KIELTYKA GLADKOWSKI represents the interests of international investors within greenfield investments in Poland. The core of our activity for our international Clients are negotiations of all types of incentives which cause that greenfield in Poland is optimal from tax and business operations perspective and maximally profitable. Legal assistance for greenfield in Poland is a complex process and requires taking into account multi-year presence of the investor in Poland, its relations with local and government authorities and must take into consideration the legal conditions of REINVESTMENTS.

Legal support of KIELTYKA GLADKOWSKI within greenfield has been presented below, taking into account the legal status as of the second half of 2022.

When reporting on greenfield-type opportunities in Poland, and precisely compiling the most important operational and legal information where and what to invest in Poland, and what government support can be obtained to encourage such investment, one should start with a few statistical data showing the scale of greenfield investments in Poland. A large number of such investments in the practice of Polish economic turnover and the status of the leader of Poland according to some rankings against the background of the economic reality of other regions of Central and Eastern Europe certainly give a tangible, clear and specific message that in Poland many foreign investors believe that it is profitable to invest in Polish greenfield sector.

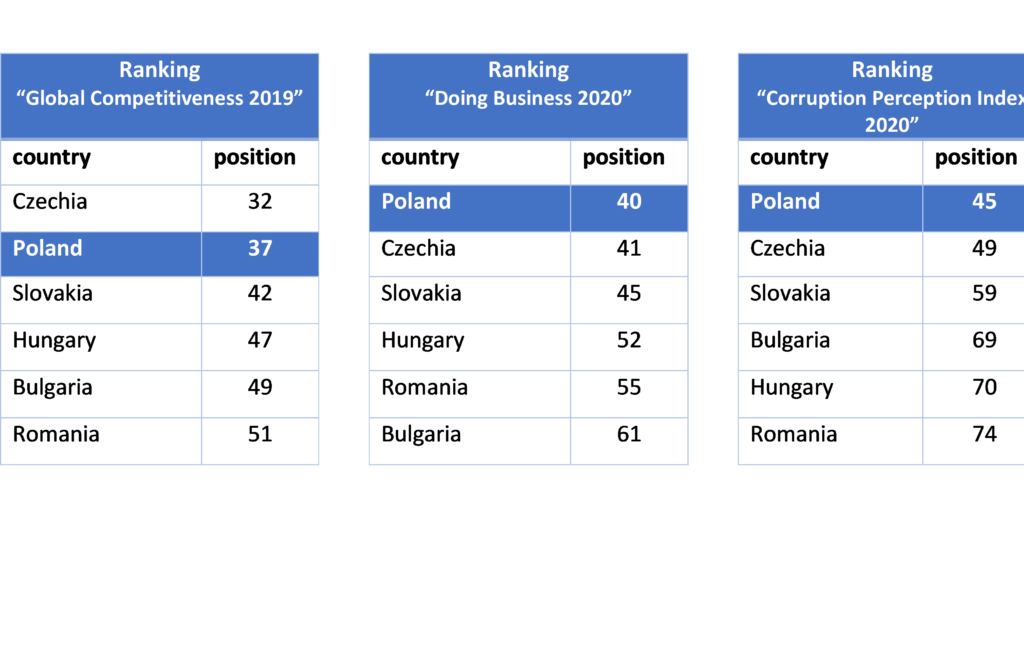

To confirm Poland’s leader position in CEE, the specialists most often refer to three mandates provided by three international sources:

There is no complete information on the entire greenfield sector in Poland for several reasons:

1. Such information is not covered by a specific task and operation of Polish statistics, specifically on what the entire greenfield investment in Poland looks like;

2. Hence, the information space is dominated by data provided by intermediaries for foreign investors in the greenfield investment process, such as the Polish Investment and Trade Agency and various types of foreign chambers of commerce operating in Poland for a specific economic destination, such as, for example, the Polish-American Chamber of Commerce (operating for American investors in Poland), Japan External Trade Organization (JETRO), Advantage Austria operating for Austrian entities, IHK – operating for German entities or other organizations, for example for South Korea;

3. There are various investment incentives for foreign greenfield investors that can, in principle, be catalogued into the five groups listed below; the nature of these groups shows at first glance the correctness that the procedure of public support for such investments is NOT CENTRALIZED and partially depends on local governments, i.e. local authorities in Poland, which does not result in automatic global reporting of all greenfield activities in Poland;

4. After all, not all investors, especially from the IT and TMT services sector, use the intermediation of economic diplomacy. The practice of KIELTYKA GLADKOWSKI shows that there are many foreign investments in Poland in the GREENFIELD sector, which invest in Poland without contact with chambers of commerce and without using government support, because the investment is profitable for other reasons and economic conditions.

