Valuation of company shares – analysis from the economic point of view

Publication date: August 20, 2025

In this article attention will be paid to the valuation of the company’s shares:

When is a stock valued at the day’s price?

When is a stock valued at its mid-year average price?

The topic will be analyzed from an economic perspective. Additionally, these aspects will include situations in which one of the previously mentioned valuations is used and why it works well in those situations.

Stock Valuation

Stock valuation is a key process for investors, allowing them to assess investment risk and helping them decide whether to buy or sell a stock. There are several stock valuation methods that provide information about whether a company is undervalued or overvalued.

The most popular share valuation methods:

1. The accounting method (net asset value) estimates the value of a company’s assets after subtracting liabilities, and divides the result by the number of shares outstanding. This method does not take into account future growth prospects and is therefore rarely used.

2. Liquidation method – assesses the value of a company’s assets in the event of its liquidation, i.e. the sale of all assets after paying off liabilities.

3. Multiples (comparative) method – this method relies on valuing the company relative to other companies in the same sector. Ratios such as price/earnings and price/book value are key here.

4. The DCF method assumes that the value of a company is equal to the sum of discounted future cash flows. This model is more complex, taking into account all relevant economic variables.

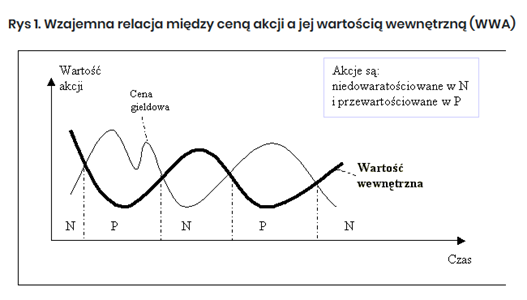

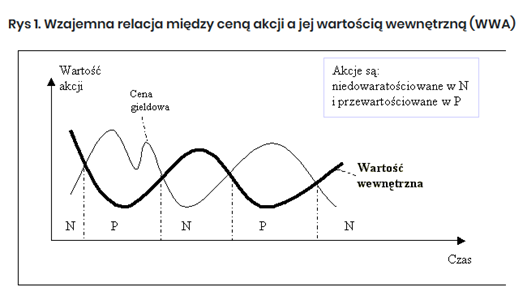

Intrinsic value of shares

If the IVA is higher than the market price, the stock is undervalued, suggesting a buy. If it is lower, the stock is overvalued, suggesting a sell.

Company valuation

A company valuation is necessary in many situations, such as during a sale, merger, creditworthiness assessment, or liquidation. Three main categories of valuation methods are used: asset-based, income-based, and comparable. Each method can be selected depending on the company’s business activity and economic conditions. Among the asset-based methods are the adjusted net asset method and the liquidation value method, which are particularly useful in the event of a company liquidation.

In summary, stock valuation is an important tool for investors to help them assess the true value of a company and make informed investment decisions.

Assets and liabilities are valued at least once per balance sheet date in accordance with the Accounting Act. Valuation methods depend on the type of assets and liabilities.

Asset valuation principles:

- Fixed assets and intangible assets: are valued at acquisition price or production cost, less depreciation and impairment losses.

- Real estate and intangible assets classified as investments: valued according to the principles relating to fixed assets or at market value.

- Fixed assets under construction: the valuation includes costs related to acquisition or production, taking into account write-offs for permanent impairment.

- Long-term shares and investments: valued at cost, adjusted for impairment losses or fair value.

- Short-term investments: valued at market value or cost, whichever is lower.

- Material current assets: at acquisition price or production cost, which cannot be higher than their net selling price.

- Receivables and loans granted: are valued at the amount due, in accordance with the prudence principle.

Principles of valuation of liabilities:

- Liabilities: are valued at the amount due, unless they are financial liabilities that can be valued at market value.

- Reserves: are valued at a reliably estimated value.

- Equity: valued at nominal value.

Additionally, assets and liabilities denominated in foreign currencies are valued at the average NBP exchange rate as at the balance sheet date.

If an entity is unable to continue as a going concern, assets are valued at their net realisable prices and a provision is made for potential losses associated with the liquidation of the business.

Stock valuation involves determining a stock’s value to identify which stocks are undervalued (to buy) or overvalued (to sell). There are several main valuation methods:

1. Income Methods: These rely on the company’s future earnings and project future cash flows to assess the value of a stock.

2. Cost and asset-based methods: These take into account the company’s assets, value of assets and liabilities to determine the value of shares.

3. Mixed methods: They combine different approaches, taking into account both the value of the assets and future income.

The key concept is the stock’s intrinsic value (IVA), which may differ from the market price due to market imperfections. Stocks are:

- Undervalued (market price is lower than PAH) – worth buying.

- Overvalued (market price is higher than PAH) – worth selling.

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

Stock valuation boils down to determining the value of a company, also known as its intrinsic value. The value of a single share is obtained by dividing the value of the company by the number of shares outstanding. For new share issues, the arithmetic or weighted average of the number of shares outstanding at the beginning and end of the reporting period is used.

