The status of lithographs in the light of art trade law

Publication date: January 28, 2026

The trade in works of art poses many practical legal challenges. This stems from the fact that numerous provisions, scattered across various legal acts, apply. To gain a thorough understanding of art trade law, one must be familiar with the following regulations:

- Act of 23 July 2003 on the protection and care of monuments (consolidated text: Journal of Laws of 2024, item 1292).

- Act of 11 March 2004 on tax on goods and services (consolidated text: Journal of Laws of 2025, item 775, as amended).

- Regulation (EU) No 952/2013 of the European Parliament and of the Council of 9 October 2013 laying down the Union Customs Code (OJ L 269, 2013, p. 1, as amended).

- Act of 19 March 2004 – Customs Law (consolidated text: Journal of Laws of 2024, item 1373)

- The Act of 23 April 1964, the Civil Code (consolidated text: Journal of Laws of 2025, item 1071).

- Council Regulation (EC) No 116/2009 of 18 December 2008 on the export of cultural goods (Codified version) (OJ L 39, 2009, p. 1).

The complications arising from the trade in works of art are best illustrated by the example of lithographic works (posters), which, despite their similarity, may have a completely different legal status under the applicable regulations.

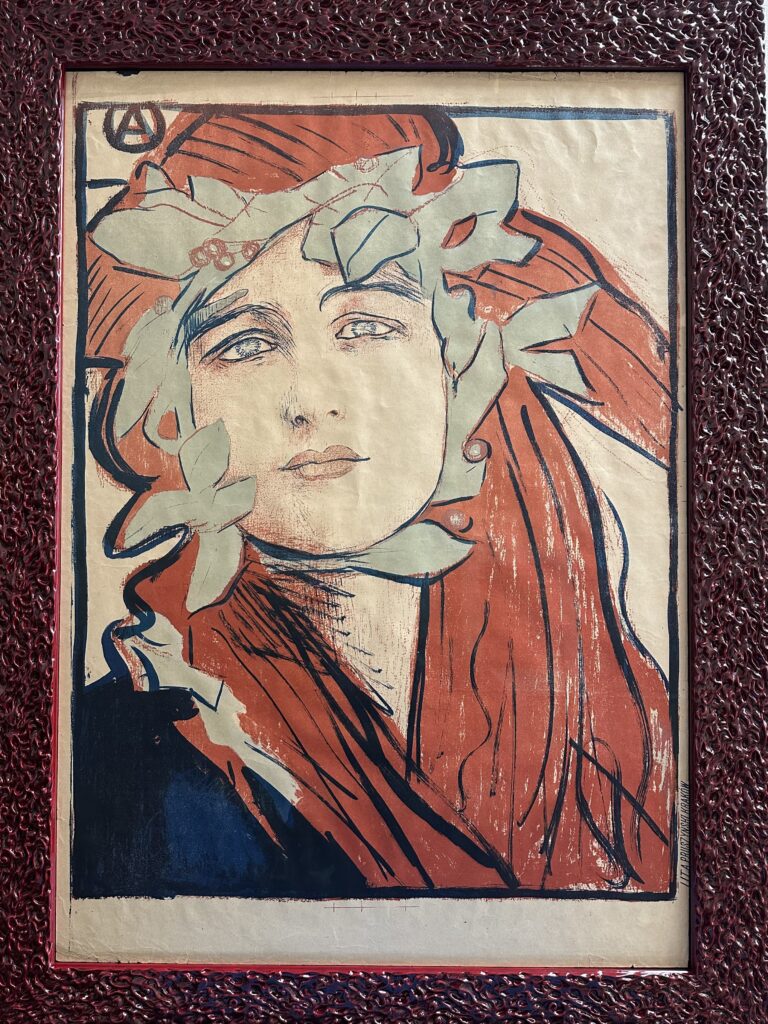

Teodor Axentowicz (1859 – 1938), Poster of the 2nd Exhibition of the Society of Polish Artists “Sztuka”, 1898

The first work analyzed is a poster by Teodor Axentowicz. As a hand-painted work, it is subject to special legal regulations. According to Article 51, Section 1, Item 3 of the Protection of Landmarks, works older than 50 years and valued at more than PLN 40,000 require an export permit. A one-time permit for the permanent export of a monument abroad is issued by the minister responsible for culture and national heritage protection (Article 52, Section 1), and the application is submitted through the provincial conservator of monuments. The value of the painting can pose challenges in this matter, especially in the case of an auction sale. Is this the actual value of the item or the amount achieved at the auction? These figures can vary significantly.

When exporting a work of art, whether to another EU member state or outside the EU, no customs duty is charged. However, VAT will be charged, which, depending on the configuration, can be 0%, 8%, or 23% – this depends on whether the painting is being sold by a gallery, antique shop, or auction house, or by the artist or their heirs, and whether it is being exported intra-Community or outside the European Union. The 0% rate will apply to intra-Community sales if the conditions of Article 42, Section 1 of the VAT Act are met. In turn, exports of goods outside the EU are subject to a 0% rate under Article 41, Section 4. Domestic sales will be taxed at 8% or 23%, depending on whether they are made by the artist or a professional art dealer. If the latter is made by the artist, the rate will be 23%, but they will be able to take advantage of the so-called margin procedure if the work of art is only to be resold – this procedure is regulated in Article 120 paragraph 4 et seq. of the VAT Act.

