Direct investments – EU and Polish regulations

Publication date: January 20, 2026

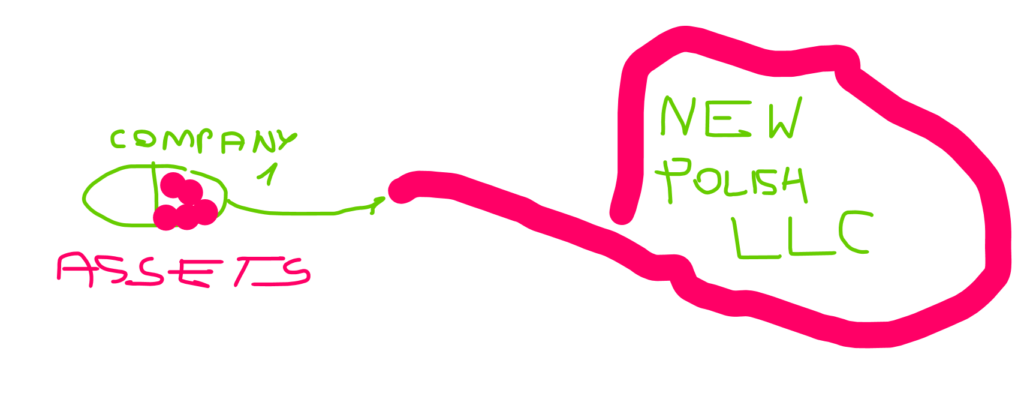

Foreign direct investment (also known as FDI) is a form of capital investment in which an investor from one country acquires a permanent stake in a particular enterprise operating in a foreign market, thereby gaining real influence over its operations. This cash flow is long-term and serves not only to generate financial profits but also to provide operational and strategic control over the foreign entity. Through foreign investment, the investor can acquire a significant stake in the company’s ownership structure, and therefore hold at least 10% of the company’s share capital. Often, the decision to conduct such investments involves more than just transferring capital; the investor also invests resources, modern technology, and management staff, ensuring the efficient operation of the foreign entity. These investments can take various forms, from the construction of new plants to the acquisition of existing enterprises. In each of these situations, the investor is responsible for managing and shaping the entity’s market situation, which is the difference between foreign direct investment and passive forms of capital investment. Moreover, unlike short-term investments, FDI typically represents a long-term commitment to a specific foreign market, requiring compliance with specific regulations and meeting various requirements. Investors must primarily consider the target country’s political stability, the availability of qualified labor, and the potential for economic growth. Foreign direct investment currently constitutes one of the foundations of globalization and the integration of global markets.