The basis for company valuation is to take into account two values:

1. Company assets.

2. The company’s ability to generate future profits (goodwill).

Business valuation methods are divided into four groups:

1. Income methods – based on forecasting the company’s future income, updated as of the valuation date.

2. Cost- and asset-based methods – focus on valuing a company’s assets.

3. Comparative methods – based on market values of equity and debt.

4. Mixed methods – combine elements of the income and asset approaches.

Income-based valuation methods are based on forecasting the financial benefits a company can generate for its owner. Key steps include determining the company’s ability to generate income and forecasting this income in the future. These valuation methods include the discounted cash flow method , future earnings valuation, and dividend-based methods.

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

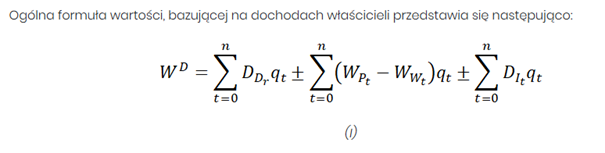

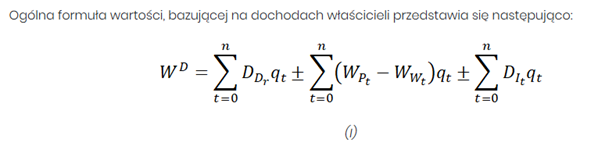

Where:

- W D – income value of the enterprise being valued

- W P – capital inflows in the nature of returns to investors

- W W – capital expenditure of investors for the enterprise

- D D – dividends

- D I – other income of investors related to owning the enterprise

- q – discount factor

- t – years

The formula presented above is considered the only true one, although its practical implementation is unlikely. Therefore, solutions are used to simplify the general value formula.

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

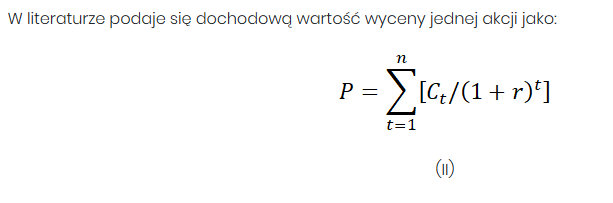

Where:

- P – value of an ordinary share

- C t – income from owning shares obtained in the t-th period

- r – required rate of return of the investor

- n – number of share holding periods

Income from owning common stock comes from two sources:

- changes in the share price during the investment period

- dividends (or other income, e.g. from subscription rights) obtained during the investment period

The disadvantage of this model is the difficulty of estimating future changes in the dividend and share price on the stock exchange.

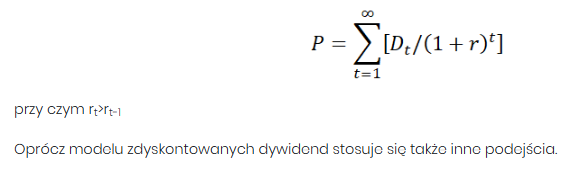

In the case of an investor holding shares indefinitely, the formula becomes:

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

The dividend growth rate is crucial for stock valuation using the discounted dividend model. In practice, the Gordon-Shapiro model is most commonly used. In addition to estimating the required rate of return, there is also the issue of determining the dividend growth rate, denoted by g. Typically, past data is used and the formula: g = r t r e ,

Where:

- r t – retention ratio calculated as the share of retained earnings in the company’s total profit

- r e – rate of return on retained earnings, determined e.g. by the ROE (Return On Equity) ratio

The discounted dividend model, presented in formula (III), does not account for the fact that the value of a dividend received in the distant future is more uncertain than the value of a dividend received in the near future. This fact should be reflected in the stock valuation model.

One indirect way to account for this fact is to assume that the required rate of return is not constant but increases over time. This will cause the value of the dividend in subsequent periods to be reduced even more than would be implied by the time value of money at a constant interest rate. This reduction reflects uncertainty. The result is a model (called Gordon’s “bird in the hand” model ) , which is a generalization of the discounted dividend model:

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

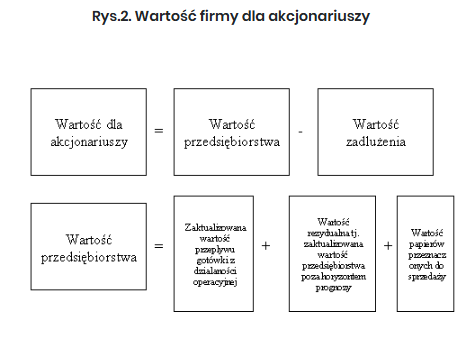

The discounted cash flow (DCF) method is one of the most popular business valuation methods, which is based on the future cash flows generated by the company. Cash flow (Cash flows reflect the cash flows between the company and its environment (suppliers, customers, employees), excluding owners. If these cash flows are positive, they can be reinvested or paid out as dividends; negative cash flows require the use of reserves, which leads to a decrease in the company’s assets.

The DCF method assumes that a company’s value is equal to the sum of future, discounted cash flows available to equity holders. It comprises free operating cash flow (FOCF) and non-operating free cash flow (NCF), which together constitute free cash flow (FCF). Non-operating assets and residual value are added to this, leading to an estimate of the company’s gross value. After subtracting the market value of debt, we obtain net value, or the intrinsic value of equity.

