Artlogic Connect 2025 – Galleries Navigating Discretion in an Era of Disclosure

Publication date: September 16, 2025

KIELTYKA GLADKOWSKI KG LEGAL AT ARTLOGIC CONNECT 2025

Compliance strategies in art trade, taking into account thresholds for AML and KYC.

Once defined by discretion, the art world now finds itself under the glare of regulatory scrutiny. Dealers must walk a careful line between client confidentiality and growing compliance demands. The panelists explored how galleries are navigating often conflicting obligations between collectors and regulation — what’s changing, what’s at stake, and how these shifting rules are redefining the dealer–collector relationship.

• Documents required for completing KYC

• Age verification

KYC and AML are initiatives aimed at preventing financial crimes.

KYC focuses on identity verification and is part of broader AML efforts to prevent money laundering, fraud, and other crimes.

Industries such as finance, e-commerce, and real estate use KYC and AML to screen customers and monitor their behavior and transactions.

Following established procedures and best practices helps companies comply with applicable laws and industry regulations regarding KYC and AML.

As part of broader AML procedures, KYC (Know Your Customer) is a required process for identifying and verifying a customer’s identity—both at account creation and throughout the relationship. It typically requires the customer to provide official documents (e.g., driver’s license or ID card) containing:

Name and surname

Date of birth

Address

Photo

The goal is to ensure that the customer is who they claim to be. The company is obligated to confirm the authenticity of documents and verify information in government registries or other databases – even in the case of electronic KYC processes.

KYC also requires banks and brokers to screen new clients for the presence of criminal suspects, sanctioned individuals, and politically exposed persons (PEPs), meaning those currently or formerly in public positions who may potentially pose a higher risk of corruption.

Continuous analysis of the money laundering risk associated with each client is essential as part of Customer Due Diligence (CDD), and clients deemed to be at higher risk should be subject to more thorough screening.

KYC focuses on verifying the client’s identity and assessing risk at the beginning of a business relationship. This is part of broader AML activities.

AML encompasses a broader and ongoing range of activities aimed at preventing, detecting, and reporting financial crimes, including:

• Continuous monitoring of financial transactions and related behavior

• Enhanced Due Diligence for high-risk customers

• Customer screening for sanctions and watchlists

• Identification of politically exposed persons (PEPs)

The European Union’s Fifth Anti Money Laundering Directive (5AMLD) came into force across all member states on 10 January 2020. The directive set out a range of requirements and amendments to EU AML legislation, including the introduction of a legal definition of cryptocurrency and reporting thresholds for prepaid credit cards. It applies also to art trade and art market.

One of 5AMLD’s key new requirements was the extension of the scope of AML/CFT compliance regulations to art dealers (persons trading or acting as intermediaries in the trade of works of art, including auction houses and galleries). The extension was motivated by insights from previous money laundering directives that indicated criminals were increasingly using the art trade to launder money, exploiting opportunities to conduct high value trades with an almost guaranteed level of anonymity.

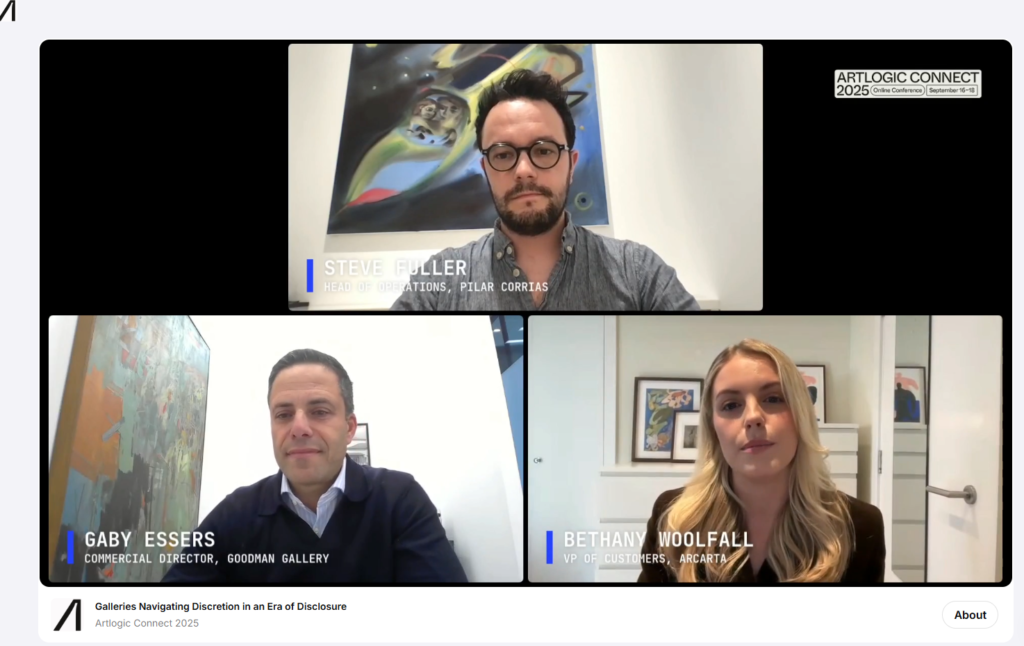

The speakers were:

Bethany Woolfall – Vice President, Arcarta

Gabrielle Essers, Commercial Director, Goodman Gallery

Steve Fuller, Head of Operations, Pilar Corrias