the latest guidelines concerns data processing on blockchain).

- NON-PERSONAL DATA PROTECTION LAW, DATABASES AND DATA ACT.

Data Law Map

Cybersecurity and Defense

- Regulation (EU) 2024/2847 (Cyber Resilience Act) (23/10/2024)

- Regulation (EU) 2023/1781 (Chips Act) (13/09/2023)

- Regulation (EU) 2022/2554 (DORA) (14/12/2022)

- Regulation (EU) 2025/295 supplementing DORA (24/11/2024)

- Regulation (EU) 2016/679 (GDPR) (27/04/2016)

- Directive (EU) 2022/2555 (NIS 2) (14/12/2022)

- Directive (EU) 2022/2557 (CER) (14/12/2022)

- Act on the protection of personal data processed in connection with the prevention and combating of crime (14/12/2018)

- Act on the national cybersecurity system (05/07/2018)

- Act amending certain acts in connection with ensuring the operational digital resilience of the financial sector and issuing European green bonds (25/06/2025)

- Act amending certain acts related to the functioning of government administration (15/05/2024)

- Act amending certain acts regarding protective measures in connection with the spread of the SARS-CoV-2 virus (14/05/2020)

- Act amending the Education Law and certain other acts (16/10/2019)

- Personal Data Protection Act (10/05/2018)

- Act amending certain acts in connection with ensuring the application of the GDPR in connection with the processing of personal data and on the free movement of such data, and repealing Directive (EU) 95/46/EC (21/02/2019)

Health and Pharmaceutical Industry

- Regulation (EU) 2025/327 (EHDS) (11/05/2025)

- Regulation (EU) 2024/1689 (AI Act) (13/06/2024)

- Regulation (EU) 2024/903 (Interoperable Europe Act) (13/03/2024)

- Regulation (EU) 2017/745 (MDR) (05/04/2017)

- Regulation (EU) 2017/746 (IVDR) (05/04/2017)

- Regulation (EU) 2016/679 (GDPR) (27/04/2016)

- Directive (EU) 2022/2555 (NIS 2) (14/12/2022)

- Directive (EU) 2022/2557 (CER) (14/12/2022)

- Act on clinical trials of medicinal products for human use (09/03/2023)

- Act on the national cybersecurity system (05/07/2018)

- Act amending certain acts in connection with ensuring the operational digital resilience of the financial sector and issuing European green bonds (25/06/2025)

- Act amending certain acts related to the functioning of government administration (15/05/2024)

- Act amending certain acts regarding protective measures in connection with the spread of the SARS-CoV-2 virus (14/05/2020)

- Act amending the Education Law and certain other acts (16/10/2019)

- Act on Medical Activity (15/04/2011)

- Act amending the Act on State Emergency Medical Services and certain other acts (24/04/2025)

- Act amending the Act on health care services financed from public funds and certain other acts (05.12.2024)

- Act amending the Act on the Postgraduate Medical Education Center and certain other acts (27/11/2024)

- Act amending the Act on Patients’ Rights and the Patient Ombudsman and certain other acts (26/06/2023)

- Act amending the Act on health care services financed by public funds and certain other acts (17/11/2021)

- Act amending the Act on health care services financed by public funds and certain other acts (11/08/2021)

- Act amending the Act on health care services financed by public funds and certain other acts (10/12/2020)

- Act amending certain acts to ensure the availability of medical personnel during the period of declaration of an epidemic threat or epidemic state (27/11/2020)

- Act amending certain acts in connection with counteracting crisis situations related to the occurrence of COVID-19 (28/10/2020)

- Act amending certain acts to ensure the functioning of health care in connection with the COVID-19 epidemic and after its termination (14/08/2020)

- Act amending certain acts in the field of the health care system related to the prevention, counteraction and combating of COVID-19 (31/03/2020)

- Act amending the Commercial Companies Code and certain other acts (19/07/2019)

- Act amending the Pharmaceutical Law and certain other acts (26/04/2019)

- Act amending the Act on the principles of state property management and certain other acts (21/02/2019)

- Act amending certain acts in connection with ensuring the application of the GDPR in connection with the processing of personal data and on the free movement of such data, and repealing Directive (EU) 95/46/EC (21/02/2019)

- Act amending the Act on health care services financed by public funds and certain other acts (05/07/2018)

- Act amending the Act on Public-Private Partnership and certain other acts (05/07/2018)

- Act amending the Pharmaceutical Law and certain other acts (07.06.2018)

- Act amending the Act on health care services financed by public funds and certain other acts (12/04/2018)

- Act amending the Act on Medical Activity (25/09/2015)

- Act amending the Act on State Emergency Medical Services, the Act on Medical Activity and the Act amending the Act on Medical Activity and certain other acts (25/09/2015)

- Act amending the Act on the professions of nurse and midwife and certain other acts (11/09/2015)

- Act amending the Act on medical devices and certain other acts (11/09/2015)

- Act amending the Act on Medical Activity (24/04/2015)

- Act amending the Act on health care services financed by public funds and certain other acts (22/07/2014)

- Act amending the Public Procurement Law and certain other acts (14/03/2014)

- Act amending the Act on Medical Activity and certain other acts (14/06/2012)

- Regulation of the Minister of Health on the types of medical documentation of occupational health services, the method of maintaining and storing it, and the templates of the documents used (29/07/2010)

- Regulation of the Minister of Health amending the regulation on the types of medical documentation of the labor service, the method of keeping and storing it and the templates of the documents used (28/08/2024)

Artificial Intelligence and Technological Progress

- Regulation (EU) 2024/1689 (AI Act) (13/06/2024)

- Regulation (EU) 2024/903 (Interoperable Europe Act) (13/03/2024)

- Regulation (EU) 2023/1781 (Chips Act) (13/09/2023)

- Regulation (EU) 2022/2554 (DORA) (14/12/2022)

- Regulation (EU) 2025/295 supplementing DORA (24/11/2024)

- Regulation (EU) 2018/1807 (14/11/2018)

- Regulation (EU) 2017/745 (MDR) (05/04/2017)

- Regulation (EU) 2017/746 (IVDR) (05/04/2017)

- Directive (EU) 2019/1024 (20/06/2019)

- Directive (EU) 2002/58 (12/07/2002)

- Act on the national cybersecurity system (05/07/2018)

- Act amending certain acts in connection with ensuring the operational digital resilience of the financial sector and issuing European green bonds (25/06/2025)

- Act amending certain acts related to the functioning of government administration (15/05/2024)

- Act amending certain acts regarding protective measures in connection with the spread of the SARS-CoV-2 virus (14/05/2020)

- Act amending the Education Law and certain other acts (16/10/2019)

Finances

- Regulation (EU) 2022/2554 (DORA) (14/12/2022)

- Regulation (EU) 2025/295 supplementing DORA (24/11/2024)

- Regulation (EU) 2017/2394 (12/12/2017)

- Directive (EU) 2024/1799 amending Regulation (EU) 2017/2394, Directive (EU) 2019/771 and Directive (EU) 2020/1828 (13/06/2024)

- Directive (EU) 2019/771 amending Regulation (EU) 2017/2394 and Directive (EU) 2009/22 and repealing Directive (EU) 1999/44 (20/05/2019)

- Regulation (EU) 2018/302 amending Regulation (EU) 2006/2004, Regulation (EU) 2017/2394 and Directive 2009/22 (28/02/2018)