One of the key elements of the DCF method is the discount rate, which is most often determined based on the weighted average cost of capital (WACC). Cash flows are forecasted for several years, after which a residual value is calculated, which takes into account the company’s future earnings after the forecast period ends.

Although the DCF method is widely used in business valuation, including during mergers and acquisitions, it has its drawbacks. Forecasting future cash flows and adopting an appropriate discount rate can be difficult and risky.

Fundamental analysis also uses other metrics, such as P/E ( price -to- earnings ratio), P/BV, P/S, P/CF, and D/S. These metrics help investors evaluate a company in comparison to its competitors and market trends.

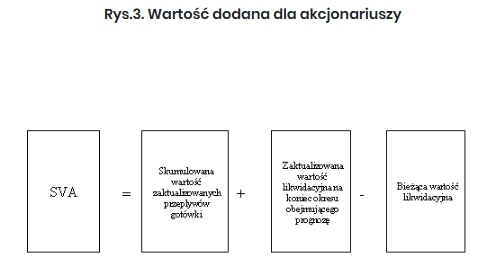

Approaches such as EVA (Economic Value Added), which measures residual income after covering all costs of capital, and SVA (Shareholder Value Added), which focuses on the added value for shareholders resulting from investments exceeding the cost of capital, are also used to value companies.

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

Cost-based and asset-based methods, the oldest in the history of valuation, rely on assessing the value of a company’s assets, i.e., its assets less liabilities. This value is referred to as the company’s net asset value. These methods focus on analyzing net assets, i.e., the difference between total assets and debt.

The most important methods in this group include:

- The balance sheet net asset valuation method measures equity based on the balance sheet, as the difference between assets and liabilities. This value often underestimates the true market value of a company, particularly its ability to generate profits. The market value of intangible assets, such as patents, licenses, or trademarks, can differ significantly from their book value.

- The adjusted net asset method is a more advanced version of the balance sheet method. Here, the net asset value is adjusted for items whose balance sheet value requires updating. This takes into account, for example, differences between the book and market values of fixed and current assets.

These methods, despite their simplicity, often do not reflect the full market value of a company, especially in the context of its ability to generate future profits.

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

Where:

- W P – company value

- A – carrying amount of assets (property components)

- K A – adjustment to the carrying amount of assets

- P O – external liabilities (carrying amount of external liabilities)

- K Po – adjustment of the carrying amount of external liabilities

- The replacement method – informs about the amount of expenditure that must be incurred to recreate the existing potential in a given company.

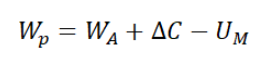

The value of an enterprise using this method is calculated based on the formula:

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

Where:

- Wp – enterprise value,

- W A – carrying amount of assets,

- △ C – the difference between the amount of expenditure that must be incurred to create a new material potential and the balance sheet value of the assets,

- U M – degree of technical wear and tear expressed by the degree of depreciation of assets.

- Liquidation method – allows us to answer the question of what net proceeds the company’s owners would have achieved if they had decided to liquidate it at the time of valuation.

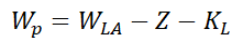

In this method, the value of the company is calculated according to the following formula:

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

Where:

- W p – enterprise value,

- W LA – liquidation value of assets (the sum of funds that can be obtained from the sale of individual assets),

- Z – balance sheet monetary liabilities to be repaid,

- K L – liquidation costs.

The method of valuing a company based on its asset value involves several difficulties:

- Valuation of assets, especially intangible assets, is complicated.

- The approach of treating a company as the sum of its components ignores the connections between them, which can lead to an incomplete assessment of value.

- Focusing on asset replacement costs, rather than potential benefits, limits the valuation perspective.

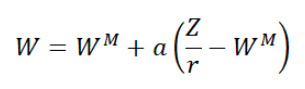

Mixed methods combine asset and income approaches, assuming that the value of a company depends on both its assets and its ability to generate income.

The general concept of this relationship is expressed by the formula:

Source: Valuation Methods | Brokerage House of Bank Ochrony Środowiska (bossa.pl)

Where:

- W – enterprise value

- W M – property value

- Z – standardized annual profit

- r – capitalization rate

- a – weight factor

The most well-known mixed methods are:

- Average value method – combines the asset and income approaches to obtain the average value of the company.

- Additional profit methods – these include, among others, the year’s method purchase, Stuttgart and UEC, which are based on the additional profit of the company.

- Methods of valuing unprofitable companies – such as the Schnettler method and methods taking into account badwill, which refer to companies generating losses.

Choosing the right method depends on several key factors:

- purpose and function of valuation,

- perspectives of the valuation entity,

- the economic situation of the enterprise,

- socio-economic conditions in the region where the company operates.

Stock valuation is crucial for investors to assess whether a stock is expensive or cheap. Stock analysts use various methods to perform this valuation and create recommendations, such as “buy” or “sell.” The main valuation approaches are income, comparative, and asset-based.

