Beneficial owner clause for withholding tax purposes according to the tax explanations of 3 July 2025 – crucial new interpretations of the Polish tax authorities

Publication date: September 01, 2025

The beneficial owner clause is used in the so-called withholding tax. Withholding tax is a flat-rate income tax collected by a tax remitter based in the country where the income was generated. It is collected before the income (e.g. from dividends) is paid to an entity that does not have its registered office in Poland. Sometimes (e.g. under Article 22(4) of the CIT Act) the tax remitter is entitled to an exemption. This is usually the case if the entity to which the payment will be made is based in the EU, the European Economic Area or a country that is a party to a double tax treaty with Poland. In such a case, it is necessary to determine whether the entity to which the payment is to be transferred is the beneficial owner of the payment and, if so, where it is subject to taxation.

Beneficial owner clause

On the basis of the tax clarifications of 3 July 2025 on the application of the so-called beneficial owner clause for withholding tax purposes published by the Polish Ministry of Finance, the beneficial owner is an entity that:

a) receives the receivable for its own benefit, including deciding on its own allocation and bears the economic risk associated with the loss of this receivable or its part,

b) is not an intermediary, representative, trustee or other entity obliged to transfer all or part of the receivables to another entity,

c) conducts genuine business activity in the country of its registered office, if the receivables are obtained in connection with its business activity, and when assessing whether the entity conducts real business activity, the nature and scale of the activity carried out by this entity in the scope of the received receivables is taken into account.

That means:

- receives the payment for his own benefit,

- there is no obligation to transfer all or part of the receivables,

- conducts real business activity.

The first two premises can be functionally considered as one. They are about determining whether the entity has economic control over the receivable. However, in the third case, it is about whether it has adequate resources (human, information or infrastructure) to exercise this authority.

It is also worth noting that the concept of beneficial owner should be interpreted in accordance with international and EU standards. As the CJEU pointed out in the N Luxembourg 1 case[1]:

- the phrase “beneficial owner” should not be understood in a narrow, technical sense, but should have such a meaning that allows to prevent tax avoidance with the use of DTTs or EU directives;

- An economic approach should be applied to the interpretation of the beneficial owner condition.

Receipt of a given receivable for one’s own benefit and non-existence of an obligation to transfer all or part of the receivables

The real owner is the entity that has economic power over the receivable. Therefore, it cannot be an entity obliged to transfer receivables to another entity, an entity substituted solely for the transfer of payments (merely a conduit for the passage of (…) payment) or only an intermediary in the transfer of receivables. The entity must actually and effectively use the payment in question.

The obligation to transfer the receivables does not have to result from the contract, it can result from the factual circumstances. Usually, obligations arising from circumstances occur between related entities, but they can also occur between unrelated entities. The obligation to transfer income must relate to the payment received and be related to it, but it does not always have to consist in transferring income in the same form in which it was earned (e.g. when the payment of interest is dependent on the receipt of dividends).

It is not possible to create an exhaustive list of conditions qualifying a given entity as obliged to make all or part of the payment. Examples include (it is not necessary for all of them to occur together):

● the entity realizes a small margin on the payments transferred;

● the entity does not report tax revenue on account of receivables received;

● receivables are transferred to another entity at short intervals;

● the entity does not reinvest funds obtained in connection with the receivables received;

● the entity has no other means or sources of income than the receivables received to enable the repayment of its liabilities;

● the entity does not bear the risk associated with a given receivable.

At the same time, the occurrence of a single of the above circumstances does not unequivocally result in the lack of the status of the beneficial owner, it is necessary to analyze all the factual circumstances.

The status of beneficial owner is also evidenced by the risk associated with a given receivable, such as the risk of performing the obligation or the exchange rate risk. This risk must also be borne for one’s own benefit, in accordance with the receivables. A company that is only supposed to hedge the risk of another entity will not be the real owner.

The “benefit” will not always be directly related to the income obtained. For example, if a company maintains and indemnifies intellectual property, trademarks, know-how, etc., against the risk of impairment and receives royalties for their use, the mere fact that the company does not make a further investment in them and pays dividends does not mean that it did not obtain such a receivable for its own benefit or was obliged to pass it on. A company may be considered the beneficial owner of the receivables if, as part of its business, it has a real opportunity to use the receivable for its own benefit (i.e. the company has its own resources, paid, m.in. from the receivables received, and sufficient to provide financing for the activity resulting in the benefit in the form of securing the value of its assets).