- Regulation (EU) 2016/679 (GDPR) (27/04/2016)

- Regulation (EU) 648/2012 (EMIR) (04/07/2012)

- Regulation (EU) 2021/23 amending Regulation (EU) 1095/2010, Regulation (EU) 648/2012, Regulation (EU) 600/2014, Regulation (EU) 806/2014, Regulation (EU) 2015/2365, Directive (EU) 2002/47, Directive (EU) 2004/25, Directive (EU) 2007/36, Directive (EU) 2014/59 and Directive (EU) 2017/1132 (16.12.2020)

- Regulation (EU) 2017/2402 amending Directive (EU) 2009/65, Directive (EU) 2009/138, Directive (EU) 2011/61, Regulation (EU) 1060/2009 and Regulation (EU) 648/2012 (12/12/2017)

- Regulation (EU) 2015/2365 amending Regulation (EU) 648/2012 (25/11/2015)

- Regulation (EU) 600/2014 amending Regulation (EU) 648/2012 (15/05/2014)

- Directive (EU) 2014/59 amending Directive (EU) 82/891, Directive (EU) 2001/24, Directive (EU) 2002/47, Directive (EU) 2004/25, Directive (EU) 2005/56, Directive (EU) 2007/36, Directive (EU) 2011/35, Directive (EU) 2012/30, Directive (EU) 2013/36 and Regulation (EU) 1093/2010 and Regulation (EU) 648/2012 (15/05/2014)

- Regulation (EU) 575/2013 amending Regulation (EU) 648/2012 (26/06/2013)

- Directive (EU) 2022/2555 (NIS 2) (14/12/2022)

- Directive (EU) 2022/2557 (CER) (14/12/2022)

- Directive (EU) 2020/1828 (25/11/2020)

- Directive (EU) 2024/1799 amending Regulation (EU) 2017/2394, Directive (EU) 2019/771 and Directive (EU) 2020/1828 (13/06/2024)

- Regulation (EU) 2022/1925 amending Directive (EU) 2019/1937 and Directive (EU) 2020/1828 (14/09/2022)

- Directive (EU) 2015/2366 (PSD 2) (25/11/2015)

- Directive (EU) 96/9 (11/03/1996)

- Directive (EU) 2019/790 amending Directive (EU) 98/9 and Directive (EU) 2001/29 (17/04/2019)

- Act on Trading in Financial Instruments (29/07/2005)

- Act amending the Act on the Defense of the Homeland and certain other acts (25/06/2025)

- Act amending certain acts in connection with ensuring the operational digital resilience of the financial sector and issuing European green bonds (25/06/2025)

- Act amending the Act on Trading in Financial Instruments (24/06/2025)

- Act amending the Act on the Prison Service and certain other acts (09/05/2025)

- Act amending the Accounting Act, the Act on Statutory Auditors, Audit Firms and Public Supervision and certain other acts (06.12.2024)

- Act amending certain acts in connection with ensuring the development of the financial market and the protection of investors on this market (16/08/2023)

- Act amending the Act on Investment Funds and the Management of Alternative Investment Funds, the Act on Bonds, the Act on the Bank Guarantee Fund, the Deposit Guarantee System and Compulsory Restructuring and certain other acts (14/04/2023)

- Act amending the Act on the handling of complaints by financial market entities and on the Financial Ombudsman and certain other acts (01.12.2022)

- Act amending certain acts to simplify administrative procedures for citizens and entrepreneurs (07/10/2022)

- Act amending the Act on the Prison Service and certain other acts (22/07/2022)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/10/2021)

- Act amending the Act on the Capacity Market and certain other acts (23/07/2021)

- Act amending the Act on investment funds and management of alternative investment funds and certain other acts (23/07/2021)

- Act amending the Act on Trading in Financial Instruments and certain other acts (21/01/2021)

- Act amending the Act on special solutions related to the prevention, counteraction and combating of COVID-19, other infectious diseases and crisis situations caused by them, and certain other acts (31/03/2020)

- Act amending the Act on Government Administration Departments and certain other acts (23/01/2020)

- Act amending the Commercial Companies Code and certain other acts (30/08/2019)

- Act amending the Commercial Companies Code and certain other acts (19/07/2019)

- Act amending the Act on Financial Market Supervision and certain other acts (15/03/2019)

- Act amending certain acts in connection with ensuring the application of GDPR (21/02/2019)

- Act amending certain acts in connection with strengthening supervision over the financial market and investor protection on this market (09/11/2018)

- Act amending certain acts to introduce simplifications for entrepreneurs in tax and economic law (09/11/2018)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/03/2018)

- Act amending the Act on certain rights of employees of the office serving the minister responsible for internal affairs and officers and employees of offices supervised by that minister, and certain other acts (09/11/2017)

- Act amending the Penal Code and certain other acts (23/03/2017)

- Act amending the Act on Trading in Financial Instruments and certain other acts (10/02/2017)

- Act amending the Act on Investment Funds and certain other acts (32/03/2016)

- Act amending acts regulating the conditions of access to the practice of certain professions (05/08/2015)

- Act amending the Act on Competition and Consumer Protection and certain other acts (05/08/2015)

- Act amending the Act on Capital Market Supervision and certain other acts (12/06/2015)

- Act amending the Act on Trading in Financial Instruments and certain other acts (05.12.2014)

- Act amending the Act on supplementary supervision of credit institutions, insurance companies, reinsurance companies and investment firms being part of a financial conglomerate and certain other acts (24/04/2014)

- Act amending the Act on Trading in Financial Instruments and certain other acts (24/10/2012)

- Act amending the Act on Trading in Financial Instruments and certain other acts (16/09/2011)

- Act amending the Banking Law, the Act on Trading in Financial Instruments and the Act on Financial Market Supervision (28/04/2011)

- Act amending the Banking Act, the Insurance Act, the Investment Funds Act, the Financial Instruments Trading Act and the Financial Market Supervision Act (25/06/2010)

- Act amending the Act on Trading in Financial Instruments (22 January 2010)

- Act amending the Act on toll motorways and the National Road Fund and the Act on trading in financial instruments (20/11/2009)

- Act amending the Commercial Companies Code and the Act on Trading in Financial Instruments (05.12.2008)

- Act amending acts to standardize IT terminology (04/09/2008)

- Banking law (29/08/1997)

- Act amending certain acts in connection with ensuring the operational digital resilience of the financial sector and issuing European green bonds (25/06/2025)

- Act amending certain acts in order to deregulate economic and administrative law and improve the principles of developing economic law (21/05/2025)

- Act amending the Act on the Prison Service and certain other acts (09/05/2025)

- Act amending the Act on Development Cooperation and certain other acts (20/03/2025)

- Act amending the Act on Goods and Services Tax, the Act on Excise Duty and certain other acts (24/01/2025)

- Act amending the Accounting Act, the Act on Statutory Auditors, Audit Firms and Public Supervision and certain other acts (06.12.2024)

- Act amending the Act on the exchange of tax information with other countries and certain other acts (23/05/2024)

- Act amending certain acts in connection with ensuring the development of the financial market and the protection of investors on this market (16/08/2023)

- Act amending certain acts to limit certain effects of identity theft (07/07/2023)

- Act amending the Act on Goods and Services Tax and certain other acts (26/05/2023)

- Act amending the Act on Goods and Services Tax and certain other acts (14/04/2023)