Income-based valuation methods focus on assessing a company’s future financial health, assuming that its value depends on future cash flows. Analysts forecast future earnings, revenues, and dividends, which allows them to estimate the stock’s value. The more accurate the forecasts, the more reliable the valuation. An example is the future dividend valuation method, which is based on the value of dividends the company will pay to investors.

Comparative methods involve analyzing ratios such as price to earnings per share (P/E) or price to book value (P/BV). These ratios are compared to other companies in the same industry, allowing us to determine how a given company’s stock compares to its competitors. Choosing the right companies for comparison is crucial, as discrepancies can distort valuation results.

Asset-based valuation methods are based on valuing a company’s assets less liabilities. This is the simplest approach, although it has been criticized for failing to consider the company’s ability to generate future profits. In some cases, a liquidation valuation is used, which estimates how much money shareholders would receive in the event of a company liquidation.

When analyzing stock valuations, it’s worth considering not only analyst recommendations but also carefully examining the company’s development plans and forecasts for the industry it operates in. This will help you better understand investment prospects.

When it comes to valuing shares on the balance sheet date, an entity that has not adopted micro status is entitled to more flexible asset valuation methods. According to the Accounting Act, micro entities must value their assets and liabilities at historical values, i.e., at purchase price, which excludes the possibility of using market value. To achieve micro status, an entity would have to decide to prepare simplified financial statements.

Since the entity in question did not opt for simplifications, it has the option of valuing shares classified as long-term assets in accordance with Article 28, Section 1, Item 3 of the Act. This means that financial assets should be valued at purchase price, with the option of revaluing to market value. If the value of the shares increases, this difference can increase the revaluation reserve, whereas if the value decreases, the effects of this action will have to be recorded as financial costs.

This approach allows an entity to adjust its share valuation to current market prices, which facilitates a more accurate representation of asset values in financial statements. This is crucial for making informed investment decisions based on realistic data about the value of shares held.

Valuing shares on the balance sheet date is a complex process that depends on their classification as short-term or long-term financial assets. For both categories, in accordance with the Accounting Act, shares are valued at purchase price less impairment losses or at fair value, which translates to market valuation.

Shares are issued by joint-stock companies and provide investors with property rights (e.g., the right to dividends) and non-property rights (e.g., the right to vote at the general meeting). The Act defines investments as assets acquired for the purpose of achieving economic benefits, which includes both appreciation in value and dividend income. Shares qualified for investment are classified according to their intended holding period: short-term (sale within 12 months) or long-term (sale after that period).

Pursuant to Article 28, Section 1, Item 3 of the Accounting Act, shares should be valued at cost or fair value no less frequently than on the balance sheet date. Costs associated with the purchase of shares, such as brokerage commissions, are included in the purchase price, while other costs, such as investment analyses, are classified as operating expenses.

If the value of shares changes, a revaluation must be performed on the balance sheet date. An increase in the value of shares to the market price increases the revaluation reserve, while a decrease in value reduces this reserve if the difference has not been previously settled. Otherwise, the effects of the decrease in value are recognized as financial expenses.

The examples illustrate the valuation principles. In the first case, the company holds shares with a market value below the acquisition price; the valuation effects are recognized as write-downs. In the second case, when the market value of the shares increases, the valuation effects are recognized as financial income.

The classification of shares as short-term or long-term financial assets influences their valuation. Entities that cannot or do not wish to apply detailed valuation principles can use the general provisions of the Accounting Act, which is advantageous for small entities.

Selling or buying a company is a process that requires precise decisions based on reliable data.

The Importance of Company Valuation

Company valuation is crucial in the context of purchases, sales, mergers, acquisitions, and tax procedures. This process includes analysis of the company’s financial condition, sector potential, customer structure, resources, and growth opportunities. A professional valuation increases the chances of attracting buyers and allows for informed investment decisions.

Valuation Methods

- Income Method (DCF):

- It is based on future cash flows.

- Considered one of the most reliable methods, it uses financial forecasts and analyzes the company’s risk.

- Market-Transaction Method:

- Compares the valued company with similar ones using market ratios (e.g. P/E, P/BV, EV/EBITDA).

Valuation Process:

- Selecting the Valuation Objective:

- Key to further proceedings and method selection.

- Data Acquisition:

- Collecting relevant information regarding the business model, finances and market environment.

- Creating a Report:

- It includes a detailed analysis and valuation, as well as answers to customer questions.

DCF Valuation – Stages

- Business model analysis.

- Micro-environment and market research.

- Preparation of a financial model.

- Financial analysis and macroeconomic indicators.

- Valuation summary and report preparation.

Valuation Report

Contains:

- Valuation assumptions.

- Methodology.

- Key company data.

- Detailed financial analyses.

- Estimated value of the company and justification.

For a proper valuation, there need to be considered the following aspects:

- Do they have extensive experience in transaction advisory?

- Is it possible to adapt activities to individual needs?

- High quality and reliable valuations – what exactly does it look like?

- Identification of risks related to transactions – whether they are identified, and even more so whether the detection is carried out reliably.

Valuing a company’s shares based on the daily price and the six-month average is a key consideration in investment analysis and speculation. Each of these valuation methods has different applications and implications for investment decisions.