Conducting real business activities

This condition is examined in the context of a specific payment. This means that the recognition of a company as conducting real business activity is not “universal”. The same company that has been found to be engaged in an economic activity in one case may be considered to be not engaged in an economic activity in another if, for example, it only acts as an intermediary in the receipt of a specific payment. On the other hand, a non-extensive activity may be considered as real in the case of a specific payment that does not require a more extensive activity in order to derive its own benefit.

An entity that does not have its own resources (property and personal) enabling it to conduct it cannot meet the condition of real business activity

The prerequisites for conducting real activity for different companies (for example, production/trading companies and those dealing with financial activities) are different. However, circumstances such as the following will always (at least some) be important:

– whether the company has its own assets;

– whether it has an office (in the sense of room/rooms);

– whether he pays bills related to his current business;

– whether it employs managers with sufficient qualifications, and

– whether there are no capital and personal ties between the entity and its owner(s) of such a kind that such an entity can be considered only an administrator of income.

The required level of development of the personal and property substrate will depend on the type of transaction and the type of business conducted.

The following circumstances may prove that the condition of having a personal substrate is not met:

- there is no assignment of the scope of duties/competences to individual members of the management board;

- employment of only (or almost only) administrative staff in the company (especially if they also provide services to other entities;

- outsourcing by the entity of most of the basic aspects of operation (m.in. extensive use of services consisting in making a country a legal seat, such as, for example, the provision of a registered office, the provision of suitably qualified resident directors of the country concerned, the provision of shared office space, handling incoming mail, etc.);

- extensive use of fiduciary services;

- consulting decisions concerning the entity mainly with advisors from a country other than the country of the entity or the country of investment carried out by the entity (including tax advisors).

In some cases, the funds needed for the company’s revenue management may be made available to the company by other entities from the group. Due to the need to have extensive knowledge as to the manner in which a given group operates, it is not up to the tax authority (which does not have such knowledge) to demonstrate that the condition of genuine business activity is met, but to the tax remitter or taxpayer. The use of the divided property and personal substrate by a given entity does not mean that it does not have to meet the conditions of the definition of beneficial owner. Such an entity must still (in relation to a specific payment) not be an intermediary and receive it for its own benefit and conduct real business activity. A finding that the company uses the divided asset and personal substrate in a manner that proves that it conducts genuine business activity in the scope of the analyzed payment is a condition for the correctness of the verification of compliance with the beneficial owner clause. The division of the property and personal assets relates only to one of the elements of the premise of conducting real business activity.

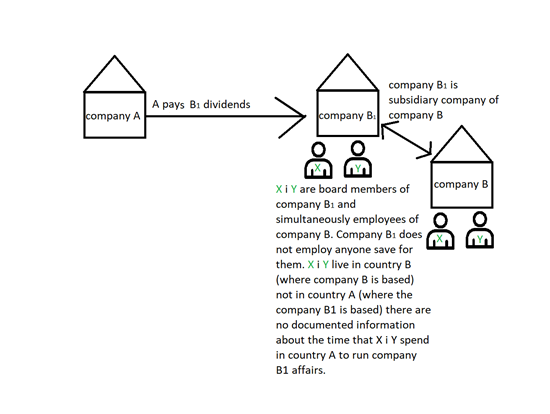

Example 1

In this example, company B1 will not be able to be considered as conducting real business activity (and thus being the beneficial owner of the receivables) and lacking personal substrate to be able to actually benefit from the benefit received.

Even entities from which a lower level of property and personal substrate is required must incur costs that justify that they bear the risk associated with the receivables they receive, and their activity must be of a profit-making nature enabling them to bear these costs independently. For example, the mere payment of a margin in connection with its receipt and further distribution does not determine the ‘real’ nature of the business. The margin must reflect the level of risk adequate for the entity using the receivables received for its own benefit. Excluding entities that (according to the regulations) can conduct non-profit activities (such as foundations or associations).