- Act amending the Act on Investment Funds and the Management of Alternative Investment Funds, the Act on Bonds, the Act on the Bank Guarantee Fund, the Deposit Guarantee System and Compulsory Restructuring and certain other acts (14/04/2023)

- Act amending the Act on the handling of complaints by financial market entities and on the Financial Ombudsman and certain other acts (01.12.2022)

- Act amending the Excise Duty Act and certain other acts (01.12.2022)

- Act amending acts to counteract usury (06/10/2022)

- Act amending the Act on the Prison Service and certain other acts (22/07/2022)

- Act amending the Act on Assistance to Citizens of Ukraine in Connection with the Armed Conflict on the Territory of That State and Certain Other Acts (08/04/2022)

- Act amending certain acts in order to improve the terminological consistency of the legal system (01/10/2021)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/10/2021)

- Act amending the Act on Tax on Goods and Services and the Act – Banking Law (11/08/2021)

- Act amending the Act on the Bank Guarantee Fund, the deposit guarantee system and compulsory restructuring and certain other acts (08/07/2021)

- Act amending the Act on Goods and Services Tax and certain other acts (27/11/2020)

- Act amending the Act – Code of Civil Procedure and certain other acts (13/02/2020)

- Act amending the Act on Government Administration Departments and certain other acts (23/01/2020)

- Act amending the Act on enforcement proceedings in administration and certain other acts (11/09/2019)

- Act amending the Act on Goods and Services Tax and certain other acts (09/08/2019)

- Act amending certain acts to reduce regulatory burdens (31/07/2019)

- Act amending certain acts in order to reduce payment backlogs (19/07/2019)

- Act amending the Act on support for borrowers in financial difficulties who have taken out a housing loan and certain other acts (04/07/2019)

- Act amending the Act on Employee Capital Plans, the Act on the Organization and Operation of Pension Funds and the Banking Law (16/05/2019)

- Act amending the Act on Financial Market Supervision and certain other acts (15/03/2019)

- Act amending certain acts in connection with ensuring the application of GDPR (21/02/2019)

- Act amending the Act on the Bank Guarantee Fund, the deposit guarantee system and compulsory restructuring and certain other acts (17/01/2019)

- Act amending certain acts in connection with strengthening supervision over the financial market and investor protection on this market (09/11/2018)

- Act amending the Act on the National Revenue Administration and certain other acts (November 9, 2018)

- Act amending the Act on payment services and certain other acts (10/05/2018)

- Act amending the Act on payment services and certain other acts (22/03/2018)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/03/2018)

- Act amending the Act on certain rights of employees of the office serving the minister responsible for internal affairs and officers and employees of offices supervised by that minister, and certain other acts (09/11/2017)

- Act amending the Penal Code and certain other acts (23/03/2017)

- Act amending the Act on Trading in Financial Instruments and certain other acts (10/02/2017)

- Act amending the Act – Code of Civil Procedure and certain other acts (15/12/2016)

- Act amending the Act – Family and Guardianship Code and certain other acts (10/06/2016)

- Act amending the Act on Investment Funds and certain other acts (31/03/2016)

- Act amending the Act on payment terms in commercial transactions, the Civil Code and certain other acts (09/10/2015)

- Act amending the Banking Law and certain other acts (25/09/2015)

- Act amending the Act on Competition and Consumer Protection and certain other acts (05/08/2015)

- Act amending the Civil Code, the Code of Civil Procedure and certain other acts (10/07/2015)

- Act amending the Act on Capital Market Supervision and certain other acts (12/06/2015)

- Act amending the Act on supplementary supervision of credit institutions, insurance companies, reinsurance companies and investment firms being part of a financial conglomerate and certain other acts (24/04/2014)

- Act amending the Act on Financial Market Supervision and certain other acts (23/10/2013)

- Act amending the Banking Law and the Investment Funds Act (19/04/2013)

- Act amending the Act on Trading in Financial Instruments and certain other acts (24/10/2012)

- Act amending the Banking Law and the Consumer Credit Act (19/08/2011)

- Act amending the Banking Law and certain other acts (29/07/2011)

- Act amending the Banking Law and certain other acts (10/06/2011)

- Act amending the Banking Law, the Act on Trading in Financial Instruments and the Act on Financial Market Supervision (28/04/2011)

- Act amending the Banking Law, the Insurance Activity Act, the Investment Funds Act, the Financial Instruments Trading Act and the Financial Market Supervision Act (25/06/2010)

- Act amending the Act on the Bank Guarantee Fund and the Banking Law (16/07/2009)

- Act amending the Act on cooperative savings and credit unions and the Banking Law (18/06/2009)

- Act amending the Act on the Bank Guarantee Fund and other acts (23/10/2008)

- Act amending acts to standardize IT terminology (04/09/2008)

- Act amending the Banking Law (04/09/2008)

- Act amending the Act on bailiffs and enforcement and certain other acts (24/05/2007)

- Act amending the Banking Law (26/01/2007)

- Act amending the Banking Law (18/10/2006)

- Act amending the Act on the Protection of Classified Information and certain other acts (15/04/2005)

- Act amending and repealing certain acts in connection with the Republic of Poland’s accession to the EU (20/04/2004)

- Act amending the Banking Law Act and other acts (01/04/2004)

- Act amending the Act – Law on Public Trading in Securities and amending other acts (12/03/2004)

- Act amending the Act on the National Bank of Poland and other acts (18 December 2003)

- Act amending the Commercial Companies Code and certain other acts (12/12/2003)

- Act amending the Act on the Social Insurance System and certain other acts (18 December 2002)

- Act amending the Tax Ordinance Act and certain other acts (12/09/2002)

- Act amending the Banking Law (27/07/2002)

- Act amending the Act on Mortgage Bonds and Mortgage Banks and amending certain other acts (05/07/2002)

- Act on transformations in the customs administration and on amending certain acts (20/03/2002)

- Act on changes in the organization and functioning of central government administration bodies and their subordinate units and on amending certain acts (01.03.2002)

- Act amending the Act on bailiffs and execution and amending certain other acts (18/09/2001)

- Act amending the Banking Law and other acts (23/08/2001)

- Act amending the Police Act, the Insurance Act, the Banking Law, the County Self-Government Act and the Act – Provisions introducing acts reforming public administration (27/07/2001)

- Act amending the Act on the Bank Guarantee Fund and the Banking Law (15/12/2000)

- Act amending the Penal Code, the Code of Criminal Procedure, the Act on Combating Unfair Competition, the Public Procurement Act and the Banking Law (09/09/2000)

- Act amending the Act on the Bank Guarantee Fund and certain other acts (09/04/1999)

Access to Information

- Regulation (EU) 2025/327 (EHDS) (11/05/2025)

- Regulation (EU) 2023/2854 (Data Act) (13/12/2023)

- Regulation (EU) 2022/868 (Data Governance Act) (30/05/2022)

- Regulation (EU) 2018/1807 (14/11/2018)

- Regulation (EU) 2018/1725 (EUDPR) (23/10/2018)

- Regulation (EU) 2016/679 (GDPR) (27/04/2016)

- Directive (EU) 2019/1024 (20/06/2019)

- Directive (EU) 2000/31 (e-commerce directive) (08.06.2000)

- Electronic Communications Law (12/07/2024)

- Act amending the Act on the Prison Service and certain other acts (09/05/2025)

- Act amending the Act on State Emergency Medical Services and certain other acts (24/04/2025)