The spot price is the current market price of a stock, which reflects current market sentiment and reaction to news. Investors who follow the spot price typically have a more short-term perspective. This valuation method is preferred in situations where a dynamic response to market changes is important, such as during a day trading or short-term speculation.

Daily price / current price:

– It reflects current market conditions such as company news, macroeconomic changes, political decisions, and speculation.

– It is more volatile and can be susceptible to manipulation in the short term, which is important in the context of speculation.

– Used in transactional valuation, i.e. when selling or buying shares, where the current price is important.

Average price for half a year ( average Price ) is a method that smooths out short-term volatility and allows to take a longer-term view of a stock. It is a more conservative approach, often used in longer-term valuations, such as in financial reports or when assessing a company’s fundamental value.

Half-year average:

- It provides a broader market perspective, which means that investment decisions are based on more average data, which can reduce the risk of making decisions based on momentary price fluctuations.

- Minimizes the impact of short-term anomalies, such as one-off events affecting the stock price (e.g., crises, quarterly results).

- It may be a more stable indicator for long-term investors, pension funds or M&A transaction valuations.

Speculation and practical applications

From a speculator’s perspective, the choice between the daily price and the six-month average directly impacts investment strategy. Here are some examples:

- The daily price is ideal for short-term speculation, where investors try to capitalize on market volatility. Decisions based on this price are quick and responsive to current changes, increasing profit potential but also increasing risk.

- The six-month average is more appropriate for long-term investments because it minimizes the risk of momentary price fluctuations. This method is often used by investors who want to avoid short-term volatility.

- Speculators can manipulate the market based on the difference between the daily price and the six-month average. For example, they can push up or down stock prices for a short period of time, triggering reactions from investors who base their decisions on current prices.

Arbitrage – Investors can profit from differences in stock valuations based on the divergence between the current market price and its historical average, a common strategy among hedge funds.

When should a company’s shares be valued at the current price and when at the six-month average?

Valuing a company’s shares is a key element of market analysis, and choosing the right method influences investment results and strategic decisions. In practice, we most often encounter two approaches: valuation at the daily price (known as the market price or current price) and valuation at the six-month average. Each of these methods has its specific applications, and the choice depends on the investment context and the desired goal.

Valuation of shares at the current price

The daily price, also known as the spot price, reflects the current market valuation of a stock at a given moment. It is the price at which shares are bought or sold during a trading session.

Applications:

- Short-term speculation:

- Speculative investors often use the daily price because it is the most accurate and reflects the current state of the market.

- Quick reaction to changes in stock prices allows speculators to take advantage of sudden price spikes to make profits.

- Decisions based on current price are often correlated with technical analysis, trend indicators and market analysis tools.

- Investment portfolio valuation:

- In actively managed portfolios, where investors frequently trade, the daily price is the primary parameter for valuing assets. In such cases, quick adaptation to changing market conditions is crucial.

- Settlement of stock exchange transactions:

- For the settlement of purchase and sale transactions on the public market, the daily price is the basis for calculating the transaction value and commission.

Disadvantages and risks:

- High volatility: Daily prices are susceptible to changes due to speculation, investor sentiment, and macroeconomic events. This can lead to wild fluctuations, making long-term forecasting difficult.

- Emotional decisions: Investors, observing current price movements, may make decisions influenced by emotions, which leads to incorrect investment steps.

Share valuation at the half-year average

The six-month average price measures the average value of a stock over a specified period, which helps smooth out market volatility. This method is particularly useful for minimizing the impact of short-term market fluctuations on investment decisions.

Applications:

- Long-term investing:

- For long-term investors, a valuation based on a six-month average provides a more stable picture of the company’s value, avoiding sudden fluctuations.

- The average price allows to better assess a company’s fundamentals while avoiding short-term market disruptions such as sudden corrections, political events, or other factors that may temporarily impact prices.

- Planning the company’s strategy:

- For company management or financial advisors, average-based valuation is useful for long-term planning and growth analysis. It offers a more balanced approach, helping assess financial health without being influenced by short-term fluctuations.

- Valuation of management options and bonuses:

- When executives are compensated through stock options, the average price is fairer because it eliminates the element of speculation and is more reflective of the long-term success of the company.

Disadvantages and risks:

- Limited response to changes: Using an average price can delay the response to dynamic market changes. This can lead to over- or underestimation during significant events, such as economic changes or mergers and acquisitions.

- Averaging: A valuation based on the average can mask serious problems for a company if the market currently values it significantly lower. This approach does not always reflect market reality.

Speculation and valuation – practical aspects

Choosing between the daily price and the six-month average price can also be a speculative strategy. Speculators, familiar with market dynamics, can use different valuation methods depending on their goals.

Short-term play: When a stock is trading at its current price, speculators may try to capitalize on short-term fluctuations, allowing them to make a quick profit at high risk.

Long-term speculation: Valuation at the six-month average can be used for more conservative speculation, where the investor hopes that the market price will return to the historical average.

Conclusions

Valuing stocks at the daily price and the six-month average are tools used in various investment contexts. The daily price is crucial for speculators and short-term investors, while the six-month average price is preferred for long-term investors, where stability is paramount. Choosing the right method depends on your investment goals, risk, and attitude toward market volatility.

