Place of delivery of goods and services in VAT – Polish and EU rules

Publication date: January 19, 2026

What is the place of delivery/place of performance?

Article 5, paragraph 1 of the VAT Act

The following are subject to value added tax (VAT):

1) paid supply of goods and paid provision of services within the territory of the country;

2) export of goods;

3) import of goods within the territory of the country;

4) intra-Community acquisition of goods for remuneration within the territory of the country; 5) intra-Community supply of goods.

The territory of a country means the territory of Poland. A transaction is subject to Polish VAT if it takes place within Poland. Exports and intra-Community supplies of goods include the place of taxation in their definition; these are ordinary goods transactions, occurring only when the goods leave Poland.

The place of delivery is understood as the country where a transaction subject to VAT is subject to VAT, as it is the national regulations that determine its taxability. The physical (actual) performance of the transaction or the place designated by local civil law are irrelevant.

Place of delivery rules apply within the EU, but not outside it. It is important to check the relevant rules in non-EU countries. It may turn out that the transaction will not be taxed at all or that double taxation will occur – although such situations should not generally occur, they can theoretically occur.

- Why is it important and why does it matter not only to the seller?

It indicates where international transactions should be taxed and settled accordingly. Sometimes, the buyer is responsible for settling the transaction.

Place of delivery of goods – Article 22 of the Act of 11 March 2004 on tax on goods and services

- “Normal” and “extraordinary” deliveries with shipping

- “Ordinary” delivery of goods

The place of delivery of goods is, in the case of goods dispatched or transported by the person delivering them, their purchaser or a third party, the place where the goods are located at the time when dispatch or transport to the purchaser begins.

Where the place of departure of the dispatch or transport of goods is the territory of a third country, the supply of goods made by a taxable person or a taxable person for value added tax who is also a taxable person in respect of the import or import of these goods shall be deemed to have been made in the territory of the Member State of import or import of these goods .

- An “unusual” delivery of goods

STOPS (Intra-Community Distance Sales of Goods) – the place of delivery of goods is the place where the goods are located at the time of completion of dispatch or transport to the buyer.

SOTI (distance selling of goods imported from third countries) – the place of delivery is in the case of:

1b) distance sales of goods imported into the territory of a Member State other than the territory of the Member State in which dispatch or transport of the goods to the buyer ends – the place where the goods are located at the time when dispatch or transport to the buyer ends;

1c) distance sales of goods imported into the territory of the Member State where dispatch or transport of the goods to the purchaser ends – the territory of that Member State, provided that the tax or value added tax on the supply of those goods is to be declared under the special scheme referred to in Chapter 9 of Section XII, or under rules corresponding to those regulations;

- Deliveries without shipping

The place of delivery of goods is, in the case of goods not dispatched or transported, the place where the goods are located at the time of delivery;

- Deliveries with assembly

In the case of goods that are installed or assembled, with or without a trial run, by the supplier or by an entity acting on his behalf, the place of delivery of goods is the place where the goods are installed or assembled ; simple operations enabling the assembled or installed goods to function in accordance with their intended purpose are not considered installation or assembly;

- Energy and gas supply

The place of delivery of goods is in the case of:

- the supply of gas in the gas system, electricity in the electricity system, heat or cooling energy through heat or cooling distribution networks to an entity that is a taxable person who independently carries out an economic activity referred to in Article 15 paragraph 2, or an economic activity corresponding to such activity, regardless of the purpose or results of such activity, taking into account Article 15 paragraph 6, whose main purpose of purchasing gas, electricity, heat or cooling energy is the resale of these goods in such distribution systems or networks and whose own consumption of such goods is insignificant – the place where such an entity has its registered office , and in the case of having a fixed establishment to which these goods are supplied – the place where this entity has a fixed establishment , and in the absence of a registered office or fixed establishment – the place where it has its permanent address or usually resides;

- the supply of gas in the gas system, electricity in the electricity system, heat or cooling energy through heat or cooling distribution networks, if such supply is made to an entity other than the entity referred to in point 5 (above) – the place where the purchaser uses and consumes these goods; if all or part of these goods are not actually consumed by the purchaser, unused goods are deemed to be used and consumed at the place where the purchaser has its registered office, and in the case of having a fixed place of business to which these goods are delivered – the place where the purchaser has a fixed place of business, and in the absence of a registered office or fixed place of business – the place where the purchaser has his permanent address or usual place of residence.

- Export and import of goods

In the case of goods that are dispatched or transported from the territory of a country outside the EU by a buyer who also delivers them, it is assumed that the dispatch or transport is assigned to the delivery made to that buyer, unless the delivery terms state that the dispatch or transport of the goods should be assigned to his delivery.