- Personal Data Protection Act (10/05/2018)

- Act amending certain acts in connection with ensuring the application of the GDPR in connection with the processing of personal data and on the free movement of such data, and repealing Directive (EU) 95/46/EC (21/02/2019)

- Detective Services Act (06/07/2011)

- Act amending certain acts in connection with ensuring the application of the GDPR in connection with the processing of personal data and on the free movement of such data, and repealing Directive (EU) 95/46/EC (21/02/2019)

- Act amending certain acts in connection with the standardization of certain templates of documents in administrative procedures (24/04/2014)

- Act amending the Act on detective services (26/11/2010)

- Act amending certain acts in connection with the entry into force of the Protocol to the Agreement between the European Community and its Member States, of the one part, and the Swiss Confederation, of the other, on the free movement of persons (05.09.2008)

- Act on Trading in Financial Instruments (29/07/2005)

- Act amending the Act on the Defense of the Homeland and certain other acts (25/06/2025)

- Act amending certain acts in connection with ensuring the operational digital resilience of the financial sector and issuing European green bonds (25/06/2025)

- Act amending the Act on Trading in Financial Instruments (24/06/2025)

- Act amending the Act on the Prison Service and certain other acts (09/05/2025)

- Act amending the Accounting Act, the Act on Statutory Auditors, Audit Firms and Public Supervision and certain other acts (06.12.2024)

- Act amending certain acts in connection with ensuring the development of the financial market and the protection of investors on this market (16/08/2023)

- Act amending the Act on Investment Funds and the Management of Alternative Investment Funds, the Act on Bonds, the Act on the Bank Guarantee Fund, the Deposit Guarantee System and Compulsory Restructuring and certain other acts (14/04/2023)

- Act amending the Act on the handling of complaints by financial market entities and on the Financial Ombudsman and certain other acts (01.12.2022)

- Act amending certain acts in order to simplify administrative procedures for citizens and entrepreneurs (07/10/2022)

- Act amending the Act on the Prison Service and certain other acts (22/07/2022)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/10/2021)

- Act amending the Act on the Capacity Market and certain other acts (23/07/2021)

- Act amending the Act on investment funds and management of alternative investment funds and certain other acts (23/07/2021)

- Act amending the Act on Trading in Financial Instruments and certain other acts (21/01/2021)

- Act amending the Act on special solutions related to the prevention, counteraction and combating of COVID-19, other infectious diseases and crisis situations caused by them, and certain other acts (31/03/2020)

- Act amending the Act on Government Administration Departments and certain other acts (23/01/2020)

- Act amending the Commercial Companies Code and certain other acts (30/08/2019)

- Act amending the Commercial Companies Code and certain other acts (19/07/2019)

- Act amending the Act on Financial Market Supervision and certain other acts (15/03/2019)

- Act amending certain acts in connection with ensuring the application of GDPR (21/02/2019)

- Act amending certain acts in connection with strengthening supervision over the financial market and investor protection on this market (09/11/2018)

- Act amending certain acts in order to introduce simplifications for entrepreneurs in tax and economic law (09/11/2018)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/03/2018)

- Act amending the Act on certain rights of employees of the office serving the minister responsible for internal affairs and officers and employees of offices supervised by that minister, and certain other acts (09/11/2017)

- Act amending the Penal Code and certain other acts (23/03/2017)

- Act amending the Act on Trading in Financial Instruments and certain other acts (10/02/2017)

- Act amending the Act on Investment Funds and certain other acts (32/03/2016)

- Act amending acts regulating the conditions of access to certain professions (05/08/2015)

- Act amending the Act on Competition and Consumer Protection and certain other acts (05/08/2015)

- Act amending the Act on Capital Market Supervision and certain other acts (12/06/2015)

- Act amending the Act on Trading in Financial Instruments and certain other acts (05.12.2014)

- Act amending the Act on supplementary supervision of credit institutions, insurance companies, reinsurance companies and investment firms being part of a financial conglomerate and certain other acts (24/04/2014)

- Act amending the Act on Trading in Financial Instruments and certain other acts (24/10/2012)

- Act amending the Act on Trading in Financial Instruments and certain other acts (16/09/2011)

- Act amending the Banking Law, the Act on Trading in Financial Instruments and the Act on Financial Market Supervision (28/04/2011)

- Act amending the Banking Act, the Insurance Act, the Investment Funds Act, the Financial Instruments Trading Act and the Financial Market Supervision Act (25/06/2010)

- Act amending the Act on Trading in Financial Instruments (22 January 2010)

- Act amending the Act on toll motorways and the National Road Fund and the Act on trading in financial instruments (20/11/2009)

- Act amending the Commercial Companies Code and the Act on Trading in Financial Instruments (05.12.2008)

- Act amending acts to standardize IT terminology (04/09/2008)

- Banking law (29/08/1997)

- Act amending certain acts in connection with ensuring the operational digital resilience of the financial sector and issuing European green bonds (25/06/2025)

- Act amending certain acts in order to deregulate economic and administrative law and improve the principles of developing economic law (21/05/2025)

- Act amending the Act on the Prison Service and certain other acts (09/05/2025)

- Act amending the Act on Development Cooperation and certain other acts (20/03/2025)

- Act amending the Act on Goods and Services Tax, the Act on Excise Duty and certain other acts (24/01/2025)

- Act amending the Accounting Act, the Act on Statutory Auditors, Audit Firms and Public Supervision and certain other acts (06.12.2024)

- Act amending the Act on the exchange of tax information with other countries and certain other acts (23/05/2024)

- Act amending certain acts in connection with ensuring the development of the financial market and the protection of investors on this market (16/08/2023)

- Act amending certain acts to limit certain effects of identity theft (07/07/2023)

- Act amending the Act on Goods and Services Tax and certain other acts (26/05/2023)

- Act amending the Act on Goods and Services Tax and certain other acts (14/04/2023)

- Act amending the Act on Investment Funds and the Management of Alternative Investment Funds, the Act on Bonds, the Act on the Bank Guarantee Fund, the Deposit Guarantee System and Compulsory Restructuring and certain other acts (14/04/2023)

- Act amending the Act on the handling of complaints by financial market entities and on the Financial Ombudsman and certain other acts (01.12.2022)

- Act amending the Excise Duty Act and certain other acts (01.12.2022)

- Act amending acts to counteract usury (06/10/2022)

- Act amending the Act on the Prison Service and certain other acts (22/07/2022)

- Act amending the Act on Assistance to Citizens of Ukraine in Connection with the Armed Conflict on the Territory of That State and Certain Other Acts (08/04/2022)

- Act amending certain acts in order to improve the terminological consistency of the legal system (01/10/2021)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/10/2021)

- Act amending the Act on Tax on Goods and Services and the Act – Banking Law (11/08/2021)

- Act amending the Act on the Bank Guarantee Fund, the deposit guarantee system and compulsory restructuring and certain other acts (08/07/2021)

- Act amending the Act on Goods and Services Tax and certain other acts (27/11/2020)

- Act amending the Act – Code of Civil Procedure and certain other acts (13/02/2020)

- Act amending the Act on Government Administration Departments and certain other acts (23/01/2020)

- Act amending the Act on enforcement proceedings in administration and certain other acts (11/09/2019)

- Act amending the Act on Goods and Services Tax and certain other acts (09/08/2019)

- Act amending certain acts to reduce regulatory burdens (31/07/2019)

