AMENDMENT OF THE POLISH ANTI-MONEY LAUNDERING ACT ON COUNTERING THE FINANCING OF TERRORISM – EUROPEAN DIRECTIVE IMPLEMENTATION

On 30th March 2021 Polish parliament passed law amending the Act on counteracting money laundering and terrorist financing which was in fact an implementation of the European Parliament and the European Council Directive amending Directive (EU) 2015/849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing, and amending Directives 2009/138/EC and 2013/36/EU – UE 2018/843 [1] The amended Act should harmonize Polish regulations to the EU’s standards and the new Act is intended to replace the previous one dating 2000.

THE PROBLEM WITH CRYPTOCURRENCY STOCK EXCHANGE AND MONEY LAUNDERING

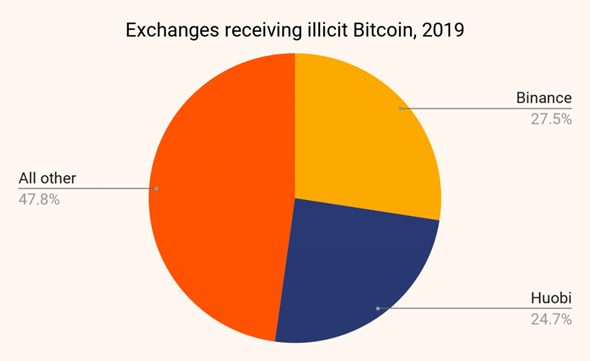

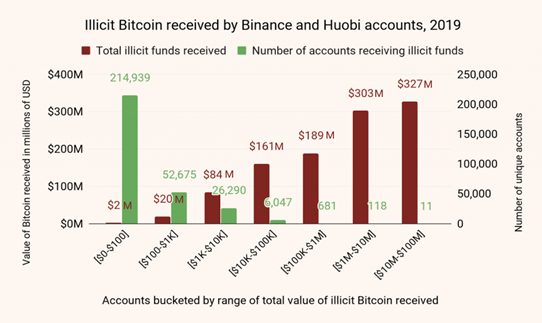

The cryptocurrency stock exchanges, as other financial sectors, entail some degree of money laundering risk. But nowadays when the non-crypto currency financial sectors are much better protected and regulated against the danger of money laundering, the crypto currency stock exchanges have become a focus of interest for criminal groups that have found in their financial operations a way to carry out illegal transactions. It has happened because until now the crypto currency market was less regulated and less controlled by public institutions. Thus, this fact connected with the anonymity during the crypto transactions has made that illegal transactions have changed place to the crypto currency market (especially on two biggest crypto-currency stock exchanges – Binance and Huobi).

The source of the diagram: https://arcana.com.pl/kryptowaluty-znane-z-cyberprzestepczosci-pomagaja-w-praniu-pieniadzy/ and https://bitcoin.pl/pranie-brudnych-pieniedzy-w-swiecie-kryptowalut/ (access date: 9th August 2021).

In such countries as Seychelles or Singapore the KYC (Know Your Costumer) procedures are not implemented hence these places become an ideal place for money laundering.

The source of chart: https://arcana.com.pl/kryptowaluty-znane-z-cyberprzestepczosci-pomagaja-w-praniu-pieniadzy/ and https://bitcoin.pl/pranie-brudnych-pieniedzy-w-swiecie-kryptowalut, (access date: 9th August, 2021).

Making this context needful to understand the changes in European law and implementation and adaptation of Polish legislation to these changes, we can move on to discuss the European Parliament and Council Directive 2018/843.

THE EUROPEAN 5AML (ANTI-MONEY LAUNDERING) DIRECTIVE

As we can read in the 5AML Directive preamble:

- Directive (EU) 2015/849 of the European Parliament and of the Council (4) constitutes the main legal instrument in the prevention of the use of the Union financial system for the purposes of money laundering and terrorist financing. That Directive, which had a transposition deadline of 26 June 2017, sets out an efficient and comprehensive legal framework for addressing the collection of money or property for terrorist purposes by requiring Member States to identify, understand and mitigate the risks related to money laundering and terrorist financing.[2]

Thus this is a main standpoint of this regulation. The contemporary challenges and the crypto currency and crypto currency stock exchange development necessitated directive amendments to the current situation. Under the terms of the Directive (EU) 2018/843 member states were obliged to implement the laws of the abovementioned Directive by 10th January 2020.

The draft law was received in the Parliament on 19 January 2021 (parliamentary print no. 909) at the request of the Council of Ministers and after 2 months, on 30th March 2021 the amended Act was enacted with the date to come into force of 15th May 2021, 31st July 2021 and 31st October 2021.

