Investing in Life Science Companies from Investment Fund Perspective

Publication date: April 28, 2025

The lawyers of KIELTYKA GLADKOWSKI KG LEGAL participated on 24 April 2025 in the meeting of the Life Science Cluster devoted to investing in life science companies from the perspective of investment funds. The case study was presented by the active investor supporting the development of innovative projects in the area of life science, specializing in investing in startups and young technology companies, especially those operating at the intersection of science, health and new technologies.

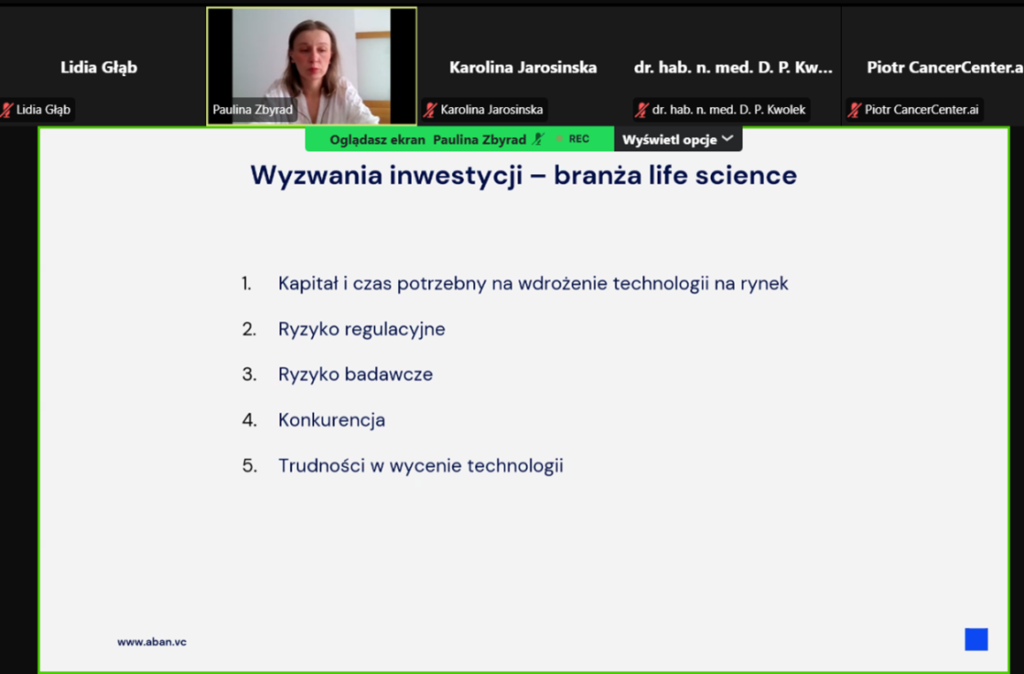

The life science industry, despite its enormous innovative and social potential, encounters many investment barriers. Among the main investment challenges, the following problems can be mentioned:

- Capital and time required to bring technology to market – this problem results from long development cycles (e.g. clinical trials, certification and marketing authorization) as well as high research and development costs.

- Regulatory risk – this problem arises due to the variability and complexity of regulations, as well as the high costs of obtaining approval.

- Research risk – This problem arises from the potential for failure in preclinical and clinical trials, as well as the lack of translation of laboratory results into clinical practice.

- Competition – this problem arises as a result of the strong position of large entities operating on the market, as well as the difficulty of entering the market without scale.

- Difficulties in valuing early-stage technologies – due to lack of revenues and clinical data, as well as uncertainty about further stages of development.

All these investment challenges mean that the life science industry, despite its attractiveness, is associated with high risk and does not enjoy great popularity on the market.

Another topic raised at the meeting concerned the possibilities of financing projects in the life science industry. According to the speakers, public financing is probably the best solution – in the form of grants, subsidies or government programs. Public financing is possible at the pre-seed / seed stage, i.e. at the early stage of project development, but before full commercialization. Then, funds are needed for validation of the idea, team building, laboratory tests. Public financing has many advantages. Among them, we can distinguish the possibility of obtaining capital without having to give up shares, because grants are non-refundable, which means that the originators retain full control over the projects. In addition, by obtaining public financing, it is possible to strengthen the credibility, and at the same time increase the attractiveness of the project for subsequent investors. Despite numerous advantages, financial financing also has disadvantages – among others, obtaining public funds is associated with bureaucracy, which requires completing a large amount of documents, formalities and reporting procedures. What is more, public financing is often insufficient for the entire commercialization process.

At the seed and growth stages, there is a possibility of financing by VC funds (Venture capital ). VC funds are characterized by the ability to make faster decisions and greater flexibility than in the case of public funds. In addition, these funds offer substantive and industry support, thanks to mentoring, access to a network of contacts or operational support. If the project develops well, there is also the potential to finance subsequent stages of the project. However, it is worth noting that VC funds cover part of the company’s capital, which means a reduction in the influence of the originators. In addition, this form of financing is associated with pressure for rapid growth and exit, because the funds expect a return on investment within a specified time horizon, and the projects are also dependent on the industry fund, which may limit the strategic flexibility of the project.