- Act amending certain acts in order to reduce payment backlogs (19/07/2019)

- Act amending the Act on support for borrowers in financial difficulties who have taken out a housing loan and certain other acts (04/07/2019)

- Act amending the Act on Employee Capital Plans, the Act on the Organization and Operation of Pension Funds and the Banking Law (16/05/2019)

- Act amending the Act on Financial Market Supervision and certain other acts (15/03/2019)

- Act amending certain acts in connection with ensuring the application of GDPR (21/02/2019)

- Act amending the Act on the Bank Guarantee Fund, the deposit guarantee system and compulsory restructuring and certain other acts (17/01/2019)

- Act amending certain acts in connection with strengthening supervision over the financial market and investor protection on this market (09/11/2018)

- Act amending the Act on the National Revenue Administration and certain other acts (November 9, 2018)

- Act amending the Act on payment services and certain other acts (10/05/2018)

- Act amending the Act on payment services and certain other acts (22/03/2018)

- Act amending the Act on Trading in Financial Instruments and certain other acts (01/03/2018)

- Act amending the Act on certain rights of employees of the office serving the minister responsible for internal affairs and officers and employees of offices supervised by that minister, and certain other acts (09/11/2017)

- Act amending the Penal Code and certain other acts (23/03/2017)

- Act amending the Act on Trading in Financial Instruments and certain other acts (10/02/2017)

- Act amending the Code of Civil Procedure and certain other acts (15/12/2016)

- Act amending the Act – Family and Guardianship Code and certain other acts (10/06/2016)

- Act amending the Act on Investment Funds and certain other acts (31/03/2016)

- Act amending the Act on payment terms in commercial transactions, the Civil Code and certain other acts (09/10/2015)

- Act amending the Banking Law and certain other acts (25/09/2015)

- Act amending the Act on Competition and Consumer Protection and certain other acts (05/08/2015)

- Act amending the Civil Code, the Code of Civil Procedure and certain other acts (10/07/2015)

- Act amending the Act on Capital Market Supervision and certain other acts (12/06/2015)

- Act amending the Act on supplementary supervision of credit institutions, insurance companies, reinsurance companies and investment firms being part of a financial conglomerate and certain other acts (24/04/2014)

- Act amending the Act on Financial Market Supervision and certain other acts (23/10/2013)

- Act amending the Banking Law and the Investment Funds Act (19/04/2013)

- Act amending the Act on Trading in Financial Instruments and certain other acts (24/10/2012)

- Act amending the Banking Law and the Consumer Credit Act (19/08/2011)

- Act amending the Banking Law and certain other acts (29/07/2011)

- Act amending the Banking Law and certain other acts (10/06/2011)

- Act amending the Banking Law, the Act on Trading in Financial Instruments and the Act on Financial Market Supervision (28/04/2011)

- Act amending the Banking Law, the Insurance Activity Act, the Investment Funds Act, the Financial Instruments Trading Act and the Financial Market Supervision Act (25/06/2010)

- Act amending the Act on the Bank Guarantee Fund and the Banking Law (16/07/2009)

- Act amending the Act on cooperative savings and credit unions and the Banking Law (18/06/2009)

- Act amending the Act on the Bank Guarantee Fund and other acts (23/10/2008)

- Act amending acts to standardize IT terminology (04/09/2008)

- Act amending the Banking Law (04/09/2008)

- Act amending the Act on court bailiffs and enforcement and certain other acts (24/05/2007)

- Act amending the Banking Law (26/01/2007)

- Act amending the Banking Law (18/10/2006)

- Act amending the Act on the Protection of Classified Information and certain other acts (15/04/2005)

- Act amending and repealing certain acts in connection with the Republic of Poland’s accession to the EU (20/04/2004)

- Act amending the Banking Law Act and other acts (01/04/2004)

- Act amending the Act – Law on Public Trading in Securities and amending other acts (12/03/2004)

- Act amending the Act on the National Bank of Poland and other acts (18 December 2003)

- Act amending the Commercial Companies Code and certain other acts (12/12/2003)

- Act amending the Act on the Social Insurance System and certain other acts (18 December 2002)

- Act amending the Tax Ordinance Act and certain other acts (12/09/2002)

- Act amending the Banking Law (27/07/2002)

- Act amending the Act on Mortgage Bonds and Mortgage Banks and amending certain other acts (05/07/2002)

- Act on transformation of the customs administration and on amending certain acts (20/03/2002)

- Act on changes in the organization and functioning of central government administration bodies and their subordinate units and on amending certain acts (01/03/2002)

- Act amending the Act on bailiffs and execution and on amending certain other acts (18/09/2001)

- Act amending the Banking Law and other acts (23/08/2001)

- Act amending the Police Act, the Insurance Act, the Banking Law, the County Self-Government Act and the Act – Provisions introducing acts reforming public administration (27/07/2001)

- Act amending the Act on the Bank Guarantee Fund and the Banking Law (15/12/2000)

- Act amending the Penal Code, the Code of Criminal Procedure, the Act on Combating Unfair Competition, the Public Procurement Act and the Banking Law (09/09/2000)

- Act amending the Act on the Bank Guarantee Fund and certain other acts (09/04/1999)

- Press Law (26/01/1984)

- Act amending the Press Law (20/07/2018)

- Act amending the Press Law (27/10/2017)

- Act amending the Press Law (10/05/2013)

- Act amending the Press Law (14/09/2012)

- Act amending the Press Law (19/08/2011)

- Act amending the Civil Code (23/08/1996)

- Act amending the Press Law (30/05/1989)

- Regulation of the Council of Ministers on the National Interoperability Framework, minimum requirements for public registers and the exchange of information in electronic form, and minimum requirements for ICT systems (21/05/2024)

Personal Data

- Regulation (EU) 2025/327 (EHDS) (11/05/2025)

- Regulation (EU) 2023/2854 (Data Act) (13/12/2023)

- Regulation (EU) 2018/1725 (EUDPR) (23/10/2018)

- Regulation (EU) 2017/2394 (12/12/2017)

- Directive (EU) 2024/1799 amending Regulation (EU) 2017/2394, Directive (EU) 2019/771 and Directive (EU) 2020/1828 (13/06/2024)

- Directive (EU) 2019/771 amending Regulation (EU) 2017/2394 and Directive (EU) 2009/22 and repealing Directive (EU) 1999/44 (20/05/2019)

- Regulation (EU) 2018/302 amending Regulation (EU) 2006/2004, Regulation (EU) 2017/2394 and Directive 2009/22 (28/02/2018)

- Regulation (EU) 2016/679 (GDPR) (27/04/2016)

- Directive (EU) 2016/680 (LED) (27/04/2016)

- Act on the protection of personal data processed in connection with the prevention and combating of crime (14/12/2018)

- Personal Data Protection Act (10/05/2018)

- Act amending certain acts in connection with ensuring the application of the GDPR in connection with the processing of personal data and on the free movement of such data, and repealing Directive (EU) 95/46/EC (21/02/2019)

- Detective Services Act (06/07/2011)

- Act amending certain acts in connection with ensuring the application of the GDPR in connection with the processing of personal data and on the free movement of such data, and repealing Directive (EU) 95/46/EC (21/02/2019)

- Act amending certain acts in connection with the standardization of certain templates of documents in administrative procedures (24/04/2014)

- Act amending the Act on detective services (26/11/2010)