Nevertheless, the Polish National Bank provides assessed value of greenfield investments, indicating the following macro-statistical data:

“In 2020 Poland received a total inflow of FDI equal to 53.94 billion PLN (EUR 11.77 billion) — according to the National Bank of Poland.”

the Polish National Bank

| Poland’s net liabilities due to inward direct investment | |||

|---|---|---|---|

| Year | Stocks and other forms of equity (mln PLN) | Debt instruments (mln PLN) | Total (mln PLN) |

| 2015 | 543 297 | 182 255 | 725 552 |

| 2016 | 582 603 | 255 206 | 788 774 |

| 2017 | 639 016 | 197 827 | 836 842 |

| 2018 | 649 860 | 213 093 | 862 963 |

| 2019 | 688 827 | 203 350 | 892 176 |

| Source: National Bank of Poland, Direct Foreign investments in Poland 2019 |

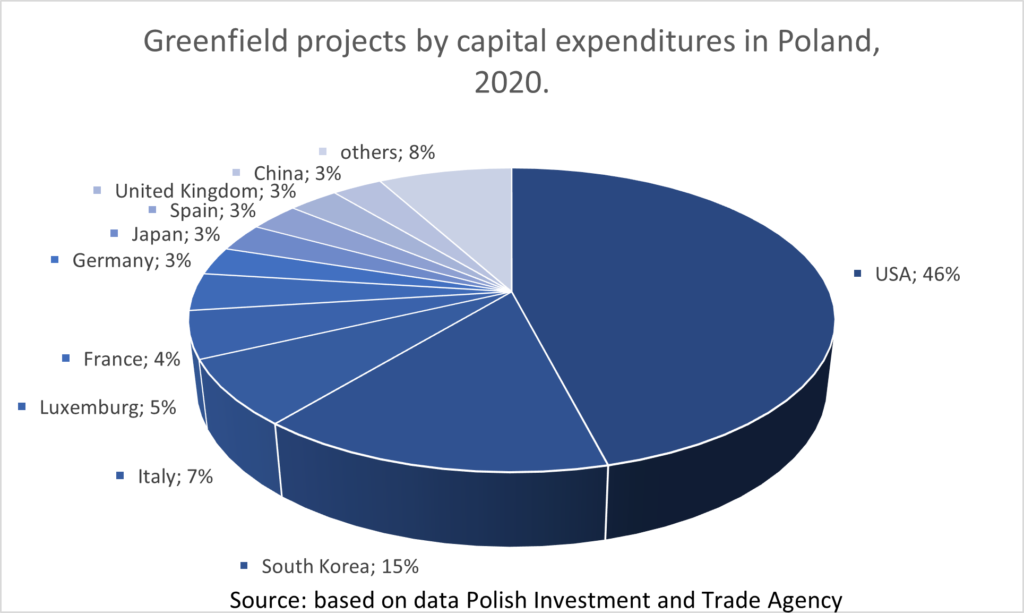

The most interesting study is presented by one of the international chamber of commerce operating in Poland which is based on the information provided by the Polish Investment and Trade Agency.

“The value of investment greenfield projects executed by investors from four countries – USA, South Korea, and Italy – exceeded PLN 500 million. These three investment sources have supplied a totality of over 2/3 of all capital expenditures of greenfield projects.”

Infrastructure and its rapid development are important in the formation of investments because of, a foreign investors entering the Polish market may select their company headquarters in Poland, in terms of, e.g. road infrastructure. This is a very mundane reason, however access to roads affects the efficient operation of the enterprise. In 2022 the government transferred the local government, PLN 2.700.000 for road construction[1]. It is worth nothing that many foreign investors emphasize very good cooperation with the local government administration.

[1] https://www.gov.pl/web/premier/273-mld-zl-z-rzadowego-funduszu-rozwoju-drog-na-dofinansowanie-budowy-przebudowy-lub-remontu-drog-powiatowych-i-gminnych

In Poland, there is applied tax exemption mechanism, referred to as a legal instrument called “Polish Investment Zone” and, additionally, within the existing “Special Economic Zones (SEZ)”.

The support consists in a special income tax exemption of several dozen per cent of the value of the investment, mainly based on the recognition of eligible investment costs.