The scope of payments subject to the obligation to examine the beneficial owner condition

In Poland, the presentation of a statement that the taxpayer is the beneficial owner of the receivables on which the tax was collected and the examination of the fulfillment of the conditions is necessary in the case of the so-called passive payments, i.e. taxed on the basis of:

- Article 21(1)(1) of the CIT Act, i.e. in the case of interest payments and the so-called royalties, and

- Article 22(1) of the CIT Act, i.e. in the case of payments from dividends and other income (income) from participation in profits of legal persons with their registered office or management board in the territory of the Republic of Poland.

In other cases, it is not necessary. In the case of intangible services (e.g. advertising or consulting services), the payer is not obliged to verify the condition of the beneficial owner.

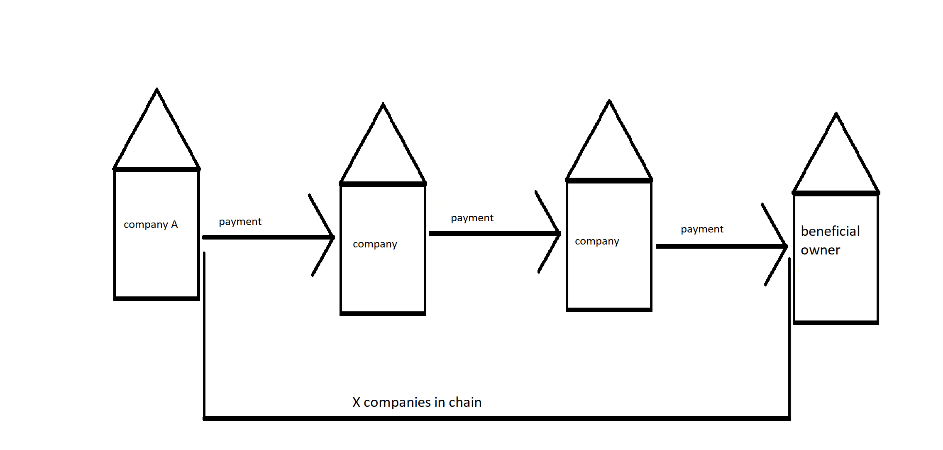

Chain of companies

The PS Directive[2] recognises that, regardless of the need for each (except the first) company in such a chain to meet the definition of a parent company, only a specific company can be identified as a parent company obtaining a distributed distribution.

Circumstances Investigated to Verify the Beneficial Owner Condition

When the application of a given tax preference depends on the fulfilment of the condition of the beneficial owner, the tax remitter is always obliged to verify whether the entity is actually the owner. In the case of related entities, it is necessary to examine all circumstances resulting in the qualification of a given entity as the beneficial owner. It is not enough to obtain the appropriate statements and certificates. It is necessary to verify other available documents that make up the “knowledge” of the tax remitter, which at the same time can be said to not justify the assumption that there were circumstances precluding the possibility of applying the tax preference. In the case of unrelated entities, it is possible to determine whether the taxpayer meets the condition of beneficial owner on the basis of the certificate of residence obtained from the taxpayer and his statement on meeting the condition of beneficial owner. The above does not mean, however, that the tax remitter is not obliged to exercise due diligence, for example, to verify the period for which they were issued or to verify their form.

In the case of payments made by a technical payer or PRO, there are special regulations as to the circumstances under consideration.

Special cases of examination of the beneficial owner condition

Optionally, the tax remitter or taxpayer may apply the tax preference on the basis of special circumstances, such as the status of the beneficial owner of another entity or the recipient of the receivables. Compliance with the Explanations in this respect consists in appropriate indication in tax returns (information) or applications of the entity whose status of beneficial owner is the basis for the preference.

LTA

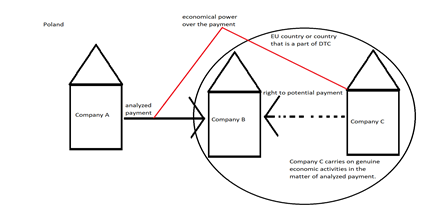

The “look-through approach” clause (LTA clause) allows the remitter paying the receivables to apply an exemption or a reduced tax rate even if the beneficial owner of the receivable is not its direct recipient, and it is transferred to him through intermediaries.