To see the entire legislation path: https://www.sejm.gov.pl/Sejm9.nsf/PrzebiegProc.xsp?nr=909

THE POLISH REGULATION – THE (EU) 2018/843 DIRECTIVE IMPLEMENTATION

- Crypto currency exchange trading

From 30th March 2021 (after the Amendment Act enactment) the crypto currency exchange trading is the regulated business activity (in accordance to the danger of the financial fraud). But this amendment does not concern only the financial institutions. The anti-money laundering legal regulatory sector consequently extends the catalogue of committed institutions.[3] So that nowadays the entrepreneurs are obliged to report the information on the beneficial owner to the Central Registration of ultimate Beneficial Owners. Also in the article 1 point 4 letter b we can find a legal definition of ultimate beneficial owner which includes such persons as: natural person, legal person, company, entities connected with trust, etc.

- Extension of the committed institutions catalogue

As we mentioned above the catalogue of the committed institutions is consequently extending. Thus, since 30th March 2021 when the Amendment Act was passed the new committed institutions are:

- The entrepreneurs within the meaning of the Entrepreneurs act,

- Real estate sales brokers

- Art brokers [4]

- Ultimate beneficial owner information report.

Third change worth noticing is again the extension of the catalogue of committed entities but this time the catalogue of the committed entities to disclose information about ultimate beneficial owners.[5]

- New requirements to obtain a registration

The extension of committed institutions catalogue entails the requirements to obtain a registration for these entities in order to begin their business activity.

For instance:

- The entity carrying on the business activity for the company or trust which conducts such activity without being registered in the register shall be a subject of pecuniary penalty of up to 100,000 PLN.

- The entity carrying on the business activity of crypto currencies (virtual currencies) which conducts such activity without being registered in the register in respect of virtual currencies shall be a subject of pecuniary penalty up to 100,000 PLN.[6]

- Obligation to publish and update the list of PEP (Politically Exposed Persons).

In the Amendment Act according to V AML Directive, each Member State should develop and publish the list of so-called national PEPs- Politically Exposed Persons. The definition of the Politically Exposed Person is included in article 2 section 2 point 11 of the Act on the prevention of money laundering and terrorist financing but the Amendment Act has already introduced this catalogue to the appropriate Act.[7] Moreover in the article 1 section 21 of the Amendment Act we can read that after article 46 of the appropriate act the article 46c is added:

Article 46c.

The minister competent for public finance shall define by ordinance, the list of national public positions and functions being politically exposed positions (the PEPs list) referred to in art. 2 section 2 item 11 letters a-g, i and j, taking into account the nature of the tasks performed and their significance in terms of combating money laundering and terrorist financing terrorism.[8]

This European and national change can be summed up to 2 main points:

- Crypto currency stock exchanges are no longer anonymous and basically there is a possibility to ascertain who bought the crypto currency, at what price and through which stock exchange. Before the V AML Directive enactment and its national implementation on this area was an uncontrolled transaction liberty.

- The Polish Financial Supervision Authority has basically the legal measures for the stock-exchange companies as for the traditional financial institutions including pecuniary penalties. And the Act on Prevention Money Laundering and Financing terrorism is the legal measure to impose such pecuniary penalties.

To see more information:

- https://www.gazetaprawna.pl/firma-i-prawo/artykuly/8118347,aml-kogo-dotyczy-nowelizacja-ustawy-o-przeciwdzialaniu-praniu-pieniedzy-i-finansowaniu-terroryzmu.html

- https://www.frr.pl/news/1134/nowelizacja-ustawy-o-przeciwdzialaniu-praniu-pieniedzy-oraz-finansowaniu-terroryzmu-oraz-zmiana-przepisow-dotyczacych-funkcjonowania-crbr

- https://www.linkedin.com/pulse/dyrektywa-aml-v-w-pigu%C5%82ce-czyli-co-warto-wiedzie%C4%87-maciej-kuranc/?originalSubdomain=pl

[1] To see full Directive: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0843 (access date: 9th August, 2021).

[2] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0843, (access date: 9th August, 2021).

[3] See the article 1 section 4 of the Amendment Act (of 30 March 2021 on amending the Act on Prevention Money Laundering and Financing terrorism and certain other acts): https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210000815/U/D20210815Lj.pdf, (access date: 9th August, 2021).

[4] See the article 1 section 4 of the Amendment Act (of 30 March 2021 on amending the Act on Prevention Money Laundering and Financing terrorism and certain other acts): https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210000815/U/D20210815Lj.pdf, (access date: 9th August, 2021).

[5] For instance see the article 1 section 13, 24, 35, 62 letter c of the Amendment Act (of 30 March 2021 on amending the Act on Prevention Money Laundering and Financing terrorism and certain other acts): https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210000815/U/D20210815Lj.pdf, (access date: 9th August, 2021).

[6] See the article 1 section 63 of the Amendment Act (of 30 March 2021 on amending the Act on Prevention Money Laundering and Financing terrorism and certain other acts): https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210000815/U/D20210815Lj.pdf, (access date: 9th August, 2021).

[7] See the article 1 section 4 letter b of the Amendment Act (of 30 March 2021 on amending the Act on Prevention Money Laundering and Financing terrorism and certain other acts): https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210000815/U/D20210815Lj.pdf, (access date: 9th August, 2021).

[8] https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210000815/U/D20210815Lj.pdf, (access date: 9th August, 2021).