The basic legal environment for this incentive for foreign investments in Poland is based on the following legal acts:

Regulation of the Council of Ministers of 15 December 2008 on Krakow special economic zone (consolidated text, Journal of Laws of 2020, item 1013);

Regulation of the Minister of Entrepreneurship and Technology of September 12, 2019 on entrusting managers of special economic zones with the control of the implementation of the conditions of permits to conduct business activity in a given zone (Polish Journal of Laws, item 1785);

Regulation of the Council of Ministers of 10 December 2008 on state aid granted to entrepreneurs operating on the basis of a permit to conduct business activity in special economic zones (consolidated text, Journal of Laws of 2019, item 121).

Regulation of the Minister of Development of 5 August 2020 on entrusting the area administrator with the performance of tasks in a separate area (Journal of Laws, item 1351).

Due to the very large variety of foreign investment location offers in many economic zones in Poland in various localities and regions of the country, a broader discussion of the institutions of economic zones is presented below.

Special economic zones somehow overlap with a program introduced by the Regulation of the Council of Ministers on the establishment of a regional aid act for the years 2022-2027, of December 14, 2018[1], that is the Polish Investment Zone, which after the year 2026 is supposed to replace the Special economic zones. The basic assumption of the program is the possibility of obtaining allowances for running a business in the area, not only in the Special economic zone, but throughout Poland. In accordance with the jurisprudence, the income from the entire plant is subject to relief.

The scope of the relief varies between, for example, for micro-enterprises 30% and 70% and depends on the province, as in the case of the time of using the relief in which business activity is carried out, in Malopolska it amounts to:

– micro and small entrepreneurs: 55%

– medium entrepreneurs: 45%

– large entrepreneurs: 35%

The period of using the tax relief is 12 years[2].

The relief is calculated on the investment costs or the two-year costs of newly hired employees.

The criteria for distinguishing the size of entrepreneurs include the fulfilment of the conditions for the number of employees and the annual income in Euro:

| micro entrepreneurs | 10 employees | 2 million |

| small entrepreneurs | 50 employees | 10 million |

| medium entrepreneurs | 250 employees | 50 million |

| large entrepreneurs | more than above | more than above |

[1] https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210002422/O/D20212422.pdf

[2] https://www.biznes.gov.pl/pl/na-czym-polega-ulga

Government grants are awarded on the basis of the Program for supporting investments of significant importance to the Polish economy.

The basic legal environment for this incentive for foreign investment in Poland is based on the following legal acts:

1. Decisions of the Polish government, including the key government legal act in this respect, in the form of Resolution No. 116/2019 of the Council of Ministers of October 1, 2019, amending the resolution on the adoption of the development program under the name “Program for supporting investments of high importance to the Polish economy for the years 2011–2030”;

2. Act of 6 December 2006 on the principles of development policy (consolidated text, Journal of Laws of 2021, item 1057, as amended); including over 1,000 executive acts, including, for example:

Regulation of the Minister of Funds and Regional Policy of August 12, 2022 on providing entrepreneurs with assistance under the post-discount adjustment reserve (Journal of Laws, item 1811).

Forms of support in the form of a Polish government grant

The support is granted in the form of a subsidy on the basis of a bilateral agreement concluded between the minister responsible for economy and the investor. The agreement regulates in detail the terms of the subsidy payment, while maintaining the principle that the subsidy is paid in proportion to the degree of fulfilment of obligations.

The aims of the grants of the Polish government

Under the Program, support for initial investment will be granted on two counts: eligible costs of creating new jobs and eligible investment costs.

The program provides support for investments in relation to aims important for macroeconomic results, such as:

– Support for the costs of creating new jobs (employment grant);

– Support for eligible costs of a new investment (investment grant);

– Support for employee training.

One of the forms of support for research and development activities is the opportunity

to participate in the Program for supporting investments of high importance for the Polish economy for 2011-2030[1].

Help can be divided into:

| Investment type | Characteristic | Minimum investment costs (inputs) | Minimum number of new jobs |

| Strategic | Production investment | PLN 160 million | 100 |

| Innovative | A production investment that results in a product or process innovation that is a novelty on a national scale. | PLN 7 million | 20 |

| Center of High-Advanced Services | Investing in the modern business services sector, providing R&D services, conducting scientific research or development works | 1 million PLN | 10 |

| Center for Advanced Business Services | Investment in the modern business services sector, at least intermediate processes | PLN 1.5 million (it depends on several factors) | 250 (it depends on several factors) |

| Business Process Excellence Center | Investment in the modern business services sector, only advanced or highly advanced processes | PLN 1.5 million (it depends on several factors) | 150 (it depends on several factors) |

[1] https://www.gov.pl/web/rozwoj-technologia/program-wspierania-inwestycji-o-istotnym-znaczeniu-dla-gospodarki-polskiej-na-lata-2011-2030

Industrial and technology parks are places where rapid development is possible thanks to the gathering of companies from one industry as well as the presence of the research and scientific institutions supporting them.