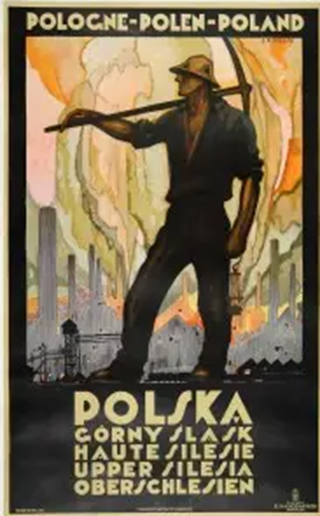

NORBLIN Stefan (1892-1952) – Poland. Upper Silesia, ca. 1926

Unlike the previous work, this poster was created exclusively using lithography. Customs and tax regulations do not introduce any changes distinguishing hand-drawn works of art from lithographic works – all rates remain the same. The only difference will be the different basis for obtaining an export permit. According to Article 51, Section 1, Item 6, a permit is required for the export of original works of graphic art, their matrices, and original posters if the work is over 50 years old and its value exceeds PLN 16,000. As can be seen, the value at which a permit is required has been reduced for lithographic works.

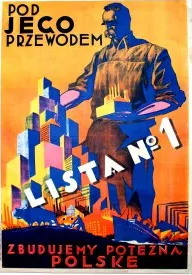

Stefan NORBLIN, “Under his leadership we will build a mighty Poland”, election poster, 1930 (198)

This poster was produced using lithography, but has been colored. For customs purposes, the classification of this work is irrelevant, as the customs duty rate is 0%. Besides, this would not be a problem, as customs regulations require paintings to be entirely handmade, so this work would be classified as a lithography. However, problems begin with tax regulations, as, pursuant to Article 120, paragraph 1, item 1, for the purposes of applying this provision, works of art are:

Letter a – paintings, collages and similar decorative plates, drawings and pastels, executed entirely by the artist (…)

Letter b – original engravings, prints and lithographs, made in a limited number of copies, black and white or colour, composed of one or more sheets, executed entirely by the artist, regardless of the process or material used.

Neither of these definitions refers to the exclusive use of a given technique. For tax purposes, the classification of a work into one category or another is also irrelevant, as the VAT rates for all works of art are the same. This distinction will have the greatest practical significance in obtaining a travel permit – a permit, depending on the qualification, will be required if the value is PLN 40,000 or PLN 16,000, respectively (Article 51, paragraph 1, points 3 and 6).

Tadeusz Gronowski (1894 – 1990) “Warsaw”, 1936

In relation to the posters presented above, it is worth considering whether they even meet the definition of a monument. According to Article 3, Section 1 of the Act on the Protection of Monuments, this means real estate or movable property, parts or assemblies thereof, created by humans or related to human activity and constituting evidence of a bygone era or event, the preservation of which is in the public interest due to its historical, artistic, or scientific value. One might wonder whether posters depicting elements of Warsaw’s urban development in the 1930s constitute evidence of a bygone era and their preservation is in the public interest. If this status of these posters were questioned, the need to obtain a permit for their export could theoretically be avoided. However, if these works are assumed to constitute monuments, the question of the requirements specified in Article 51, Section 1, Section 6 remains – this provision refers to original posters. The Act does not define which works are considered original, therefore the need to obtain a permit for the export of a monument could be questioned. For example, one could argue that since more posters like this were created, they are not original works. In my opinion, the interpretation of this concept relies on understanding originality as authenticity or originality – the work cannot be a reproduction or copy. However, this example demonstrates that in art trade law, the provisions must be carefully analyzed and every single word interpreted.

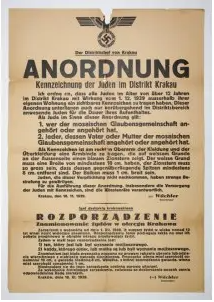

Regulation. Nomination of Jews in the Krakow district […]. Krakow, November 18, 1939

This regulation may be problematic in that it will be classified differently under different provisions. Under the Monument Protection Act, it will be classified as a monument because it is a movable item that bears witness to a bygone era and events, the preservation of which is in the public interest due to its historical value. One might wonder whether such a regulation is a poster within the meaning of Article 51, Section 1, Item 6, or whether it will be considered “another monument” within the meaning of Item 15. In practice, this is irrelevant, as the value at which an export permit is required is the same, at PLN 16,000.

This regulation will have a completely different meaning under tax law. It is difficult to assume that this poster will be considered “made in a limited number of copies” within the meaning of Article 120, Section 1, Item 1, Letter b of the VAT Act – it is impossible to determine how many such posters were printed; they were intended for mass distribution during the occupation, and in particular, they were not numbered. Therefore, it would not be a work of art within the meaning of the VAT Act. However, this poster could be considered a collector’s item of historical value within the meaning of Article 120, Section 1, Item 2, Letter b. The difference for tax law is that a 23% VAT rate always applies to domestic sales – the 8% rate for creators applies only to works of art. However, in this case, galleries, antique shops, or auction houses will also be able to take advantage of the so-called margin procedure. In turn, under customs regulations, it will be a document of historical value, but the customs duty rate will remain 0%.

Summary

As discussed above, the law governing the trade in works of art and historical monuments is very complex, stemming from the fact that numerous regulations from various legal fields apply. It’s essential to be well-versed in tax regulations (the VAT Act itself is already complex), as well as in the Monument Protection Act, and to properly understand the concepts contained therein. Even those familiar with the broader field of art can find this challenging. Customs regulations are the easiest from this perspective, as the rate for exports is always 0%. Each case requires a thorough analysis and subsumption of the facts under the relevant regulations.