Automotive trade links between Spain and Poland, the importance of the electricity industry

Publication date: February 21, 2023

Transportation trade sector has a central role between Spain and Poland commercial relations. The Spanish exports reached $1.05B (2020), 47.5% were cars ($499M) while 38.3% were motor vehicles; parts and accessories ($402M). On the other hand, Polish exports reached $1.16B (2020), a bit more than the Spanish ones. However, only 19,2% were cars ($222M), while 57% were motor vehicles; parts and accessories ($659M). This data in trade transactions is lesser than the normal level they have because the data is dated from the Covid19 economic recession.

Moreover, excluding the transport sector, trade flows between the two countries have been increasing in recent years. They can only be considered as first level partners, with a clear will to strengthen relations between the two countries. Furthermore, the great similarities between the two states, the background, the way of joining the European Union, the similarity of values between the societies and the similarity of socio-economic trends – all provide an experience that can be transferred to the other partner’s market.

During last decade, Poland is specialising in the manufacture of batteries and components for electric vehicles, as well as electric buses and cars. In addition, it was noted that there is great potential for cooperation in the development of virtual reality technologies and the railway network, as well as in renewable energies, where Poland is focusing on the development of photovoltaic energy and wind farms. In this way, Spain could be a key-partner of the Polish batteries industry because of the probably new commercial agreement between European Union and Chile, to guarantee lithium supply and avoid dependency on China, which is likely to be celebrated this autumn.

Other advantages of the Polish economy include a solid banking system, very strong domestic demand and efficient use of European Structural Funds resources. Great business opportunities have arisen in the Polish market thanks to its dynamism and the increasing income of its population.

On the other hand, Spain is the 2nd largest automaker in Europe and the 9th largest in the world. 9 multinational brand with 17 plants are established in the country. Spanish plants manufactured 2.1 million vehicles in 2021, including 16 electrified models. The introduction of electrical energy as a means of propulsion is an option for sustainable mobility. The development of new propulsion systems is generating important challenges and opportunities in the automobile spare parts industry. Manufacturers will have to supply electrical propulsion systems, including electrical engines and power electronics, batteries, and energy recovery devices for brakes.

The Spanish automotive industry turnover represents 10% of Spain’s GDP and 18% of total exports, including vehicles and auto-parts. External trade surplus of vehicles reached €18.9B in 2021. The industry generates 9% of total employment, nearly 2 million jobs are linked to this industry, and of those, 300,000 are direct jobs in the assembly plants and 201,450 directly employed in the auto-parts industry.

The automotive industry invests on average an estimated €4 bn a year in expanding and modernizing plants, being one of the largest investors in R&D&I of the economy. Besides, Spanish automotive industry is one of the most attractive sectors for foreign investors. 86% of the vehicles and 60% of the auto-parts manufactured in Spain were exported worldwide in 2021. A total of 1,820,727 made in Spain vehicles were exported.

The specialisation of Polish industry in the manufacture of automotive parts, especially electric vehicles, together with the strong Spanish industrial base in this sector can generate a symbiotic relationship. Hence, strong trade relations should be a must – specifically after the new European ban on new petrol and diesel cars by 2035. The renewal that started a few years ago should now be reinforced by necessity. The signs of globalisation faltering with the Taiwan semiconductor and microchip crisis should be an extra incentive for cross-border business within the framework of the European Union to secure the supply of components.

Energy production, a long way to go

In relation to the renewal of the automotive industry with the electric car, emphasis should be placed on energy production, especially green energy. In this respect, Spain has an advantage over Poland.

Ukrainian war had shown our dangerous dependency on Russian fossil fuels. Because of that the EU and the EU-members had searched new sources of energy in other countries and, also, increasing their investment in renewable energy with a great initiative and leadership of the European Institutions. The dependency to Russians imports had dropped from 40% to 15% in a very short period of time. The savings measures and diversification of origins promoted by the European Commission have borne fruit and have given more prominence to other countries, especially the United States, from 7% to 15.2%.

But this is a short-term solution, one dependency should not be replaced by another. It is essential for Europe to diversify its electrical sources, from countries and own production. This is where Fit for 55 takes place. The “Fit for 55” package is a set of legislative applications to change and update EU regulations and introduce new initiatives thanks to which EU policy will be in line with the climate objectives agreed by the Council and the European Parliament. Two major measures are green energy production and energy efficiency. The new target is to obtain at least 40% of all its used energy from renewable sources by 2030; and for energy efficiency – plans to reduce 39% for primary consumption and 36% for final consumption by 2030.