Mark -to-market valuation of a company’s shares is a method of determining the value of assets (including shares) based on their current market price. This type of valuation has many applications in economics and finance, and the decision to use it depends on specific market conditions and the objectives of investors and fund managers.

Here are the main economic aspects to consider when analyzing the valuation of a stock at its current price:

- Transparency and ongoing market value assessment

Daily price valuation provides the most up-to-date assessment of a company’s stock value. This is useful when:

- You want to know the exact value of your investment portfolio.

- You follow current market changes, which may influence your decisions to buy or sell shares.

- You analyze the current state of the market for management purposes, e.g. in investment funds or capital reserves.

- Application in short-term investment strategies

Daily price pricing is particularly important for speculators and short-term investors. It’s linked to dynamic share price movements, allowing for:

- Quick response to changing market conditions.

- Using day trading, swing trading or other short-term investment techniques that require quick decision-making based on current prices.

- High volatility and market risk

High market volatility means that stock prices can change rapidly, which impacts investment decisions. Investors who use the price of:

- They can better adapt their decisions to current changes and reduce the risk of losses resulting from sudden price drops.

- However, they must be prepared to take higher risks arising from these fluctuations, which may lead to the need to monitor their investments more frequently.

- Financial reporting and regulations

Daily valuation is often required for asset valuations for financial reporting purposes, particularly by financial institutions such as investment funds and pension funds. Using this valuation method allows for:

- Better transparency for investors and regulators.

- Real-time assessment of the true value of assets.

- Comparison with long-term valuation (e.g. after a six-month average)

For long-term investments, daily valuation may not be appropriate because:

- It can introduce large fluctuations in portfolio value over short periods that do not reflect long-term trends.

- Long-term investors may prefer to value the stock at a six-month average, which helps mitigate the impact of short-term market movements and better reflect the company’s long-term potential.

- Speculation and valuation stability

For speculators looking to maximize profits in the short term, intraday pricing is more useful. It allows them to:

- Immediate response to market events, such as company financial results, macroeconomic or political changes.

- But it also carries greater risk due to sudden, unpredictable price changes.

In general, daily stock valuation is crucial when a current, market-based assessment of a stock’s value is needed. It is particularly useful for short-term investors and speculators who capitalize on dynamic market movements. However, its use also involves higher risk and greater volatility of asset values.

Examples of using daily price pricing can help illustrate how different approaches to this method impact investment decisions and portfolio management. Here are some specific examples from different markets and strategies:

- Short-term speculator in tech stocks

Let’s assume an investor focuses on technology stocks such as Apple, Amazon, or Tesla, which are often characterized by high price volatility.

Example:

An investor buys Tesla stock on Monday morning at $240 per share. Later in the day, news breaks that Tesla is launching a new electric car model with revolutionary technology. Tesla’s share price jumps to $270 by market close.

By valuing the shares at the daily price, the investor can immediately estimate the profit:

Purchase price: $240

Closing Price: $270

Earnings per share: $30 ($270 – $240)

The investor decides to sell the stock at the end of the day, realizing an immediate profit. In this case, the daily price allowed him to react quickly to new information and realize a profit in the short term.

2. Investment fund monitoring portfolio daily

Investment funds, especially those managing highly liquid assets, often use overnight pricing to keep investors informed about the value of their portfolio.

Example:

The investment fund holds shares of several large companies from the S&P 500 index, including Microsoft, Apple, Alphabet (Google), and Johnson & Johnson. Following Apple’s quarterly earnings announcement, the company’s share price fell 5% overnight.

At the end of the day, the fund must mark -to-market all of its assets:

Apple shares fall from $190 to $180.

Microsoft shares rise from $300 to $305.

Other shares remain stable.

The fund’s management may inform its investors that the value of the portfolio has changed as a result of the decline in Apple prices, which may influence decisions on possible adjustments to the fund’s strategy.

3. Management of financial reserves by the company

For large companies that hold shares as part of their financial reserves, day-of valuation allows for accurate monitoring of the value of those reserves and for making management decisions.

Example:

The company has a $10 million investment in shares of energy company ExxonMobil . As a result of the changes in the oil market, ExxonMobil’s share price is down 3% on the day.

Portfolio value at the beginning of the day: $10 million

3% share price drop: $10 million * 0.03 = $300,000

End-of-day portfolio value: $9.7 million

Thanks to the day’s valuation, the company’s management knows that the value of the reserves has decreased by USD 300,000, which may prompt the company to decide to sell the shares or hedge against further declines, for example through derivatives.

4. Asset management in high volatility conditions

Investors who trade in highly volatile markets, such as cryptocurrency markets , often rely on day-of-the-day pricing.

Example:

An investor buys Bitcoin on Monday morning for $20,000. During the day, the price of Bitcoin rises to $22,000, but by the end of the day, it falls back to $19,500.

Purchase price: $20,000

Closing Price: $19,500

Loss per unit: $500 ($20,000 – $19,500)

An investor who values the price daily can decide whether to hold Bitcoin for an extended period (hoping for a trend reversal) or minimize losses and sell at closing. High volatility in the short term is a risk that investors must consider.