- Act amending certain acts in connection with the entry into force of the Protocol to the Agreement between the European Community and its Member States, of the one part, and the Swiss Confederation, of the other, on the free movement of persons (05/09/2008)

Non-Personal Data

- Regulation (EU) 2023/2854 (Data Act) (13/12/2023)

- Regulation (EU) 2022/868 (Data Governance Act) (30/05/2022)

- Directive (EU) 2019/1024 (20/06/2019)

- Regulation (EU) 2018/1807 (14/11/2018)

Legal Acts

- Regulation (EU) 2016/679 (GDPR) http://data.europa.eu/eli/reg/2016/679/2016-05-04

- The GDPR applies to the processing of personal data of European Union citizens. This covers all data-related operations, such as collection, storage, analysis, and sharing, regardless of whether they are carried out by automated means. The regulation aims to protect the privacy of individuals and ensure that their personal data is processed securely and lawfully. The GDPR covers the protection of personal data, which is any information that can identify a natural person. The regulation imposes several principles on entities processing data, such as the principles of lawfulness, fairness, transparency, purpose limitation, data minimization, accuracy, storage limitation, integrity, and confidentiality. The GDPR grants data subjects a number of rights, such as the right to access, rectification, erasure (the right to be forgotten), restriction of processing, data portability, and the right to object to processing. Data processors must implement appropriate technical and organizational measures to ensure data security and compliance with the GDPR principles. The GDPR applies to all organizations that process personal data of EU citizens, regardless of their location. Violation of GDPR provisions may result in the imposition of high financial penalties.

- Regulation 2025/327 (EHDS)http://data.europa.eu/eli/reg/2025/327/oj

- The European Health Data Space regulates the exchange and use of health data in the European Union. The main goals of the regulation are to ensure secure access to citizens’ health data across the EU, facilitate the exchange of information between healthcare providers, and promote innovation in the field of health. The regulation aims to:

- Increasing patient control over their health data:

- Citizens will have the right to access their electronic health data and control its use.

- This will enable secure data sharing between different medical facilities in the EU, contributing to better healthcare.

- EHDS is intended to facilitate access to health data for research purposes, which is expected to accelerate the development of new therapies and improve disease prevention.

- Through improved information flow, EHDS is intended to help respond to health crises more quickly and effectively.

- Increasing patient control over their health data:

- The introduction of the EHDS requires adapting national healthcare systems to new requirements. As a member state, Poland must adapt its regulations and IT infrastructure to the new regulations to ensure full compliance with the EHDS.

- The European Health Data Space regulates the exchange and use of health data in the European Union. The main goals of the regulation are to ensure secure access to citizens’ health data across the EU, facilitate the exchange of information between healthcare providers, and promote innovation in the field of health. The regulation aims to:

- Regulation (EU) 2022/2554 (DORA) http://data.europa.eu/eli/reg/2022/2554/oj

- DORA governs the digital operational resilience of the EU financial sector by establishing a comprehensive framework for managing risks related to information and communication technologies (ICT). Key aspects regulated by DORA include:

- ICT Risk Management: DORA requires financial institutions to proactively and comprehensively manage all types of ICT-related risks.Incident Reporting: The Regulation specifies which ICT-related incidents are subject to mandatory reporting and sets out detailed reporting procedures.Resilience Testing: Financial institutions are required to regularly conduct digital resilience testing, including penetration testing.Third-party ICT service providers: DORA establishes a supervisory framework for key third-party ICT service providers and regulates their relationships with financial institutions.Harmonisation of standards: The Regulation aims to create a unified front for cyber resilience across the EU by harmonising security standards.

- DORA governs the digital operational resilience of the EU financial sector by establishing a comprehensive framework for managing risks related to information and communication technologies (ICT). Key aspects regulated by DORA include:

- Regulation (EU) 2023/1781 (Chips Act )http://data.europa.eu/eli/reg/2023/1781/oj

- The European Chips Act aims to strengthen the European semiconductor ecosystem, increase the European Union’s competitiveness and technological sovereignty by supporting research, production, and development of innovative technologies in this sector, and ensure the resilience of supply chains and reduce dependence on non-EU suppliers. Main objectives and provisions:

- Strengthening research and technological leadership: The Act aims to boost Europe’s capacity to innovate in the design, production and packaging of advanced chips;

- Increasing production capacity: A legal framework and investments, including support for pioneering production facilities, are provided to increase semiconductor production in the EU and double the EU’s share of the global market by 2030;

- Supply chain coordination and monitoring: The Regulation introduces mechanisms to monitor global supply chains, anticipate shortages and coordinate actions with Member States to ensure stability of supply;

- Development of skilled workforce: The activities also aim to attract new talent and address the shortage of skilled labor in the semiconductor sector;

- Increasing resilience and technological sovereignty: By strengthening the European semiconductor ecosystem, the Act aims to increase Europe’s autonomy and resilience to global crises and supply disruptions.

- Regulation (EU) 2024/2847 (Cyber Resilience Act) http://data.europa.eu/eli/reg/2024/2847/2024-11-20

- The CRA is an EU legal act establishing uniform cybersecurity requirements for all digital products introduced to the European Union market. Its main goal is to ensure that, from design and production, and throughout the product lifecycle, hardware and software are built with security in mind, minimizing security vulnerabilities and reducing the risk of attacks. The CRA addresses:

- Manufacturers: Holds them responsible for the security of their digital products throughout their lifespan;

- The CRA is an EU legal act establishing uniform cybersecurity requirements for all digital products introduced to the European Union market. Its main goal is to ensure that, from design and production, and throughout the product lifecycle, hardware and software are built with security in mind, minimizing security vulnerabilities and reducing the risk of attacks. The CRA addresses:

- Importers and distributors: Responsible for placing compliant products on the market;

- Consumers: Influences their choices by giving access to more secure devices;

- The Regulation entered into force on December 10, 2024. Most of the CRA requirements will become mandatory from September 11, 2026, and will be fully applicable on December 11, 2027.

- In the event of non-compliance with the regulation, high financial penalties are foreseen.

- In summary, CRA is introducing security standards that will make digital products such as smartwatches, smart refrigerators and antivirus software safer for users and better protected against cyber threats.

- Regulation (EU) 2023/2854 (Data Act ) http://data.europa.eu/eli/reg/2023/2854/oj

- The Data Regulation is an EU law aimed at regulating access to, exchange, and use of data, particularly data generated by devices connected to the Internet of Things (IoT). The Data Act aims to increase competitiveness and innovation in the European market by facilitating access to data for various entities, including consumers, businesses, and public administrations. The main objectives of the Data Act are:

- Data sharing by manufacturers and service providers:

- The Data Act imposes an obligation to share data generated by IoT devices with their users, other companies (including competitors) and, in certain cases, public authorities;

- Sharing of personal data may only occur at the user’s request and must be in accordance with the General Data Protection Regulation (GDPR);

- The Data Act aims to counteract unfair contractual provisions regarding access to and use of data;

- The regulation aims to facilitate the switching of cloud computing service providers and improve the interoperability of data and services;

- Easier access to data is intended to support the creation of new products and services, especially by small and medium-sized enterprises;

- Consumers will gain greater control over their data and a wider choice of service providers.

- IoT devices (e.g. smart household appliances, cars, agricultural machinery);Service providers who process data from these devices;IoT devices (both consumers and businesses);Companies that want to use data to create new products and services;Public administration.