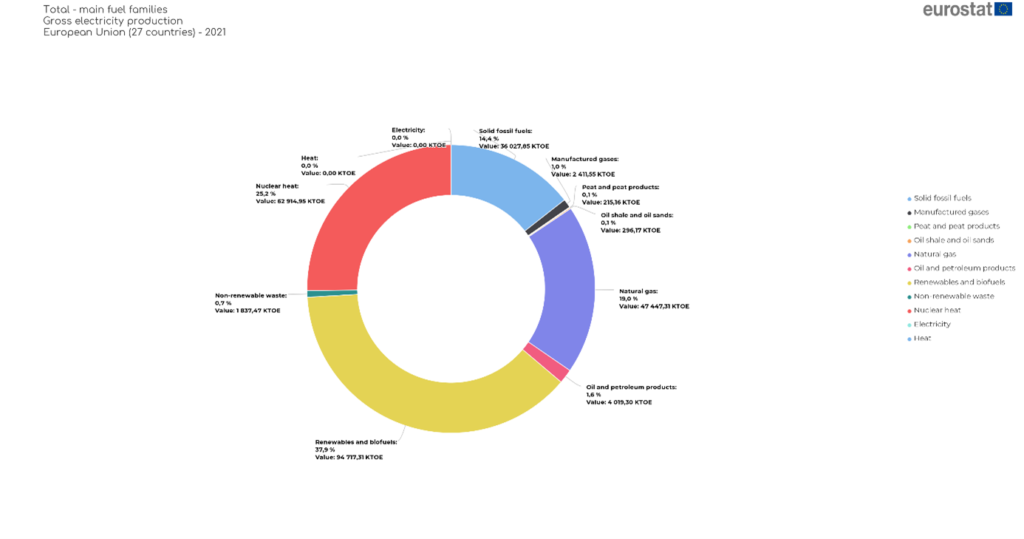

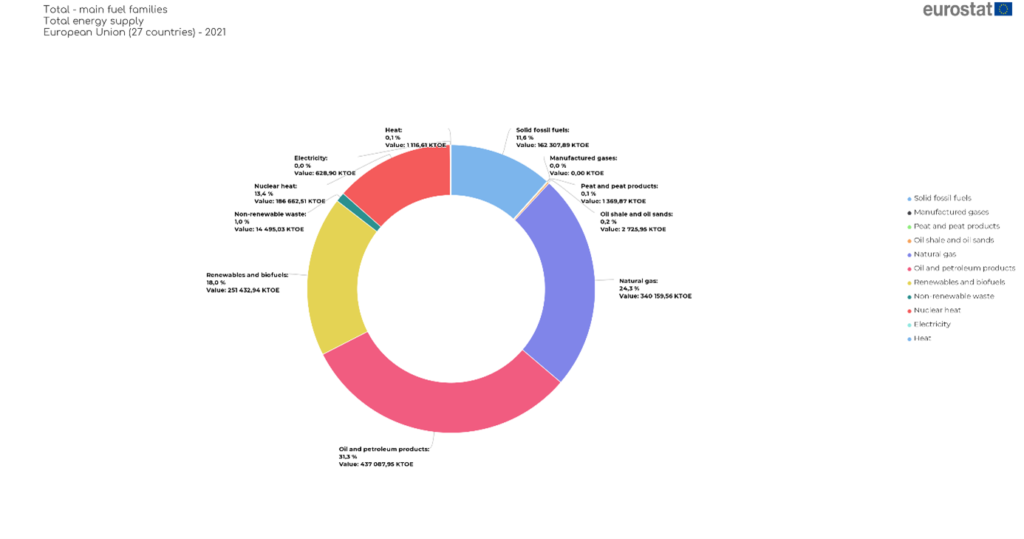

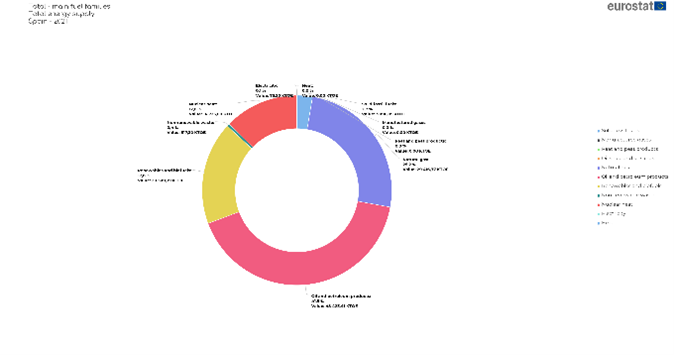

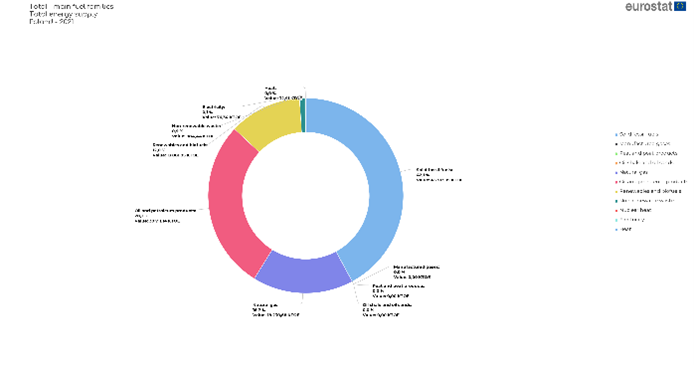

Currently, the major source of autonomous production in European Union are Renewables and biofuels by a 37.9%, followed by nuclear energy with 25.2%. The percentages look promising but still there is great dependency on fossil fuels. A greater investment is required. But data does not look so well when we search for Energy consumption. In this sense, only 18% of energy consumed by Europeans come from renewable sources. Here, we still have a major dependency on fossil fuels. At least 68.6% (without counting nuclear power) came from petrol or gas. At least, it seems that the right steps for the energy transition are being taken.

But what about Poland and Spain – the starting point of both countries are quite different. The geographical position of Spain in South-West Europe brings to Spain a great range of renewable energy sources. Over a vast part of its territory, the country enjoys more than 2,500 hours of sunshine per year. This a great advantage, in 2022 the productions at the end of august was 13,100 MW. However, despite this advantage, Germany produces twice as much solar energy when its territory has an average of 1200 to 1800 hours of sunshine per year. But we should not be totally pessimistic, solar energy has tripled in the last three years in Spain. On the other hand, Poland has produced one fifth of Spain’s production. This figure may seem bad, but it should be borne in mind that Poland has between 1600 and 1800 hours of daylight and that, compared to last year, it has increased its production by 134.9%.

Another renewable energy source to consider is wind energy. It’s the major renewable energy source of Spain right now, being the fifth producer in the world 28,196 MW installed. For its part, Poland has about 6,000 MW installed. Wind energy covered 15% of EU electricity demand in 2021, and all indications are that in the next few years, wind power capacity will increase rapidly.

The hydropower energy is another energy source utilise in Europe. However, unlike solar and wind power, this energy is not going through its best moment. Drought threatens its availability, especially in south-west Europe, where Spain is located. A restructuring of reservoirs and river protection is needed, as well as a plan for water use. Poland is better situated because, but the effects of climate change still can be felt. But, even now, Poland does not use its full potential, Spain with drought produces eight times more energy than Poland.