Before applying the LTA, the tax remitter should, as part of due diligence, determine:

1) the beneficial owner of the receivables;

2) whether the beneficial owner recognizes tax revenue in his country on account of the receivables received;

3) whether payments made in the chain of entities are generically identical;

4) whether the conditions for a given tax preference are met,

Example 2

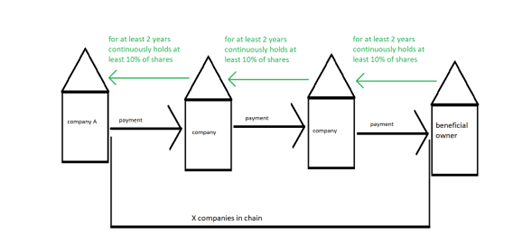

The generic identity of the payment is based on the fact that the receivable made by the Polish payer is paid to the beneficial owner under the same title. For example, if it was paid as a dividend, it should also be paid to the beneficial owner in the form of a dividend. It is not necessary to have a monetary identity, i.e. the receivables do not have to be transferred in full, some of them may remain in the “earlier” companies. In the case of dividends, in order to be able to apply LTAs, individual entities in the chain must be subject to income tax on all of their income, regardless of where they are earned, not be exempt from income tax on their entire income, be a company within the meaning of Article 4a(21) of the CIT Act or one of the entities listed in Appendix 4 to the CIT Act or one of the entities, to which the provisions of sections 4-4b apply mutatis mutandis, hold continuously for a period of at least two years directly not less than 10% of shares (stocks) in the capital of the company paying the dividend the so-called premise of direct ownership of shares (graphic) and hold the ownership title of the shares on account of which the dividend is paid. In the case of interest and royalties, it is required that none of the entities in the chain benefit from an exemption from income tax on all of their income, regardless of the source of their income, and that the entity in the chain holds directly not less than 25% of the shares of the “previous” entity (similarly to dividends).

The condition of direct shareholding is fulfilled when all entities in the payment chain cascade to the next company in the chain. In such a case, each subsequent company receiving the receivables should meet the condition of direct ownership of shares in relation to the next paying company, and not to the first paying company.

International double tax treaties may provide for different conditions for the application of exemptions or a reduced tax rate.

Extended scope of the examination of the beneficial owner condition

Payments that may be analysed for the application of preferences on the basis of the extended scope of the examination

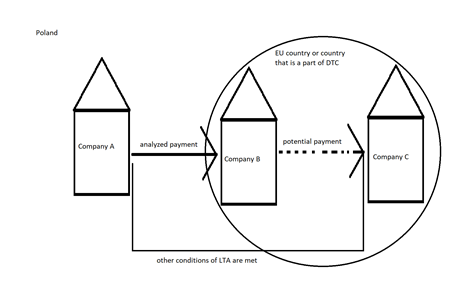

Example 4

If company A (which is the Polish payer) cannot apply the preference to payments to B solely due to the lack of the status of the beneficial owner of entity B, and C meets the condition of a cascade of LTA shares for B, if the payment was made by entity B to entity C (hypothetical payment), the condition of identity of the payment within the meaning of LTA would be maintained, and C is based in an area covered by the same preference as B (and moreover, in the same area), and the legal form C would justify the application of this preference, if the LTA of the Polish remitter could apply.

Conditions for meeting the condition of beneficial owner on the basis of the extended scope of the examination

Example 5

In order to meet the condition of beneficial owner on the basis of the extended scope of the audit, it is necessary to demonstrate that in the situation described above:

a) there are circumstances that allow the audited entity (on the example of company C) to demand that the entity that will receive the payment (company B) transfer it, i.e. company B is not its BO due to the rights of company C.

b) the audited entity (company C) may independently decide on the allocation of a given payment “from the level” of the entity generating revenue (company B) and conducts actual business activity in the scope of this payment, i.e. the audited entity is the BO of the analyzed payment.

[1] Judgment of the CJEU of 26 February 2019 in Joined Cases C-115/16, C-118/16, C-119/16 and C-299/16

[2] Council Directive 2011/96/EU of 30 November 2011 on the common system of taxation applicable to parent companies and subsidiaries of different Member States (conversion) – in consolidated version: http://data.europa.eu/eli/dir/2011/96/2015-02-17