5. Regulations on the valuation of financial assets

Regulated pension and insurance funds often need to use spot pricing to provide current data on their investment portfolios to regulators.

Example:

The pension fund has 20% of its assets in healthcare stocks. Due to changes in drug reimbursement regulations, the share price of the pharmaceutical company Pfizer is falling 6% in a single day.

The fund must update its financial statements at the end of the day:

Pfizer stock value before the drop: $5 million

6% decrease: $5 million * 0.06 = $300,000

Value after probate: $4.7 million

In accordance with regulatory requirements, the fund must immediately update its reports and inform the supervisor of changes in the value of its assets.

Summary

In each of these examples, daily pricing enables rapid response to market changes. This is useful for portfolio management in volatile and speculative environments, as well as for asset monitoring by companies and funds that need to provide current information to investors and regulators.

Let’s look at each example in more detail, expanding on market mechanisms and practical implications.

1. Short-Term Tech Stock Speculator

Details:

Short-term speculators, also known as day traders operate in highly volatile markets, such as the technology sector. These types of investors rely on intraday price movements, reacting to news that can suddenly change the value of a stock. In the Tesla example above, the sudden announcement of a new car model with advanced technology triggered a rapid increase in demand for the company’s shares.

Economic explanation:

Short-term market valuations: In this situation, the stock price is directly influenced by newly emerging information and the immediate market reaction. Investors try to predict how a given event will affect the company’s future earnings and, consequently, the value of its shares.

Market psychology: Short-term speculators often use technical analysis tools (charts, indicators) to track trend direction. When Tesla announces a new product, the price increases are linked to expectations of increased sales and profitability for the company.

Timing: Daily pricing is key because the investor needs to know the exact value of their assets in real time to decide when to sell the shares and take a profit.

2. Investment fund monitoring portfolio daily

Details:

Investment funds that manage stock portfolios for individual and institutional investors must report the value of their portfolios on an ongoing basis. If a fund holds a variety of stocks, such as Microsoft, Apple, or Alphabet, earnings announcements can trigger changes in their valuations.

Economic explanation:

Mark-to-market: Investment funds must value their assets based on current market prices. This regulatory requirement allows investors to track the fund’s value on an ongoing basis. In the event of price volatility resulting from quarterly earnings releases, as in the Apple example, the value of the fund’s portfolio can change significantly.

Risk management: Changes in the value of individual company shares require portfolio managers to make decisions about whether to sell, buy, or rebalance their portfolio to minimize losses or maximize gains.

Investor Communication: Investors in mutual funds are kept up-to-date on the value of their shares. If the price of a stock, such as Apple, falls by 5%, fund managers must provide investors with information about the decline in the value of their shares, which may influence investors’ decisions about whether to continue investing in the fund.

3. Management of financial reserves by the company

Details:

Companies often hold investment portfolios as part of their financial reserves. By investing excess capital in stocks or other financial instruments, the company must monitor the value of these investments in real time to make appropriate financial decisions.

Economic explanation:

Liquidity Control: For large companies, the value of their investment portfolio directly impacts their cash flow and operating reserves. A 3% decline in ExxonMobil’s stock price reduces the value of their reserves, which can impact their ability to invest in other projects or meet current liabilities.

Diversification Strategy: Companies often diversify their portfolios by investing in different sectors (energy, technology, healthcare, etc.) to minimize the risk of a single sector declining in value. However, daily valuation provides them with a picture of how price changes in one segment impact their overall financial reserves.

Managing losses and gains: If there are significant declines in the value of shares, the company may decide to sell assets to realize capital losses (which may have tax benefits) or to protect itself against further declines.

4. Asset management in high volatility conditions

Details:

In highly volatile markets like cryptocurrencies , overnight pricing is a key tool for monitoring portfolio value and making quick investment decisions.

Economic explanation:

High volatility: The cryptocurrency market is characterized by significant price fluctuations over short periods. Investors purchasing Bitcoin can see its value fluctuate by several percent in a single day. By valuing it at the daily price, they can continuously monitor whether their investment is generating profits or losses.

Risk Management: High volatility also means high risk. Investors must react quickly to changing market conditions, for example, by selling assets when their value falls below a certain threshold (e.g., $19,500 in the example). Daily pricing allows for immediate action, which is crucial in such a dynamic environment.

Cryptocurrency investors often use short-term strategies like day trading or swing trading to capitalize on short-term price fluctuations. Daily pricing is an essential tool for monitoring the value of an investment and making buy or sell decisions.

5. Regulations on the valuation of financial assets

Details:

Regulated pension and insurance funds must use spot pricing to provide regulators and investors with current asset values.

Economic explanation:

Regulatory: Pension and insurance funds are required to report the value of their assets on an ongoing basis to ensure they have sufficient resources to cover future liabilities. Daily valuation provides them with an accurate picture of their portfolio’s value on a given day, which is crucial for meeting regulatory requirements.

Risk management: When a pension fund invests in stocks, such as those in the healthcare sector, and there is a 6% decline in Pfizer shares, the fund must update the portfolio value and potentially adjust its investment strategy to minimize the risk of further losses.