In practice, technology parks are created as commercial companies with the capital of local government, the purpose of which is to manage and coordinate a special economic zone.

On the example of one of such entities as a technology park in the form of Krakow Technology Park in Krakow, the Park creates additional industry investment support in the form of the following programs:

– Digital Innovation Hub – development of a new area of companies’ operations: Industry 4.0;

– Poland Prize – the first accelerator for foreign companies from the gaming industry and Industry 4.0.

One of the basic investment incentives available to entrepreneurs in municipalities is the exemption from local taxes and fees. The Act of 12 January 1991 on Local Taxes and Fees grants municipal councils the power to shape tax rates and to establish the exemptions from taxes and charges provided for therein. The real estate tax exemption is of fundamental importance for entrepreneurs.

An entrepreneur who is not a research institute within the meaning of the Act of 30 April 2010 on research institutes (Journal of Laws of 2022, item 498), who conducts research or development, may apply for the status of a Research and Scientific Centre.

An entrepreneur who applies for the status of a Research and Science Centre for its company should achieve net revenues from the sale of goods, products and financial operations for the previous financial year in the amount of at least:

– PLN 5,000,000.00 and whose net revenues from the sale of research and development services produced by it classified as services in the field of scientific research and development works, within the meaning of the provisions on the Polish classification of products and services or industrial property rights, constitute at least PLN 20 % of net revenues or

PLN 2,500,000 and is lower than PLN 5,000,000 and whose net revenues from sales of R&D services produced by it are classified as services in the field of scientific research and development works, within the meaning of the provisions on the Polish classification of goods and services or industrial property rights, constitute at least 70% of net revenues.

In addition, the entrepreneur is obliged to submit a declaration of non-arrears with the payment of taxes and social and health insurance contributions and applies the accounting regulations.

The obligation of an entrepreneur who applies for the status of a RESEARCH AND DEVELOPMENT CENTER is also to submit an application to the minister, which includes the name of the company, registered office and address, legal form, tax identification number and REGON number and data on net revenues (specified in Article 17, paragraph 2 point 1 and 2 of the Act on certain forms of supporting innovative activity). The documentation must also contain a description of the research or research and development work carried out in the last financial year, as well as the results, and a list of accreditations, patents or practical applications obtained.

Research and development centers have the option of exempting, inter alia, on the basis of de minimis aid from real estate tax and agricultural and forestry tax. In total, it can be up to 200,000. euro in three consecutive years.

The basic legal environment of this incentive for foreign investment in Poland is based on the following basic legal acts:

Regulation of the Council of Ministers of September 24, 2013 on granting the Oil and Gas Institute the status of a state research institute (Journal of Laws, item 1239).

containing about 100 executive acts, including, for example, individual administrative decisions of the Polish Minister of Development and Technology on granting an entrepreneur the status of a research and development center.

Other local initiatives

There are also various types of local initiatives, such as Invest in Pomerania[1], which provide for the possibility of obtaining various types of support, under the condition of investing in the development of this region of Poland.

Other forms of support

Other forms of support[2] include venture capital, i.e. a form of financing enterprises by other specialized entities in return for shares or participation in a fund. This form is quite risky, however according to the PFR Ventures report, PLN 916.000.000 of capital was invested in the second quarter of 2022, which is a significant increase compared to previous years. According to the latest regulations, investing related to venture capital will become more profitable for the investors. An investor can take advantage of a 50% discount on its investment by deducting this amount from its income in one tax year. The maximum deduction is PLN 250.000.

Another form of support is the stock exchange relief, which assumes that direct costs,

such as, e.g. stock exchange fees, can be recognized as income costs, in the amount of 150%. Additionally, it is possible to deduct 50% of expenses related to the issue of advisory, legal and financial shares, up to PLN 50.000, not including Value Added Tax.

Another relief will be the relief for consolidation, i.e. relief related to an attempt to take over a company that is at risk of bankruptcy. A taxpayer who wants to acquire the company will be able to include all related expenses as tax deductible costs, which will undoubtedly allow him to save some funds related to tax. In addition, he will be able to deduct these costs from the tax base.

Other benefits that the entrepreneur will be able to take advantage of is the lack of payment of Value Added Tax between companies belonging to the same entrepreneur, i.e. VAT group, which will undoubtedly, apart from saving costs, facilitate tax procedures.

[1] https://investinpomerania.pl/

[2] https://podatki.gazetaprawna.pl/artykuly/8180183,polski-lad-podatki-ulga-na-ekspansje-zagraniczna-konsolidacje-wejscie-na-gielde.html