Measuring Brand Equity, Polish legal regulations and the World’s Most Valuable Brands

The term “brand” is sometimes defined in different ways. Generally speaking, however, it is a name, a symbol, a graphic sign or a combination of these created in order to distinguish a given product or service from other competing goods. A brand is a set of functional elements that help build a customer base and enable the brand owner to achieve market leadership. A brand may consist of a name which is the verbal part and a non-verbal part, i.e. any symbol, logo. A brand or part of a brand under legal protection becomes a trademark.[1]

What is a trade mark and what is its purpose?

A trademark can be any sign capable of distinguishing the goods or services of individual entrepreneurs. Pursuant to Article 120 of the Polish Industrial Property Law Act, a trademark can be a word or a phrase as well as a drawing, an ornament or a colour composition. Trademarks are used in business transactions. In other words, an entrepreneur uses its trademark in trade with a consumer or another entrepreneur to identify its products or services. A trademark is therefore a sign that distinguishes enterprise from other enterprises of the same kind that have a similar offer.[2]

Estimation of brand value

In the various classifications of the breakdown of intangible assets, the company brand occupies a key position. The value of a brand, also known as goodwill, is linked to a specific company (it doesn’t exist on its own) and is often independent of the cost of acquiring it – a high valuation of a brand or location need not be a direct consequence of high costs or outlays. The value of a brand isn’t the same as the value of an entire company. The value of a brand constitutes several, a dozen or even 80-90 percent of the value of the whole enterprise. A brand is most often classified as a part of intangible assets, called among others the market capital of the company.[3] The fundamental issue in the brand valuation procedure is to define the purpose of the brand valuation. Estimates of brand value can be used to: authenticate the brand’s power of influence, calculate the size of royalties, determine the value of depreciation on its value, assess the ability to build brand value.[4]

Brand valuation methods

The amount of brand equity can be measured in a number of ways, however its valuation will depend on the valuation objective, standard and method indicated earlier. Most brand valuation methods fall into three main groups of methods: market, cost and income.[5]

- Cost methods

- Income methods

- Market-based methods

The cost method is based on adding up the costs incurred to promote the brand. Income methods, on the other hand, attempt to estimate future revenues associated with the use of a brand, i.e. additional revenues from price premiums. Market-based methods establish the value of a brand based on comparisons with other brands that have been the subject of buy-sell transactions in the brand market.

International Organization for Standarization (ISO)

The International Organization for Standardization, is a global non-governmental organization based in Geneva, Switzerland. It defines standards for products, services and management systems. Valuation of a brand is often carried out according to ISO 10668. The valuation procedure starts with the definition of the valuation objective, which determines the subsequent steps. In determining the purpose of the valuation, it is necessary to take into account any limitations that are associated with the operation of the brand being valued. The next stage is connected with determining the scope of valuation, i.e. the main subject of valuation.

Valuation impact of volatility

The enormous volatility in the world economy that we are currently experiencing, caused by a pandemic, makes many valuation models that worked well under conditions of stability less relevant under conditions of enormous volatility. Among other things, the pandemic has changed the demand structure and the financial situation of many companies. All this makes the modelling of economic processes and the valuation of companies, including brand valuation, more difficult. For the valuation itself, especially when using income methods, the correctness of the forecast for the next few years is of key importance. Good brand perception should translate into increased turnover and profits in the years ahead. The financial performance of many companies deteriorated in 2020, while many improved. This raises a fundamental research question: whether the new trends that have emerged in 2020 and 2021 are short-term (pandemic) or permanent.

The most expensive brands

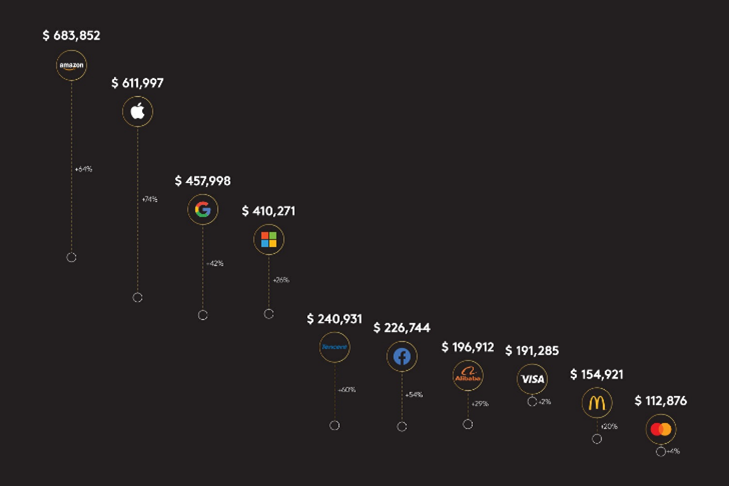

[6] photo: Kantar

According to the 2020 BrandZTM Top 100 ranking of the world’s most valuable brands by WPP and Kantar, the value of the Top 100 brands reached $5 trillion.[7] Amazon maintained its No. 1 position and continues to be the world’s most valuable brand. Technology brands continue to dominate the top of the ranking. Among the world’s most valuable brands, the first three places go to Amazon, Apple and Google. Technology brands also dominate the top ten of the ranking, where, in addition to the three mentioned above, the following are Microsoft, Tencent, Facebook. Also noteworthy brands named in the report for the first time are Tesla, Zoom, Spotify.

[1] M. Zieliński, M. Kubacki, Marka we współczesnej gospodarce, Zeszyty Naukowe Uniwersytetu Szczecińskiego nr.803, Szczecin 2014,

[2] J. Sieńczyło-Chlabicz, Prawo własności intelektualnej, Wolters Kluwer Warszawa 2018,

[3] A. Black, P. Wright, J.E. Bachman, W poszukiwaniu wartości dla akcjonariuszy, Dom Wydawniczy ABC, Warszawa 2000,

[4] https://polskiprzemysl.com.pl/zarzadzanie/wycena-marki-w-praktyce/

[5] T. Słoński, Wykorzystanie koncepcji wartości pozbawionej w wycenie marki dla potrzeb restrukturyzacji majątkowej przedsiębiorstwa, Zeszyty Naukowe Uniwersytetu Szczecińskiego

[6] https://www.kantar.com/campaigns/brandz/global

[7] https://www.kantar.com/campaigns/brandz/global