Transparency for investors: These funds must provide current information about the value of their assets to their clients. As stock market prices fluctuate, daily valuation ensures that investors and fund clients are informed about the current value of their investments.

Each of these examples demonstrates the importance of monitoring stock prices on an ongoing basis, especially in times of high volatility or regulatory constraints. Daily pricing allows for quicker responses to market changes, risk management, and better investment decision-making.

Analyzing a company’s stock valuation using the six-month or annual average price has many practical applications, particularly in the context of long-term investment decisions, assessing a company’s financial health, and risk management. Using the average price allows for a more balanced assessment of a stock’s value by eliminating the impact of short-term price fluctuations. Let’s look at a few situations when this method is worthwhile.

When do we use the half-year (or yearly) average price for stock valuation?

1. Fundamental analysis of long-term trends

In long-term fundamental analysis, the average share price over six months (or longer) is used to assess a company’s overall financial health and growth potential. Instead of focusing on short-term fluctuations, which may be the result of speculation or short-lived events, the average price provides a more stable picture.

Example: An investor is analyzing a company in the energy sector, which is subject to periodic fluctuations in commodity prices. Using the average price over the past six months, they can assess whether the company’s value is growing steadily or is subject to cyclical fluctuations. The average price allows them to assess whether the current trend (upward/downward) is part of a larger, long-term picture or a short-term anomaly.

Economic explanation:

Balancing fluctuations: The six-month average price allows investors to ignore momentary fluctuations that may be the result of speculation, unexpected news, or seasonal changes.

Assessing Long-Term Trends: A company’s value should be assessed based on its performance over the long term. The average price better reflects the overall direction of a company, as opposed to sudden spikes or declines.

2. Risk management by financial institutions

Banks and pension funds often use average stock prices to reduce the impact of short-term fluctuations on their portfolios. This allows them to better plan long-term investment strategies and protect themselves from excessive risk.

Example: A pension fund invests in shares of large, stable companies. Using the average share price over a six-month period, the fund can monitor the stability of its investments, reducing the risk associated with temporary fluctuations, such as those caused by speculation or temporary stock market declines. This helps avoid panic-driven investment decisions.

Economic explanation:

Portfolio stability: Pension and investment funds have long-term commitments to their investors. Analyzing average prices over a longer period allows for more stable asset management.

Avoiding overreactions: Using price averages reduces emotional or momentary market events that can lead to unsuccessful investments.

3. Calculating value for long-term transactions (e.g. acquisitions, mergers)

The average share price is also often used in calculations in mergers and acquisitions. A stock’s value based on an average price over six months or longer is more representative than the daily price, as it eliminates momentary fluctuations that can result from market sentiment.

Example: Company A plans to acquire Company B. Instead of basing the valuation on the current share price, which may be inflated by takeover rumors, the parties may agree to a valuation based on the average share price over six months to achieve a fairer deal value.

Economic explanation:

Representativeness: The average price better reflects the true value of a company over the long term, especially when the current share price may be inflated or deflated by speculation.

Minimizing risk: Using an average price eliminates the impact of short-term fluctuations, which is important for large transactions such as acquisitions or mergers where the stakes are very high.

4. Assessment of investment attractiveness in low-liquidity markets

In illiquid markets, where stock prices can fluctuate significantly over short periods, using the six-month average price helps investors assess how stable a company is. This can be especially important for small companies whose shares aren’t traded frequently.

Example: An investor is considering buying shares of a small company in the local market. Because the number of transactions is low, the share price often fluctuates due to single, large transactions. By analyzing the average price over six months, the investor can gain a more objective picture of the company’s value.

Economic explanation:

Avoiding the Impact of Low Liquidity: In low-liquidity markets, single trades can cause large price swings. Average prices over a longer period provide a better understanding of a stock’s true value by eliminating the impact of small, individual trades.

Reliable risk assessment: Average-price pricing gives investors greater certainty about the value of their investment, especially in less liquid and riskier environments.

5. Assessment of value for tax and accounting purposes

In some cases, particularly for companies and funds, valuing shares based on the six-month average price may be used for tax or accounting purposes. This helps avoid value spikes that could impact tax liabilities or reported profits.

Example: A company has an investment portfolio and must reconcile its value for accounting purposes at the end of the year. Using the average share price over the six-month period avoids a situation where a high price on the valuation date would inflate the portfolio’s value, which could lead to higher tax liabilities.

Economic explanation:

Minimizing the effect of volatility: Average-price valuation eliminates the impact of one-time events that could disproportionately impact the portfolio value and tax liability of the company.

Reliable asset valuation: The average price is more representative for accounting purposes because it provides a more stable picture of the asset value over the long term.

Summary

Valuing stocks based on the six-month (or annual) average price is particularly useful when investors or institutions want to avoid the influence of short-term fluctuations on their decisions. This method is often used in long-term analysis, risk management, mergers and acquisitions, in illiquid markets, and for accounting and tax purposes. Choosing this valuation method allows for more balanced investment decisions and minimizes the risk of short-term market anomalies.