- Data sharing by manufacturers and service providers:

- The Data Regulation is an EU law aimed at regulating access to, exchange, and use of data, particularly data generated by devices connected to the Internet of Things (IoT). The Data Act aims to increase competitiveness and innovation in the European market by facilitating access to data for various entities, including consumers, businesses, and public administrations. The main objectives of the Data Act are:

- Regulation (EU) 2022/868 (Data Governance Act) http://data.europa.eu/eli/reg/2022/868/oj

- Data Governance Act is a European Union regulation that establishes rules for the secure and transparent sharing and reuse of data, especially data held by the public sector. The regulation introduces mechanisms to support data exchange, including data brokerage services (aggregating and sharing data) and promoting data altruism (voluntary, free data sharing). Its goal is to support the digital economy, innovation, and better use of data for public and commercial purposes. The Act facilitates access to protected public data in a secure and controlled manner, while requiring its anonymity and compliance with personal data protection law (e.g., GDPR). It creates a framework for trusted providers who can act as intermediaries in data exchange. It promotes voluntary and free sharing of data by individuals and organizations with other entities. Improved conditions for data use are intended to foster the development of new data-driven products and services and increase the competitiveness of European businesses. Trust in data-sharing mechanisms is crucial for the development of a data-driven economy. The DGA is the EU’s first step in creating a comprehensive legal framework for data management. It is complemented by the Data Act, which focuses on regulating access to data generated by Internet of Things (IoT) devices.

- Regulation (EU) 2017/2394 http://data.europa.eu/eli/reg/2017/2394/2025-01-19

- Regulation (EU) 2017/2394 governs cooperation between national authorities responsible for enforcing consumer protection laws. Its main objective is to ensure effective international cooperation in combating infringements of consumer rights, so as to protect the interests of consumers in the EU single market. Key aspects of the regulation include:

- Establishes a framework for cooperation between authorities such as those operating in the Consumer Protection Cooperation (CPC) network;

- Regulation (EU) 2017/2394 governs cooperation between national authorities responsible for enforcing consumer protection laws. Its main objective is to ensure effective international cooperation in combating infringements of consumer rights, so as to protect the interests of consumers in the EU single market. Key aspects of the regulation include:

- It aims to guarantee a high level of consumer protection in all Member States, regardless of where they purchase or travel;

- Enables coordinated action against unfair commercial practices that harm consumers across the European Union;

- Enforcement authorities can require businesses to make good the damage, compensate consumers and apply effective sanctions, which can amount to up to 4% of the company’s turnover in a given EU country.

- This regulation applies to a wide range of consumer protection issues, including unfair commercial practices, product safety, personal data protection, financial services, and e-commerce. In short, Regulation 2017/2394 is a key instrument in EU consumer policy, aiming to ensure that consumers across the European Union are protected from unfair practices and can benefit from safe products and services.

- Directive (EU) 2024/1799 amends Regulation (EU) 2017/2394 and Directives (EU) 2019/771 and (EU) 2020/1828 on common rules promoting the repair of goods. http://data.europa.eu/eli/dir/2024/1799/oj

- Directive (EU) 2019/771 amends Regulation (EU) 2017/2394 and Directive (EU) 2009/22 and repeals Directive (EU) 1999/44 on certain aspects concerning contracts for the sale of goods. https://eur-lex.europa.eu/legal-content/PL/TXT/HTML/?uri=CELEX:02019L0771-20190522 [link in Polish]

- Regulation (EU) 2018/302 amends Regulation (EU) 2006/2004 and Regulation (EU) 2017/2394 and Directive 2009/22 on unjustified geo-blocking and other forms of discrimination against customers based on their nationality, place of residence or place of establishment in the internal market. http://data.europa.eu/eli/reg/2018/302/oj

- Regulation (EU) 2024/1689 (AI Act )http://data.europa.eu/eli/reg/2024/1689/oj

- The AI Act establishes a comprehensive legal framework for AI in the EU. It classifies AI systems based on risk levels and imposes specific obligations on AI providers and implementers. The goal is to foster trustworthy AI, ensure security, protect fundamental rights, and promote innovation. Due to the scope of the regulations, the individual elements of the AI Act are being implemented gradually. The AI Act stipulates:

- Harmonised rules for the placing on the market, putting into service and use of AI systems in the EU;

- The AI Act establishes a comprehensive legal framework for AI in the EU. It classifies AI systems based on risk levels and imposes specific obligations on AI providers and implementers. The goal is to foster trustworthy AI, ensure security, protect fundamental rights, and promote innovation. Due to the scope of the regulations, the individual elements of the AI Act are being implemented gradually. The AI Act stipulates:

- Prohibitions on certain AI practices;

- Specific requirements for high-risk AI systems and obligations incumbent on operators of such systems;

- Harmonized transparency rules for certain AI systems;

- Harmonized rules for placing general-purpose AI models on the market;

- Provisions relating to marketing monitoring, market surveillance, management and enforcement;

- Measures to support innovation, with particular emphasis on SMEs, including start-ups.

- Providers placing AI systems or general purpose AI models on the market in the EU, regardless of whether those providers are established or located in the EU or in a third country;Entities using AI systems that are established or located in the EU;Providers of AI systems and entities using AI systems that are established or located in a third country where the results produced by the AI system are used in the EU;Importers and distributors of AI systems;Product manufacturers who, under their own name or trademark, and together with their product, introduce an AI system into the market or put it into use;Authorised representatives of suppliers not established in the EU;People affected by AI who are located in the EU.

- Regulation (EU) 2018/1725 (EUDPR)http://data.europa.eu/eli/reg/2018/1725/oj

- Regulation (EU) 2018/1725 governs the processing of personal data by European Union institutions, bodies, and other agencies. This regulation repeals previous regulations in this area and introduces personal data protection principles similar to those contained in the GDPR. Individuals whose data is processed by EU institutions have the right to access, rectify, block, or erase their data. In case of doubts or problems, you can contact the data controller and, in the event of a dispute, the Data Protection Officer or the European Data Protection Supervisor (EDPS).

- Regulation (EU) 2018/1807http://data.europa.eu/eli/reg/2018/1807/oj

- Regulation (EU) 2018/2018 provides a framework for the free flow of non-personal data within the European Union. Its main goal is to ensure the free movement of non-personal data within the EU single market, while prohibiting Member States from imposing data localization requirements (e.g., storing them in a specific country) unless justified by public security concerns. The regulation aims to foster the development of modern technologies, such as the cloud and artificial intelligence, by facilitating the cross-border mobility of non-personal data. The regulation ensures that competent authorities have access to non-personal data for control, inspection, and audit purposes. It makes it easier for professional users to transfer data from one processing or storage service provider to another, preventing market disruptions. It entered into force on May 28, 2019.

- Regulation (EU) 2024/903 (Interoperable Europe Act)http://data.europa.eu/eli/reg/2024/903/oj

- Regulation (EU) 2024/903 establishes a framework for cooperation between Member States’ public administrations to enable them to deliver public services efficiently across borders, while supporting the digital transformation and the “only once” principle. This act aims to simplify administrative processes for citizens and businesses, providing them with access to high-quality digital services regardless of their place of residence in the EU. It enables various public administrations, as well as systems and services, to exchange data and effectively interact. It ensures the efficient provision of public services (e.g., health, taxation, professional qualifications) between different Member States. The Interoperable Europe Act introduces mechanisms to support the goal of making all key public services available electronically by 2030 – including enabling citizens and businesses to share data for official purposes only once, without having to submit the same information repeatedly. An Interoperable Europe Council was established, responsible for the development and oversight of the implementation of common solutions. The act supports openness and cooperation with the private and scientific sectors. Emphasis is placed on the accessibility of digital public services for all, including the elderly, people with disabilities, and other vulnerable groups.

