MINIMUM WAGES IN POLAND – COSTS OF EMPLOYMENT FOR THE EMPLOYER

Publication date: April 07, 2025

One of the most frequently raised topics in public debate is the problem of the minimum wage. This is undoubtedly due to the fact that the issue concerns all employees and employers. The minimum wage is the legally established lowest permissible level of monetary remuneration for hired work.

In accordance with the regulation of the Polish Council of Ministers on the minimum wage and the minimum hourly rate in 2025, from 1 January 2025, the minimum wage in Poland is PLN 4,666 gross per month, and the rate for civil law contracts is PLN 30.50 gross (no. in the list of legislative works RD111). In July 2024, the minimum wage was PLN 4,300 gross – this means that the minimum wage in 2025 increased by PLN 366. For contracts for services and contracts for the provision of services in the second half of the year, the lowest permitted level of pay was PLN 28.10 gross. Therefore, an increase of PLN 2.40 is noticeable. It is worth noting that in 2025, the minimum wage increase was introduced once at the beginning of the year, in contrast to 2023 and 2024, when the increases took place twice – in January and July. The increase in wages is undoubtedly influenced by inflation and the government’s pro-social policy. The increase in the minimum wage can have various effects on entrepreneurs. On the one hand, it increases employment costs, which can be particularly noticeable for small and medium-sized companies. On the other hand, higher wages can contribute to increased employee motivation and reduced staff turnover. The increase in the minimum wage can also lead to the so-called “flattening” of the wage structure, where the differences between the salaries of employees with different experience and qualifications become smaller. This may result in the need to adjust the salaries of more experienced employees to maintain their motivation and commitment.

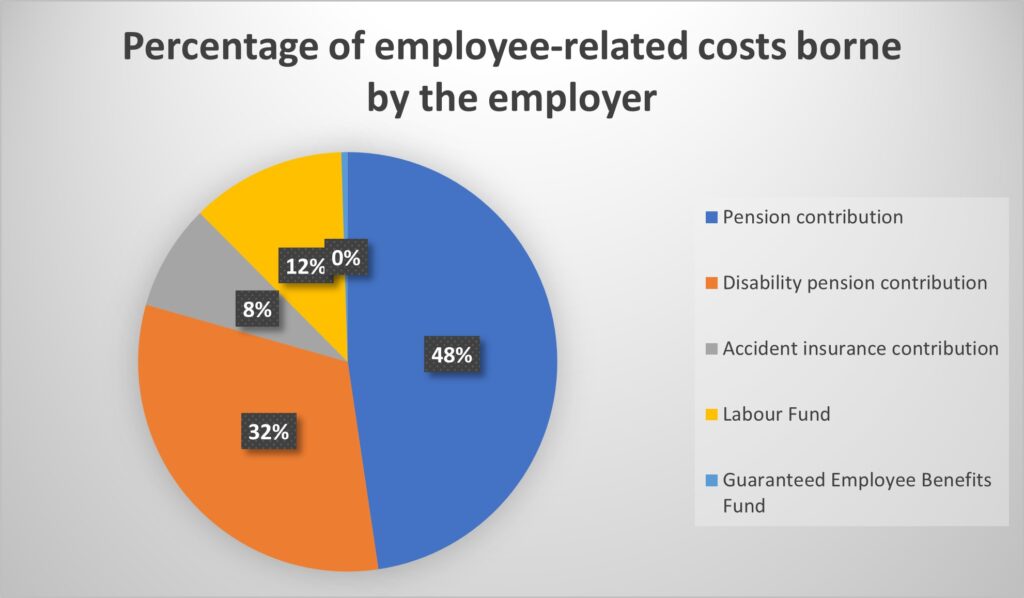

The above issue is closely related to the topic of employee costs borne by employers. The employer bears the following contribution costs:

- Pension contribution (9.76%) – PLN 455.40

- Social pension contribution (6.50%) – PLN 303.29

- Accident contribution (1.67%) – PLN 77.92

- Labor Fund (2.45%) – PLN 114.32

- Guaranteed Employee Benefits Fund – PLN 4.67

This means that in addition to the employee’s salary (PLN 4,666), the employer incurs an additional PLN 955.60 in fees. Total employee costs in 2025 therefore amount to PLN 5,691.60. Compared to the second half of 2024, this means an increase of PLN 446.45.

Additional, irregular costs incurred by the employer include, among others, expenses for mandatory medical examinations of employees (initial, periodic and control), as well as occupational health and safety (OSH) training.

Another important aspect of employment is personal income tax (PIT), which is paid by the employer. The amount of tax depends on, among other things, the tax bracket to which the employee belongs, as well as their age – for example, people up to 26 years of age benefit from PIT exemption.

In the case of civil law contracts, the costs on the client’s side are varied and depend on several factors. A contract for specific work usually does not generate an obligation to pay social insurance contributions by either the contractor or the client. The situation is different in the case of a contract for services. Here, the scope of contribution obligations depends on, among other things, the age of the contractor (people under 26 are most often exempt from social and health insurance), their educational status (e.g. students and pupils are also excluded), as well as any possible connection with an employment contract with the same employer – in such a case, contributions are attributed to the employment relationship.

It is also worth remembering that employment costs also occur on the employee’s side. The difference between gross and net pay is due to social security deductions, including pensions, which are partly financed by the employee themselves.

All of the above issues are regulated by a number of acts, such as the Labor Code (consolidated text: Journal of Laws of 2025, item 277, as amended), the Act on the Social Insurance System (consolidated text: Journal of Laws of 2025, item 350) and the Act on Occupational Pension Programs (consolidated text: Journal of Laws of 2024, item 556).