- Chain transactions

Art. 22 sec. 2. If the same goods are the subject of subsequent deliveries and are dispatched or transported directly from the first supplier to the last buyer, the dispatch or transport is attributed to only one delivery.

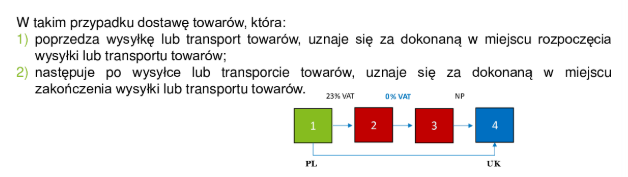

Figure 1. Place of supply of goods and services in VAT, prepared by Wolters Kluwer

A delivery with shipping is assigned to invoice 2; it is a mobile delivery; the UK is outside the EU – only one invoice can have a 0% rate. All invoices prior to the delivery are treated as standard domestic deliveries (subject to standard Polish VAT). Invoices issued after the mobile delivery are transactions treated as domestic deliveries in the country where the goods arrived (standard delivery outside the country is not subject to Polish VAT). Formally, a delivery, if the goods neither left nor arrived in Poland, will never be subject to Polish VAT.

Art. 22 paragraph 2b. In the case of goods referred to in paragraph 2, which are dispatched or transported from the territory of one Member State to the territory of another Member State, the dispatch or transport of these goods shall be attributed exclusively to the delivery made to the intermediary entity.

2c. Where the intermediary operator has communicated to his supplier the identification number for intra-Community transactions issued to him by the Member State from which the goods are dispatched or transported, the dispatch or transport shall be attributed solely to the supply made by that operator.

2d. The intermediary referred to in paragraphs 2b and 2c shall be understood as a supplier of goods other than the first in line, who sends or transports the goods himself or through a third party acting on his behalf.

2e. In the case of goods referred to in paragraph 2, which are dispatched or transported from the territory of the country to the territory of a third country or from the territory of one Member State to the territory of another Member State by:

1) first supplier – shipment or transport is attributed to his delivery;

2) the last buyer – the shipment or transport is assigned to the delivery made to this buyer.

- intra-Community acquisition of goods

The intra-Community acquisition of goods is deemed to have taken place in the territory of the Member State in which the goods are located at the time when their dispatch or transport ends.

If the purchaser has provided an identification number for intra-Community transactions allocated to him by a Member State other than the Member State in which the goods are located at the time when their dispatch or transport ends, the intra-Community transactions are deemed to have been made also in the territory of that Member State, unless the purchaser proves that the intra-Community transactions:

1) was taxed in the territory of the Member State in which the goods are located at the time when their dispatch or transport ends, or

2) was deemed to be taxed in the territory of the Member State in which the goods are located at the time when their dispatch or transport ends, due to the application of the simplified procedure for intra-Community triangular transactions referred to in Section XII.

- Place of import of goods

Art. 26a. 1. The place of importation of goods is the territory of the Member State in which the goods are located at the time of their entry into the territory of the European Union.

2. Where the goods are placed under one of the following procedures upon their entry into the territory of the European Union:

1) inward processing,

2) temporary importation with full exemption from import duties,

3) customs warehousing,

4) transit, including temporary storage before the goods are placed under one of the customs procedures,

5) free zone

– the place of import of such goods is the territory of the Member State where the goods cease to be subject to these procedures.

- IDT and export of goods

As mentioned above, the place of taxation for intra-Community supplies of goods and exports of goods is Poland.

- Place of supply of services

- General rules for determining the place of taxation of B2B and B2C

- B2B – taxpayer – taxpayer (Article 28b)

The place of supply of services in the case of services provided to a taxpayer is the place where the taxpayer-service recipient has its registered office.

Reverse charge – if the buyer is from the European Union, it is assumed that he will settle the VAT.

If the services are provided for a fixed place of business of the taxpayer which is located in a place other than the place where the taxpayer has its registered office, the place of supply of these services is the fixed place of business.

If the taxpayer who is the recipient of the services does not have a registered office or a permanent place of business as referred to in paragraph 2, the place of supply of services is the place where he has his permanent place of residence or usual place of residence.

In the case of the provision of services intended exclusively for the personal purposes of the taxpayer or its employees, including former employees, partners, shareholders, stockholders, members of a cooperative and their household members, members of the decision-making bodies of legal persons or members of an association, the provisions of Article 28c (general B2C rule) shall apply accordingly to determine the place of supply.

