KIELTYKA GLADKOWSKI KG LEGAL is participating in Wall Street Journal Pro Cybersecurity Webinar on Nation-State Attacks

On September 30, 2021 KIELTYKA GLADKOWSKI KG LEGAL will participate in Pro Cybersecurity Webinar on cyberattacks, organized by Wall Street Journal and sponsored by Dow Jones.

The webinar will address multiple issues related to ransomware and other extortion attacks on companies. The speakers will analyse nation-state cyber activity and the motivations behind it, gaps in the understanding and how the latter may be addressed. The participants will, among others learn:

Which types of nation-state attacks have been detected recently,

Where the gaps in our understanding of nation-state attacks are,

What data and which industries are at risk,

Whether there is a hard boundary between cyber crime and nation-state attacks

How organizations can prepare for cyberattacks.

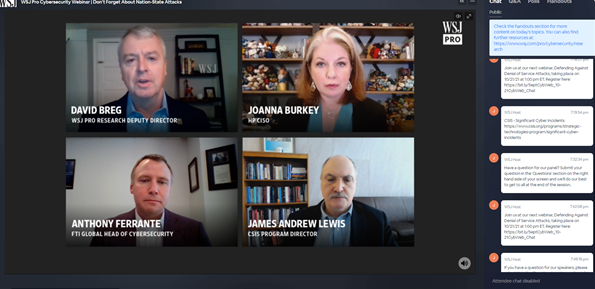

The speakers will include:

JOANNA BURKEY, CISO HP

ANTHONY FERRANTE, SENIOR MANAGING DIRECTOR, GLOBAL HEAD OF CYBERSECURITY, FTI CONSULTING

JAMES ANDREW LEWIS, SVP AND PROGRAM DIRECTOR, STRATEGIC TECHNOLOGIES PROGRAM, CENTER FOR STRATEGIC & INTERNATIONAL STUDIES

The subject matter of the webinar is closely related to core specialisations of KIELTYKA GLADKOWSKI within cyber security, data protection & data privacy, international data transfers, data breaches, cybersecurity in e-payments as well as data security in virtual currencies.