- Regulation (EU) 648/2012 (EMIR) http://data.europa.eu/eli/reg/2012/648/2025-01-17

- European Market Infrastructure Regulation enhances the security and transparency of the European over-the-counter (OTC) derivatives market by introducing obligations regarding transaction clearing, risk management, and reporting to trade repositories. Its purpose is to reduce systemic and operational risk, prevent future financial crises, and provide market reassurance. This regulation applies to financial contracts not concluded on regulated exchanges, such as energy, gas, foreign exchange, and interest rate contracts. EMIR requires certain transactions to be cleared through a central counterparty (CCP), which is intended to increase security. It obliges entities to report details of concluded transactions to a trade repository. It introduces requirements for managing the risks associated with derivative contracts, including the obligation to conclude transaction processing agreements. The regulation applies to various entities that conclude derivatives transactions. The main objectives of EMIR:

- Reducing systemic risk associated with the derivatives market;

- European Market Infrastructure Regulation enhances the security and transparency of the European over-the-counter (OTC) derivatives market by introducing obligations regarding transaction clearing, risk management, and reporting to trade repositories. Its purpose is to reduce systemic and operational risk, prevent future financial crises, and provide market reassurance. This regulation applies to financial contracts not concluded on regulated exchanges, such as energy, gas, foreign exchange, and interest rate contracts. EMIR requires certain transactions to be cleared through a central counterparty (CCP), which is intended to increase security. It obliges entities to report details of concluded transactions to a trade repository. It introduces requirements for managing the risks associated with derivative contracts, including the obligation to conclude transaction processing agreements. The regulation applies to various entities that conclude derivatives transactions. The main objectives of EMIR:

- Calming markets through better risk management and increased transparency;

- Enabling regulators to better monitor and oversee the market.

- Regulation (EU) 2021/23 amends Regulation (EU) 1095/2010, Regulation (EU) 648/2012, Regulation (EU) 600/2014, Regulation (EU) 806/2014, Regulation (EU) 2015/2365, Directive (EU) 2002/47, Directive (EU) 2004/25, Directive (EU) 2007/36, Directive (EU) 2014/59 and Directive (EU) 2017/1132 on a framework for the recovery and resolution of central counterparties. http://data.europa.eu/eli/reg/2021/23/oj

- Regulation (EU) 2017/2402 amends Directive (EU) 2009/65, Directive (EU) 2009/138, Directive (EU) 2011/61, Regulation (EU) 1060/2009 and Regulation (EU) 648/2012 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation. http://data.europa.eu/eli/reg/2017/2402/2021-04-09

- Regulation (EU) 2015/2365 amends Regulation (EU) 648/2012 on transparency of securities financing transactions and reuse. http://data.europa.eu/eli/reg/2015/2365/2024-01-09

- Regulation (EU) 600/2014 amends Regulation (EU) 648/2012 on markets in financial instruments. http://data.europa.eu/eli/reg/2014/600/2025-01-17

- Directive (EU) 2014/59 amends Directive (EU) 82/891, Directive (EU) 2001/24, Directive (EU) 2002/47, Directive (EU) 2004/25, Directive (EU) 2005/56, Directive (EU) 2007/36, Directive (EU) 2011/35, Directive (EU) 2012/30, Directive (EU) 2013/36, Regulation (EU) 1093/2010 and Regulation (EU) 648/2012 for the recovery and resolution of credit institutions and investment firms. http://data.europa.eu/eli/dir/2014/59/2025-01-17

- Regulation (EU) 575/2013 amends Regulation (EU) 648/2012 on prudential requirements for credit institutions. http://data.europa.eu/eli/reg/2013/575/2025-06-29

- Regulation (EU) 2017/745 (MDR)http://data.europa.eu/eli/reg/2017/745/2025-01-10

- The Medical Device Regulation establishes uniform and more stringent rules for the marketing, distribution, and monitoring of medical devices in the European Economic Area. The main objectives and key aspects of the MDR:

- Ensuring a robust, transparent and sustainable regulatory framework for medical devices;

- The Medical Device Regulation establishes uniform and more stringent rules for the marketing, distribution, and monitoring of medical devices in the European Economic Area. The main objectives and key aspects of the MDR:

- More detailed regulations regarding the classification of medical devices according to their risk;

- Stricter regulations for medical device conformity assessment bodies responsible for confirming compliance with MDR requirements;

- Introduction of new, extended obligations for manufacturers, importers, authorized representatives and distributors;

- Requirements for the traceability of medical devices across the market, facilitating tracking and inventory management.

- The regulation became fully applicable on 26 May 2021, replacing the MDD.

- Regulation (EU) 2017/746 (IVDR)http://data.europa.eu/eli/reg/2017/746/2025-01-10

- The IVDR applies to in vitro diagnostic medical devices (IVDs). Its goal is to ensure the effectiveness, safety, and quality of these devices on the EU market. The IVDR introduces stringent requirements, a four-level classification system for devices (A, B, C, D) based on risk and increases oversight of notified bodies. The IVDR replaced the old IVDD (98/79/EC), adapting the regulations to technological and medical progress. The new regulations aim to enhance public health and patient safety. Companies must undergo additional clinical trials and tighten the technical documentation of their products. Manufacturers are required to report serious incidents, and member states are required to facilitate reporting by healthcare professionals, patients, and users. A centralized database (Eudamed) has been introduced to provide access to information about medical devices available in the EU.

- Directive (EU) 2000/31 (e-commerce directive) http://data.europa.eu/eli/dir/2000/31/2024-02-17

- The E-Commerce Directive establishes harmonised legal rules for information society services (including online services) across the European Union. It aims to remove barriers to cross-border online services, increase legal certainty, and regulate issues such as information requirements for providers, rules on advertising, spam, and online contracts. The Directive also introduces safe harbors. The directive introduces so-called “safe harbors” for intermediary service providers, exempting them from liability for third-party content if they meet certain conditions. The directive eliminates obstacles to cross-border services provided online. It ensures regulatory clarity for businesses and consumers using online services. It also establishes rules for advertising and other forms of commercial communication. It requires the publication of basic company data (name, address, and registration number). Recognizing online contracts as equivalent to paper contracts requires clearly defining the terms and allowing consumers to store them. The e-commerce directive limits the liability of intermediary service providers (so-called “safe harbors”) for illegal content shared by their users, provided that certain procedures are followed (e.g., notice and takedown). It also introduces provisions regarding unsolicited commercial communications.

- Directive (EU) 2016/680 (LED)http://data.europa.eu/eli/dir/2016/680/2016-05-04

- Directive (EU) 2016/680, also known as the Criminal Data Protection Directive, covers the protection of personal data processed by competent authorities for the purposes of preventing, investigating, detecting, or prosecuting criminal offences, or executing criminal penalties. It establishes a legal framework to ensure a high level of protection of the personal data of persons involved in criminal proceedings, such as witnesses, victims, and suspects. The directive aims to:

- Schengen countries, which is intended to facilitate cooperation in combating crime;