The judgment of the CJEU of 7 April 2022 in case C-333/20:

Article 44 of Directive 2006/112 on the common system of value added tax, should be interpreted as meaning that a company established in one Member State does not have a fixed establishment in another Member State because it has a subsidiary there which, under contracts, provides it with technical and human resources through which it provides, on an exclusive basis, marketing, regulatory, advertising and representation services that may have a direct impact on the volume of sales.

- B2C – taxpayer – non-taxpayer (Article 28c)

The place of supply of services to non-taxable entities is the place where the service provider has its registered office.

Where services are provided from a fixed place of business of the service provider located in a place other than his registered office, the place of supply of these services is the fixed place of business.

If the service provider does not have a registered office or a permanent place of business as referred to in paragraph 2, the place of supply of services is the place where he has his permanent place of residence or usual place of residence.

The VAT Act does not define the concepts of business establishment and permanent establishment. Their definitions are found in EU Regulation 282/2011.

The place of business of a taxpayer is the place where the functions of the company’s management are performed. To determine this place, the place where important decisions regarding the general management of the company are made, the address of the company’s registered office, and the place of company board meetings are taken into account. If these criteria do not allow for the determination of the place of business of the taxpayer with complete certainty, the decisive criterion is the place where important decisions regarding the general management of the company are made (Article 10 of the Regulation).

A fixed establishment is any location (other than the taxpayer’s registered office) that is sufficiently permanent and has an appropriate structure, in terms of personnel and technical resources, to enable the taxpayer to receive and use services provided for the taxpayer’s own needs. The fact of having a VAT identification number is not, in itself, sufficient to consider a taxpayer to have a fixed establishment (Article 11 of the Regulation).

- Real estate services

Art. 28e. The place of supply of services related to real estate, including services provided by appraisers, real estate agents, accommodation services in hotels or facilities with a similar function, such as holiday resorts or places intended for use as camping sites, the use and enjoyment of real estate, and services related to the preparation and coordination of construction works, such as the services of architects and construction supervision, is the place where the real estate is located.

The catalogue listed in this article is an open catalogue, the categories of services listed therein are examples.

Pursuant to Article 31a of Regulation 282/2011, services connected with immovable property referred to in Article 47 of Directive 2006/112/EC cover only those services which have a sufficiently direct link with the immovable property in question. Services are deemed to have a sufficiently direct link with the immovable property in the following cases:

a) when they originate from real estate, and the real estate in question constitutes a component of the service and is a central and indispensable element from the point of view of the services provided;

b) when they are provided in relation to real estate or intended for it and are intended to change the legal or physical status of a given property.[1]

According to the above-mentioned regulation, the following cannot be considered as benefits related to real estate:

- preparation of plans for a building or part thereof, if they are not intended for a specific plot of land;

- providing advertising services, even if it involves the use of real estate. For example, in the individual interpretation of the Director of the Tax Chamber in Warsaw of 20 May 2014, IPPP3/443-190/14-2/KC, it was deemed that placing vinyl mesh on a building facade is a service taxed under general rules, i.e. as advertising services, not rental services;

- legal services related to contracts, including advice on the terms of an agreement relating to the transfer of real estate or the enforcement of such an agreement or proving the existence of such an agreement, where such services do not relate to the transfer of title to real estate.

- Transport of goods and transport of passengers (Article 28f)

- goods (28f section 1a)

Place of supply of goods transport services to the taxpayer:

- who has a registered office or permanent place of business in the territory of the country for which these services are provided, and in the absence of such a registered office or permanent place of business, who has a permanent place of residence or habitual residence in the territory of the country, if the transport is performed entirely outside the territory of the European Union, is a territory located outside the territory of the European Union;

- having a registered office of business in the territory of a third country , a permanent place of business for which these services are provided, and in the absence of such a registered office of business or a permanent place of business, having a permanent place of residence or habitual residence in the territory of a third country , if the transport is performed entirely within the territory of the country, is the territory of the country.

- passengers (Article 28f paragraph 1)

of passenger transport services is the place where the transport takes place, taking into account the distances covered.

- Participation in fairs, conferences or events (Article 28g)

- The place of supply of services related to admission to cultural, artistic, sporting, scientific, educational, entertainment or similar events , such as fairs and exhibitions, and of ancillary services related to admission to these events, provided to the taxpayer, where attendance at them is not virtual, is the place where these events actually take place.

- The place of supply of services in the field of culture, art, sports, science, education, entertainment and similar services , such as fairs and exhibitions, as well as ancillary services to these services, including the supply of services by service organisers in these fields, provided to non-taxable entities, is the place where the activity is actually performed.

[1]J. Matarewicz [in:] Act on Goods and Services Tax. Updated commentary, LEX/el. 2025, art. 28(e).