Even the share of renewables in total supply is lower than their production (17,4% and 12%). This can be explained by many reasons, political, economic, social, developmental. Great investment from Poland and the European Union is being spent to change this condition. As it is a mandatory change, it also guarantees investors certain guarantees to make a profit while contributing to the development of the country.

The supply in Spain is a bit more diversified with a great importance of renewable energy but still a great dependence on gas and oil. Also Spain has the capacity to produce nuclear energy that is not as much pollutant as fossils fuels but still produces radioactive waste.

In resume

The efforts of both states to contribute to strong and balanced bilateral relations have only deepened business opportunities in both countries, especially in key sectors such as energy infrastructure, transport and renewable energy development.

In the current situation electric cars and vans (and other vehicles) are the future of automotive industry. Actions have been taken by the Institutions and the governments, and currently it is time to see if that will bear results and incentivize the private sector to take the role of producer of the development in the right way. An important part of trade between both countries is focused in this sector. If the predictions of a nice transition on Spanish industry turn proper, probably this will mean an increase of cross border business between the specialised Polish industry of car components and the Spanish manufacture industry.

Development of energy infrastructure probably will increase the cross border business as well. Experienced Spanish companies in the renewable energy sector will compete with those from other countries such as Germany and the not so experienced but still capable Polish companies for a share of the Polish market. This market has yet to make a major transition to renewable energies compared to other European markets. However, it is also likely that Polish companies will want to participate in the development of the energy sectors of other European partners, because even if they are a little more advanced in the energy transition, they still have a long way to go.

Perhaps the car industry will go in other directions, such as the disappearance of the private car in favour of the rental car or the state-owned car. But what is certain is that this is a promising area for the coming years that will require more cross-border legal services as European harmonisation and integration progresses.

In any case, KIEŁTYKA GŁADOWSKI keeps abreast of new regulatory changes and new trends in order to offer its clients the best service available.