AI algorithmic pricing and its assessment under Polish and EU competition law

Publication date: October 10, 2025

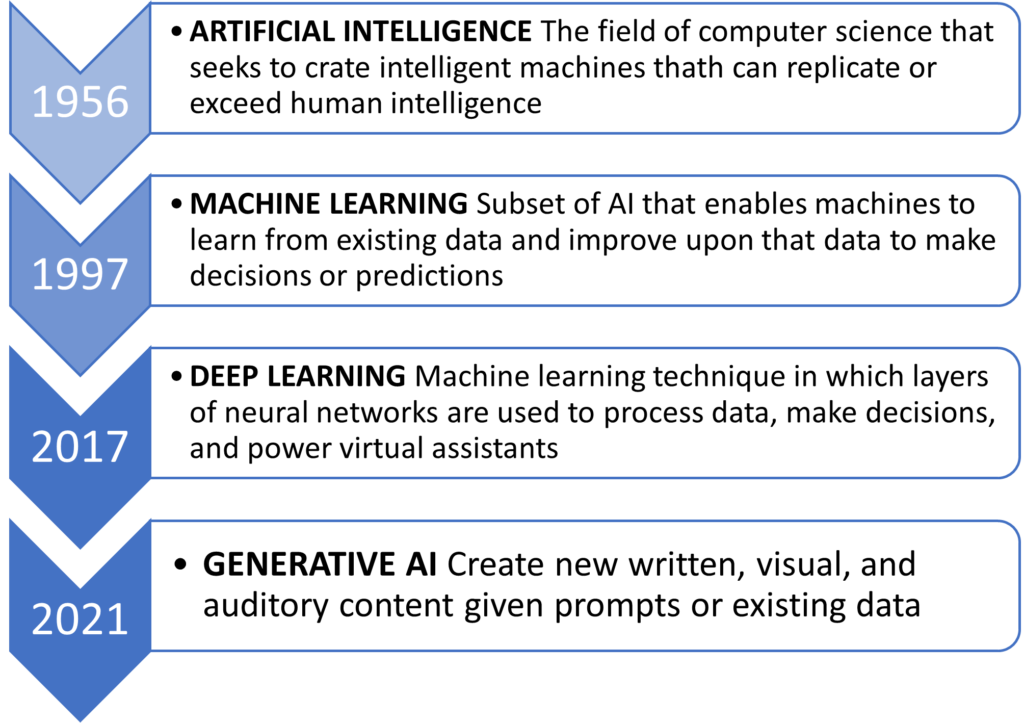

The development of artificial intelligence

Artificial intelligence is an interdisciplinary field of knowledge combining elements of computer science, mathematics, statistics, neuroscience, and cognitive science. Its goal is to create systems capable of performing tasks that previously required human intelligence. This includes the ability to learn from data, reason, make decisions, recognize patterns, and process and generate natural language. Unlike traditional programming, in which a computer executes strictly defined instructions, artificial intelligence aims to grant machines a degree of autonomy, allowing them to independently adapt their strategies to changing conditions. Today, AI is no longer an abstract theoretical concept, but a practical tool.