Another form of funding may be investments from large pharmaceutical or medtech companies that want to have access to innovations outside their own departments. For many startups and young biotech companies, this is often a more strategic path than classic VC funds. These funds come from CVC (Corporate Venture Capital) or industry partners. This financing usually occurs at the growth and commercialization stages. The greatest value offered by industry partners is expert knowledge, research infrastructure and commercialization channels, to which young companies usually do not have access. Additionally, such cooperation makes the technology credible in the eyes of other investors, clients or regulatory bodies. However, this form of financing is not free from risks. An industry partner can expect a significant influence on the company’s strategy, including the right of first refusal, preferential licensing conditions or even co-decision on the direction of research. Additionally, there is a risk of technological dependence on one partner, which may hinder further development if the interests of both parties diverge.

IPOs in the life sciences industry rarely happen at a very early stage, but for developing companies, they can be a significant step in raising capital for later stages of development – especially before expensive Phase III clinical trials or product commercialization begin. They usually happen when we have a technology that is recognizable, valued, and a concrete way to leverage capital on the stock market. Among the advantages of going public are:

- The opportunity to raise large amounts of capital, often significantly exceeding the capabilities of individual private investors.

- Increased brand recognition and prestige, which makes it easier to establish partnerships, recruit talent and obtain grants.

- Enabling earlier investors to exit and diversify the ownership structure.

However, entering the public market is associated with many challenges. The preparation process is expensive and time-consuming, requires conducting audits, preparing an issue prospectus and meeting a number of regulatory requirements. In addition, a listed company must conduct its business with a high level of transparency – regularly publishing financial reports, informing about risks and important events, and coping with market pressure.

The issue of broadly understood analysis of pharmaceutical and clinical data using intelligent tools was also raised. It is used to support the patient’s pharmacology within such software and ensure drug safety. AI tools are also used to inform the patient and doctor about possible dangers and complications related to taking medications. In theory, this area is quite quick to commercialize. In the case of all solutions that must be delivered to public entities, it is worth considering how to plan recognition and the path to opening for the end customer. In the B2B model, this is a rather specific area. For this purpose, it is necessary to know and analyze the answers to questions such as:

- How long will this process of acquiring your paying customer take?

- How long will the process of building recognition take?

- Who do we need to decide whether the paying institution will choose a given solution?

- Alternatively – Is it possible and profitable for a customer to switch from B2B to B2C?

An example of an investment in the life science sector that the speakers have been involved in is the personal genomics platform, IMAGENE.ME LIFE. It deals with programming and genetic testing, providing services related to customer support after such tests. The aim is to personalize health prevention and support informed decisions of patients regarding lifestyle and treatment.

One of the main challenges that investors of such platforms face is gaining the trust of potential users and persuading them to use the offered services. In such cases, the key factors are appropriate brand positioning, transparent communication of values and a partnership approach to the customer. The opinions of opinion leaders – doctors, scientists and industry experts – also play an extremely important role.

Investments in diagnostic projects are often based on a strategic assumption: offering services that generate value not only in terms of health, but also economic. Two companies cooperating in a B2B model can focus on creating solutions optimized for revenue and cost efficiency – such that can be sold to external entities (e.g. clinics, laboratories or insurance companies). The key here is to transform revenue into value – both for the end customer and for investors. Innovative medical solutions, properly implemented, can translate into improved financial liquidity of the company, reduced healthcare costs and increased patient satisfaction.

In the case of solutions dedicated to planned short-circuiting by insurers, the decision-making process related to the implementation of new technologies in the medical sector can be complex and multi-stage. Key questions include: who decides to purchase the solution? What arguments are most effective in convincing decision-makers? In practice, the following are of great importance:

- Project framework – clearly defined goals, time horizon and budget;

- Content-related aspects – compliance with the current state of medical knowledge, recommendations of scientific institutions;

- Technological aspects – interoperability with other systems, data security, scalability;

- Trust and reputation – how the supplier is perceived, what experience and references they have.

Questions and Answers

- What features influence the attractiveness of an investment?

You can create a pillar of three most important investment features. The first is the technology used , as well as the assessment of its readiness by the investor or experts – and therefore, the assessment of whether it is promising. The second important investment feature is a suitably qualified team that would be able to implement the proposed solution. The team’s competences are verified by checking the history of experience they have gained. The third feature that affects the attractiveness of the investment is the idea itself.

- Aren’t you afraid of risk of medical products?

Awareness of regulatory and certification risk is key in industry investments. It is easier in the case of a leveraged fund. Investors investing in the life science industry are aware that the moment when you exit with an investment is the moment before clinical trials, before certification. They are early stage investors who invest when the product is almost ready. They invest in a small part of the research and minimize the investment risk. The valuation of the company will then be more realistic.

- Do you get involved in the project before the prototype phase?

With validated technology, everything depends on the details of the project. Each investment is analyzed individually and individually.

- Investment areas – it is difficult to count on a quick return, doesn’t that discourage investors?

Yes. Biotechnology does not have solutions that are largely software-based and have a prospect of exiting in a short time. In Poland, VC projects predominate – it all depends on the location and the fund. It is worth noting that there are biotechnology companies that offer other solutions. Private investors – from a domestic perspective – are rather skeptical about such areas due to the high investment risk, as well as the process of educating management teams. However, growing interest can be observed.

- How should startup entrepreneurs prepare for a conversation with a potential investor?

When it comes to the pitch deck (short investor presentation), in the case of a company that is just starting its business, it is worth paying attention to:

- appearance of the solution,

- what the solution is about,

- how to define problems,

- what advantages does it have over those already existing on the market,

- market description,

- description of the model planned for development,

- preliminary valuation of the service based on available information,

- description of the team’s originators, description of the team’s competencies,

- proposed solutions.